Addressing Captive Coal Power Crucial to the Decarbonisation of Indonesia

26 February 2024 – by Viktor Tachev

Once a rich oil and gas nation, Indonesia is now a global coal superpower. While this has helped fuel the country’s steady economic growth, it is currently accruing environmental, health and economic costs to the nation. The early retirement of Indonesian coal power plant fleet is estimated to be cheaper than a business-as-usual scenario. However, alone, it won’t break the country’s coal dependence. This would require decommissioning the country’s captive coal power plants also – a process yet to receive the needed attention.

Indonesia and Its Coal Reliance

Indonesia is the world’s largest global thermal coal exporter and third-largest coal producer. Fossil fuels account for around 80% of the country’s electricity generation, with coal responsible for around two-thirds of it.

The country operates Southeast Asia’s largest coal-fired power plant fleet, with 249 units and 45.6 GW in total capacity. Furthermore, the fleet has an average age of less than 15 years compared to the 40-year typical lifespan of a coal power plant.

Even more worrying is that the country’s coal capacity additions have been outpacing the additions of renewables despite Indonesia’s goal of peaking emissions by 2030. Today, the country has around 28.7 GW of new coal-fired capacity at various stages of consideration and development.

Alongside other Southeast Asian countries, Indonesia also plans to lead the global gas expansion. The country is pursuing expensive and questionable technologies, such as hydrogen, ammonia and CCUS, and making them a part of its long-term energy plan – a move that will further delay its decarbonisation by locking the country into a future of sustained emissions.

Captive Coal Power Plants: Holding Back Indonesia’s Decarbonisation

The discussion around Indonesia’s coal reliance often centres around the national power sector, while captive coal plants are rarely in the spotlight.

However, according to the Emerging Captive Coal: Dark Clouds on Indonesia’s Clean Energy Transition joint report by the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM), nearly 25% of operating coal capacity in Indonesia is for captive use – power generated by plants operated and utilised off-grid by the industry.

The report’s authors estimate that captive coal power capacity has increased eightfold over the past 10 years – from 1.4 GW in 2013 to 10.8 GW in 2023. Furthermore, another 14.4 GW of captive coal capacity, half of Indonesia’s entire coal pipeline, is now proposed or under construction.

Despite the significant growth and share of captive coal, CREA and GEM note that the government’s efforts to transition away from coal focus only on the power sector.

The reason is that 76% of the country’s captive coal plant capacity is used to develop metals for the clean energy transition. The national industrial development plan for 2015-2035 allows the development of coal plants to power metal processing since it provides “added value to natural resources”.

