Japan Most at Risk from Disruption in the Strait of Hormuz

Source: CNN

09 July 2025 – by Eric Koons

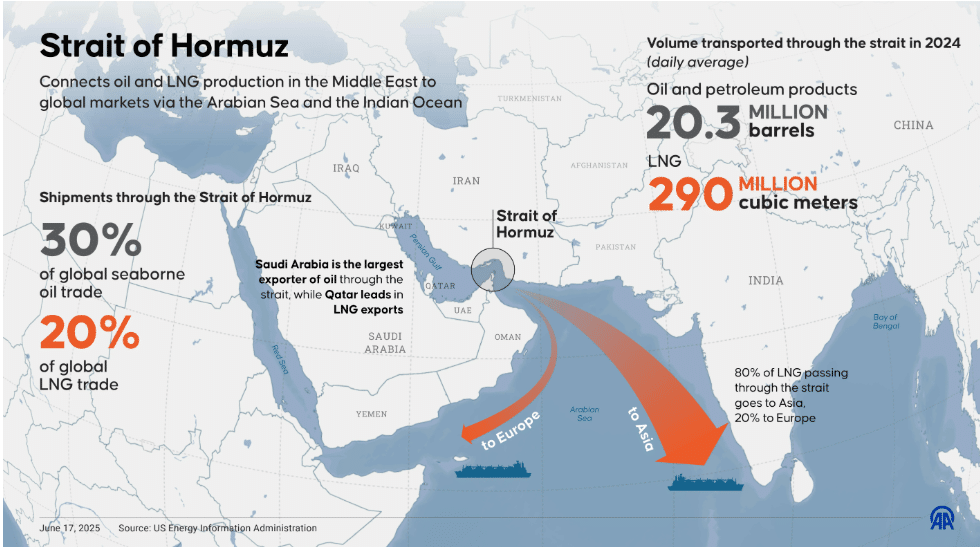

Tensions surrounding the Strait of Hormuz have been growing as the conflict between Israel and Iran has progressed. This spiked in June 2025 after Iranian missiles struck a U.S. base in Qatar, prompting fears that Tehran might seal the channel that funnels roughly 20 million barrels a day of crude oil and one-fifth of the world’s LNG.

Markets quickly remembered that Japan, which still gets 85% of its primary energy from fossil fuels, sits at the very front of the collateral damage queue. Understanding why this is the case illuminates both the scale of the risk and the potential escape route.

The Strait of Hormuz: A Global Energy Choke Point

In 2024, 84% of the crude oil and 83% of the LNG that left the Persian Gulf sailed through the Strait of Hormuz to Asia. Just four customers — China, India, Japan and South Korea — accounted for 75% of the oil and 59% of the LNG.

The choke point risk is amplified by geography: Hormuz’s shipping lanes are only 2 miles (3.2 km) wide in each direction and surrounded by Iranian territory on three sides. This makes Asia uniquely exposed as even a brief blockade can create a point of failure for Asian energy security.

Iran Threatened to Close the Strait of Hormuz

Iran has repeatedly threatened to “close the Strait of Hormuz,” and U.S. intelligence reported that the Iranian military loaded naval mines onto ships in late June 2025. Although the mines have not been placed, the act represented a serious escalation towards closing the Strait.

