Why Does Japan Rely on Fossil Fuels?

06 December 2023 – by Viktor Tachev

Under its currently proposed decarbonisation strategy, Japan won’t get any closer to reaching its net-zero target, but it will help keep fossil fuels as a part of Japan’s energy system. The country and the region can’t afford to pursue expensive and untested technologies like hydrogen, ammonia, and carbon capture and storage. There simply isn’t any time, and going down this path will surely prove costly in Southeast Asia, which Japan sees as a primary energy target market.

Fossil Fuels in Disguise: The Decarbonisation Strategy of Japan

Japan has aspirations of becoming a leading hydrogen-based economy and is also promoting the idea of blending coal with ammonia for “zero-emission thermal power”. These strategies, along with the use of “clean coal”, seemingly look like positive innovations. However, closer analysis reveals that Japan intends to prolong the life of fossil fuels instead of replacing them with renewable energy sources.

Hydrogen

Japan intends to primarily use fossil fuel-derived hydrogen to achieve its hydrogen plans. For now, the cleaner alternative, green hydrogen, remains expensive and faces notable commercialisation challenges.

Estimates reveal that greenhouse gas emissions from blue hydrogen plants can exceed those of conventional, gas-fired power generation. The UK government’s Department of Business, Energy and Industrial Strategy notes that hydrogen is “twice as powerful a greenhouse gas as previously thought”. It reacts with other greenhouse gases in the atmosphere and exacerbates their global warming potential.

Ammonia-coal Co-firing

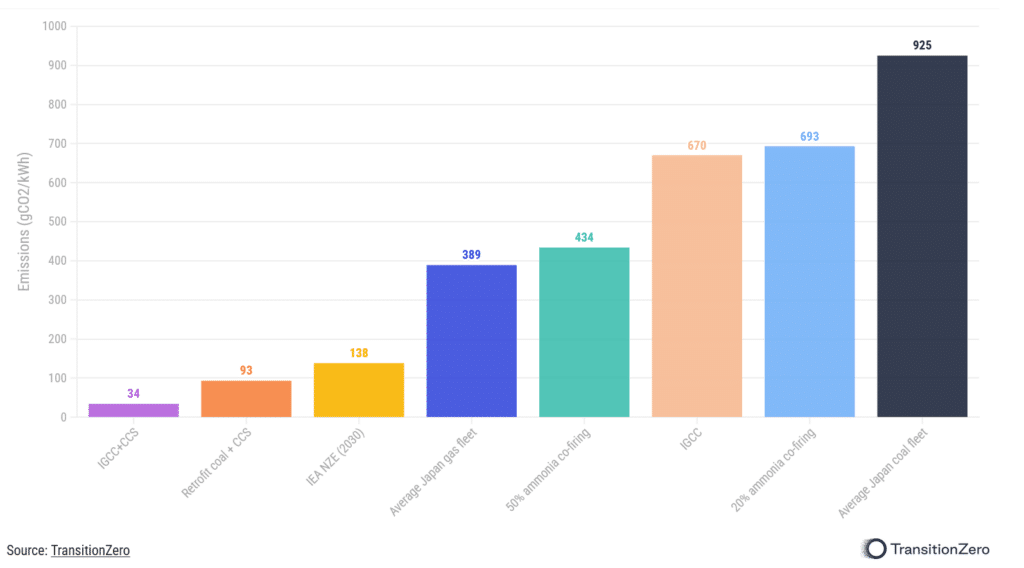

To make coal “clean”, Japan plans to achieve an ammonia-coal co-firing rate of over 50% by 2030. The goal is to make coal a “regulating power source“, supplementing renewables. Moreover, according to Japanese officials, technologies to make coal cleaner will “contribute to Japan’s climate targets”.

However, ammonia is far from clean. Conservative estimates indicate that with ammonia use, life-cycle air pollution at a 50% co-firing ratio would increase by 167%.

This is due to a range of factors. Firstly, ammonia production emits significant amounts of CO2. Next, air pollution across the ammonia supply chain causes environmental and health impacts, most of which have been underreported. Among them are air and water contamination through the escape of unburnt ammonia, nitrogen oxide release and PM 2.5 pollution.

Currently, Japan imports mostly grey ammonia. While the country expects to rely on more blue ammonia starting from 2027, it plans to switch between the two depending on price dynamics.