Sluggish Coal Phaseout Progress Due to Lack of Ambitious Policy Support

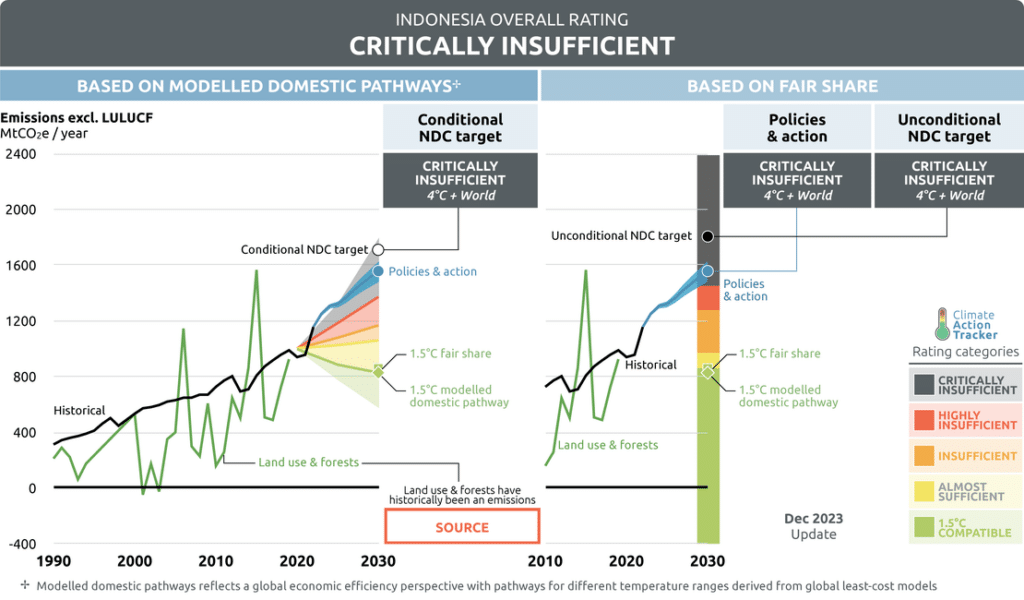

According to Climate Action Tracker (CAT), the huge fleet of newly operating coal plants has increased Indonesia’s emissions by 21% in 2022. Furthermore, it is likely to elevate total power sector emissions to 400 MtCO2 in 2030. This would be more than twice the level of the Paris Agreement’s temperature limit.

The country is among the worst performers in CAT’s ranking, with a “critically insufficient” rating for climate targets and policies.

While the government has already started decommissioning coal plants prematurely, it is considering making a U-turn against its 2022 green taxonomy. Under the initial categorisation, only renewable energy projects were considered “green”. However, the IEEFA seems wary of Indonesian financial regulators and their claim that new coal-powered generation could protect or improve the environment if “aimed at the energy transition”. It could, however, open up opportunities for greenwashing, deter investors and impede the clean energy transition, the agency warns.

Furthermore, the Indonesian government hasn’t set out a plan to retire captive coal-fired power plants in the industrial sector. According to CREA and GEM, the lack of adequate policies and regulations creates uncertainty and opens a gap that allows the extended use of new captive coal plants for industrial purposes under certain conditions. Although some policies are strictly defined, like ceasing operations by 2050 and decreasing emissions by 35% within 10 years of a plant coming online, some are also vague, like the operation of plants for the purpose of processing natural resources.

Strong Economic Argument For Early Coal Plant Retirement

According to TransitionZero, phasing out all 118 of Indonesia’s coal plants by 2040 would cost USD 37 billion. However, it would be cheaper than a business-as-usual scenario. For comparison, in 2022, the country budgeted USD 37.75 billion or 19.87% of its total annual expenditure for subsidies and compensation to keep most energy and fuel prices unchanged and protect consumers. According to the EU-ASEAN Business Council, this is twice Indonesia’s 2022 healthcare budget and four times its defence budget.

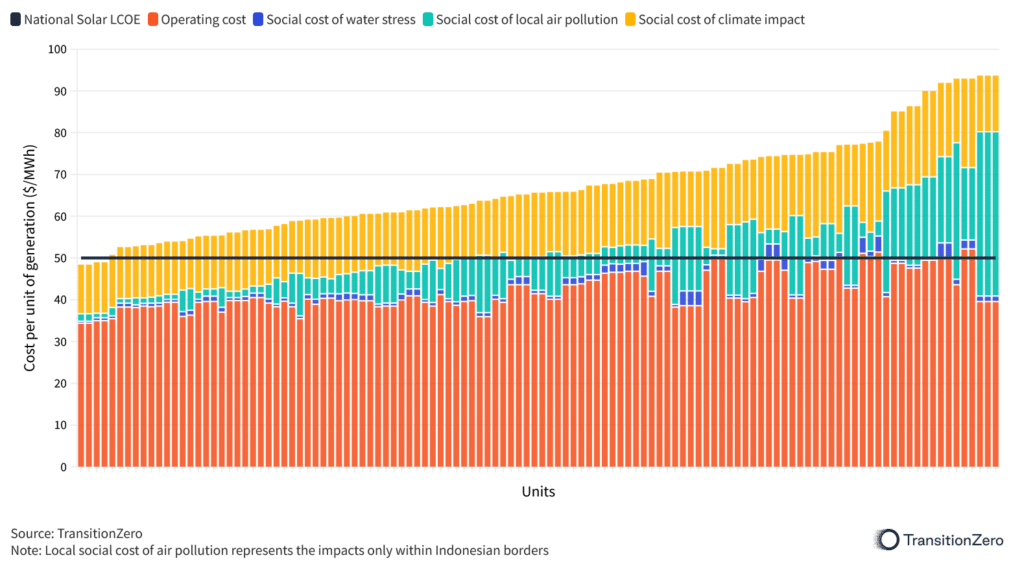

TransitionZero estimates that, when accounting for air, water and climate costs, the average operating cost of coal is 27% higher than that of clean energy. By 2030, replacing fossil fuels with renewables will save between USD 15.6-51.7 billion when accounting for air pollution costs.