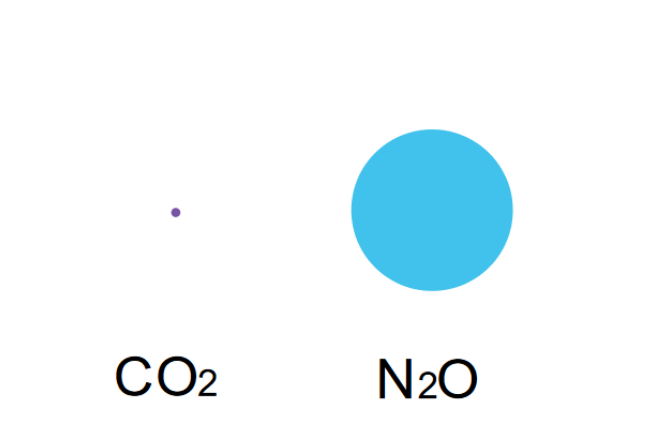

However, according to reports, if not appropriately burned, even green ammonia can emit nitrous oxide (N2O). Research shows that the atmosphere warming potential of nitrous oxide is 300 times higher than CO2 over a 100-year period.

Carbon Capture and Storage (CCS)

CCS, another technology that Japan plans to concentrate on, remains expensive and has limited applications. According to reports, existing CCS projects have largely underperformed. Even if CCS becomes feasible, carbon capture rates will likely reach 80-85% at best. This is why experts describe the technology as “an excuse” for producing gas-derived ammonia.

Furthermore, according to the IEEFA, the captured carbon has been mainly used for enhanced oil recovery.

Consistent Efforts to Delay the Renewable Energy Transition

Instead of retiring fossil fuel infrastructure as the IEA and the IPCC have repeatedly called for, Japan is looking to retrofit it to continue operating.

The Green Transformation Strategy (GX) aims to gather over USD 1.1 trillion of public-private financing to support developing and deploying hydrogen, ammonia, CCS and gas technologies in Japan and Southeast Asia. However, in their current form, Japan’s plans won’t decarbonise but lock its and ASEAN countries’ economies in prolonged fossil fuel use. Furthermore, they will pave the way for building new gas infrastructure.

Environmentalists and activists from various Asian organisations and affected countries have repeatedly voiced concerns against the proposed technologies. The plans have also been criticised by market experts, scientists, and political leaders, describing them as “false solutions,” “a greenwashing exercise,” and “a way to legitimise coal in the eyes of financiers and lenders.” Critics note that such technologies have little practical success, harmful environmental impact and notable economic drawbacks. Bloomberg NEF describes them as “expensive and very dirty” and even warns that they might not be ready for application by 2035.

According to experts, the push for these technologies is influenced by corporate interests and the fossil fuel lobby in the country. A Reuters analysis suggests that some of their biggest supporters are also among Japan’s leading emitters.

Kimiko Hirata, the founder of Kiko Network and Climate Integrate, suggests that Japan has a strong interest in maintaining the status quo due to the active participation of the corporate sector in fossil fuel projects and the hesitance to lose their investments. Hirata also adds that most are strongly tied to METI and the political parties in the country. As a result, they have the influence to block climate policy progress.

Japan Opposes Complete Coal Phaseout

By 2030, Japan will still make coal responsible for 19% of its total electricity generation. Together with gas, it will make up 39%. In comparison, renewables will account for no more than 38%.

According to Beyond Coal, as of November 2023, Japan operates 171 coal plants, with a total capacity of around 55 GW. Since September 2020, the country has added 10, with two new plants in the pipeline.

While the reputation of the rest of the G7 is far from stellar when it comes to energy policies, including Germany’s support for gas investments and the US’ broken promise regarding the end of foreign fossil fuel financing, Japan’s climate actions are quickly making it the worst of the group. Currently, it operates the second-biggest coal fleet in the G7. At the same time, it has retired the least amount of coal-fired capacity in the period between 2000 and 2023.

Among the G7, only the US and Japan lack concrete plans to phase out coal. Furthermore, Japan remains the only G7 member planning to build new coal plants.

Japan was among the key advocates for the use of vague language in the G7’s final communique, using words like “predominantly” in regard to the decarbonisation of the power sector. This would allow the door for fossil fuel use to remain open. Japan’s Ministry of the Environment even stated that it considers the word “predominantly” to mean more than 50% decarbonisation.

Continued Push For New Gas and Support For GX Transition Technologies

Japan has been actively trying to onboard other G7 nations with the energy technologies proposed in its GX strategy. G7 leaders challenged the plan, reportedly blaming it for prolonging the use of fossil fuels. In addition, the group’s members have been opposing the country’s persistence in continuing fossil fuel investments, and they criticised the country’s reluctance to commit to full power sector decarbonisation by 2035.

“Japan is doubling down on fossil fuels and is using the G7 to promote Japanese industry, undermining meaningful action to mitigate the climate and energy crises.”

Susanne Wong, Asia Program Manager, Oil Change International

While the rest of the G7 admitted they were opposing fossil fuels and gas exploration, Iwata Kazuchika, Japan’s state minister of Economy, Trade and Industry, noted that as this year’s president of the G7, Japan was issuing “a clear message regarding the importance of LNG”. “LNG is a transitional energy, so it occupies a very important position,” he explained.

Japan’s actions come despite calls from the Academies of the G7, the body’s scientific board, to rapidly transition from fossil fuels.

Japan has the highest carbon intensity, the highest coal usage and the lowest clean electricity ranking among the G7.

The G7 has committed to building 150 GW of offshore wind by 2030. Yet, just 4% would be in Japan by 2030, highlighting how far the country has fallen behind in the electricity transition.

While renewables will account for 36-38% of the total electricity production in Japan by 2030, in fellow G7 countries like Germany, Italy, Canada, the UK and the US, their share will be 70-80%. Even if Japan realises its most ambitious clean energy targets, the country won’t reach the levels of major European countries.

Funding Fossil Fuel Projects Abroad

In a 2021 report, the IEA warned that to reach net zero by 2050 and limit global warming to 1.5°C, the world should stop investments in new oil and gas projects and not approve any more coal plants.

Japan promised to end public finance for coal projects abroad by the end of 2021 and stop fossil fuel project development overseas by the end of 2022. Yet, the country remains among the leading global coal plant financiers. Japanese banks are second behind their Chinese counterparts regarding the share of financing the top 120 coal plant developers. When it comes to fossil fuels as a whole, Oil Change International identifies Japan as the world’s largest public finance provider.

Experts warn that Japan could continue backing overseas coal projects by exploiting loopholes. One example is the legal status of the Japan International Cooperation Agency, a leading fossil fuel financier in Asia. Currently, it is defined as an independent administrative institution, even though it operates like a government agency.

The World Needs Japan to Lead the Battle Against Climate Change

While fossil fuel-producing countries and big emitters like the US are perceived as the major culprits of the climate crisis, Japan often remains in the shadows. Yet, it should be up there with the biggest climate offenders. Climate Action Tracker notes that if all countries followed Japan’s approach, global warming would shoot up to 3°C. The climate action of Japan, the world’s fifth-biggest CO2 emitter, is “insufficient” and needs substantial improvements to align with the 1.5°C temperature target.

Not only should the country take responsibility for its lack of effort, but it should be questioned about going against the grain to prolong the life of fossil fuels.

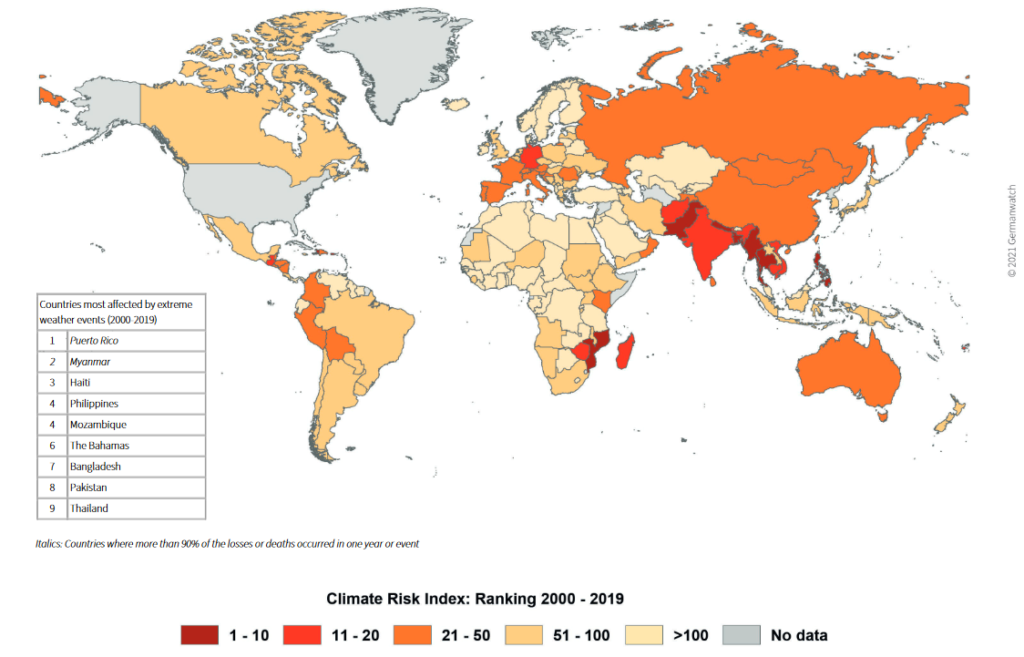

At COP26, Japan promised to “lead the way in the clean energy transition, with a particular focus on Asia”. Today, experts criticise it for not caring about the urgency of climate change. What’s worse, its questionable technologies risk exacerbating and not solving the problems of target markets, including derailing the energy transition of Southeast Asia. The region is among the most vulnerable to droughts, floods, typhoons, rising sea levels and heat waves.

The time has come for Japan to start acting like the technology and innovation leader it always has been, not the guardian of a dying industry that is dragging the world with it.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more