In 2022, coal-fired power plants caused 10,500 deaths in Indonesia. According to estimates, if they continue to operate, the death toll could soar to 180,000 by 2040. Estimates also reveal that in 2022, the health costs of coal-fired power plants in Indonesia reached USD 7.4 billion. At the same time, cleaning up one coal power plant near Jakarta could help Indonesia avoid USD 1 billion annually in preventable deaths, medical bills and work absences.

Indonesia Needs a New Way Forward: The Priorities For the New Government

Under the leadership of President Joko Widodo, Indonesia experienced a massive boom in the number of coal plants. Although the country has signed the Global Coal to Clean Power Transition Statement, which demonstrates commitment to a transition away from unabated coal power generation by 2030, Indonesia’s coal fleet is still expanding.

According to surveys, Indonesians are critical of the current government’s lack of progress in tackling the effects of climate change. Furthermore, they express the need for the country’s leadership to declare a climate emergency and take swift action to tame its impacts. Among the most widely anticipated measures are implementing a carbon tax, the buildup of clean and renewable energy sources and a phaseout of coal-fired power plants.

The likely next president, Prabowo Subianto, who will be sworn in in October, has pledged to continue his predecessor’s mineral export ban, support the domestic battery-making industry and back the country’s gradual transition away from coal. However, the roadmap for achieving these tasks has yet to be released. Other key priorities that the new leadership should focus on include the following.

Advancing the Clean Energy Transition Without Coal

Indonesia aims to continue establishing itself as a key cog in the global supply chain for metals like nickel, aluminium and iron, integral to various green technologies. While these commodities are crucial for enabling the global clean energy transition, satisfying the power demand of Indonesia’s metal processing plants and associated industries shouldn’t come at the expense of the country’s emissions reduction journey. Remaining reliant on captive coal-fired power plants will complicate the task of meeting the national climate targets and achieving net-zero emissions by 2060.

Among the top priorities of the country’s new leadership should be introducing adequate policies and commitments that address coal’s role in the energy transition – not only in the power sector but also in industry.

Increased Focus on Climate Change Mitigation and Adaptation

Indonesia’s sustained high emissions are fuelling the risk of extreme weather events hitting the country. The implications of this problem have been evident in the past few years, while scientists warn its probability and severity are likely to grow further in the future. Yet, the response to the glaring environmental and health crisis is slow and stalling. The country has fallen by 10 places to 36th in the Climate Change Performance Index for 2024. The Environmental Performance Index, assessing national efforts towards environmental health to enhance ecosystem vitality and mitigate climate change, ranks it 164th out of 180 countries.

To improve these rankings, the new government will have to ensure that the country’s plans for increased new coal and gas don’t come to fruition.

Considering Indonesia’s strong industry interests, doing this wouldn’t be a popular solution. But it would be a much-needed step to unlock green financing, ease the burden of high energy prices for the economy and consumers and ensure a healthier and cleaner future for Indonesians.

Mobilising JETP Funds to Address Captive Coal Production Plants

In their joint report, CREA and GEM called for Indonesia to make use of the USD 20 billion in funding under the Just Energy Transition Partnership (JETP) to address the threat that existing and planned captive coal-fired power plants pose to Indonesia’s decarbonisation.

According to the report, excluding their retirement from the national plan would cause 27,000 air pollution deaths and a USD 20-billion economic burden from health impacts under a 1.5°C-aligned scenario. In reality, delayed captive retirement implies even higher impacts, the authors warn.

Early retirement would not only support the government’s energy transition and climate targets but also accelerate clean energy adoption and capitalise on Indonesia’s vast yet unexplored potential.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more