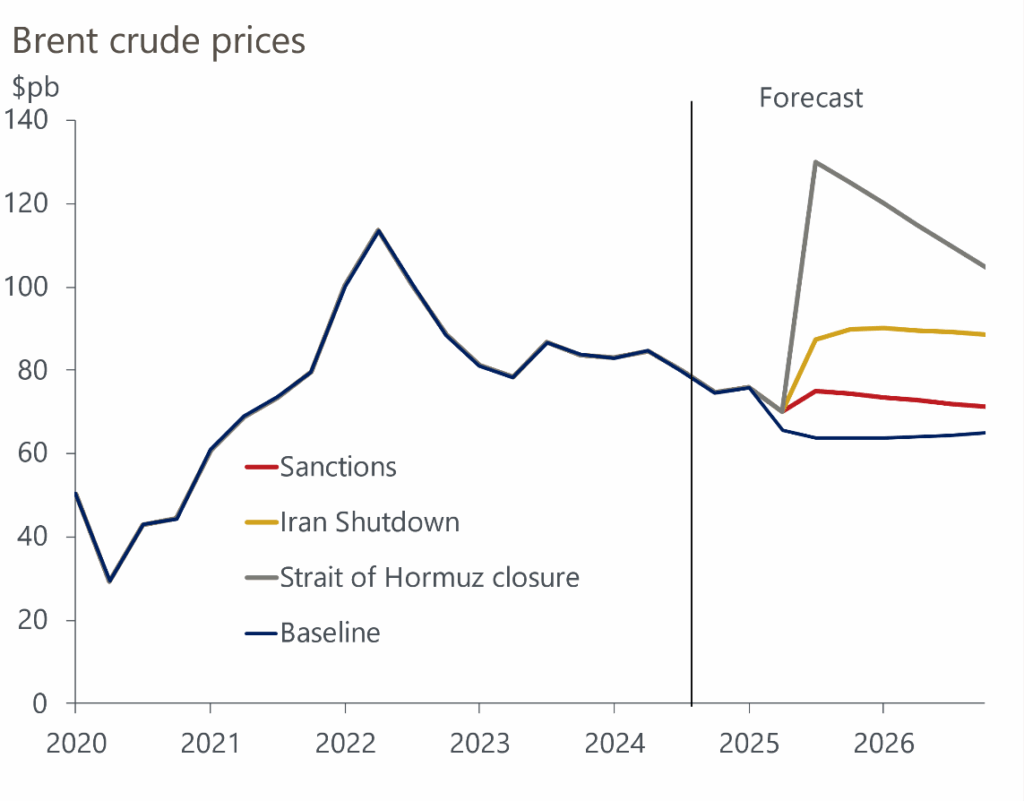

New modelling by Zero Carbon Analytics warns that a complete shutdown could drive Brent crude to about USD 130 per barrel, up from the low USD 60 per barrel in early June 2025 and matching the 2008 oil shock. On the more extreme side, Iraq’s deputy prime minister floated an extreme USD 300 per barrel price. While JPMorgan analysts place the severe-outcome band at up to USD 130, the repercussions would extend well beyond just energy costs, likely impacting global economic growth and inflation.

LNG prices in Asia move roughly in tandem with oil, so the Japan Korea Marker would likely double or triple in the same scenario.

Japan’s Heavy Reliance on Hormuz-linked Fuels

Japan imports approximately 87% of its total primary energy supply, and fossil fuels still generate over 60% of its electricity, one of the highest dependency ratios among OECD countries. Such heavy reliance means that any disruption to Gulf shipping would reverberate directly through Japan’s economy, a vulnerability that is the most acute among major Asian importers.

Crude Oil Exposure

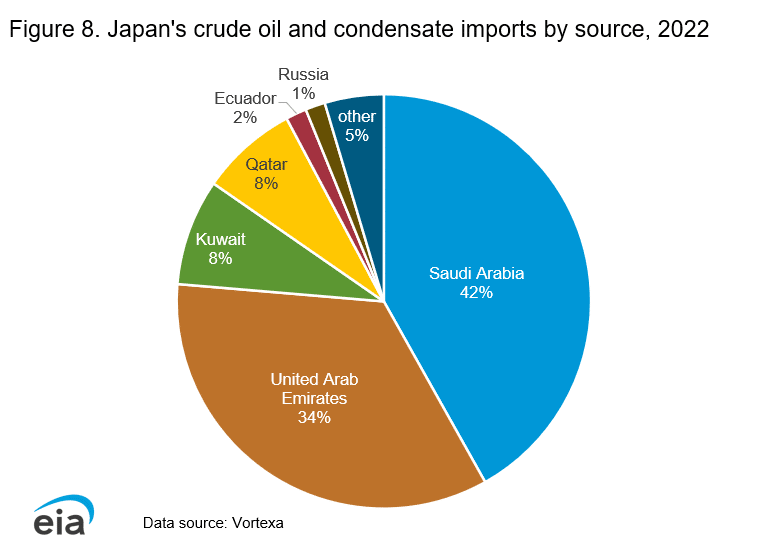

Japan buys virtually all of its oil from the Middle East. The IEA calculated that approximately 80% of Japan’s crude imports transited the Strait in 2018. The share is likely little changed today because Saudi Arabia, the UAE and Kuwait remain Tokyo’s top suppliers.

This is a unique level of exposure among Asian countries. South Korea’s exposure is lower, at 68%, while India’s is lower still, at 53%, and China’s is the lowest, at 15%. One of the primary reasons for this is that Japan has no overland pipelines and limited domestic production to soften the blow.

LNG Dependency

While Japan has diversified its LNG imports since the Fukushima disaster, the Middle East still supplied roughly 10% of Japan’s cargoes in 2022, most of which must sail through the Strait of Hormuz. Utilities such as JERA and Kyushu Electric held long-term Qatari contracts that expired in 2021 and are now negotiating replacements even as tensions flare. Unlike crude, LNG cannot be easily rerouted because Q-Max tankers require specialised ports, so even modest Gulf exposure matters during a crisis.

Economic Shock Channels for Japan

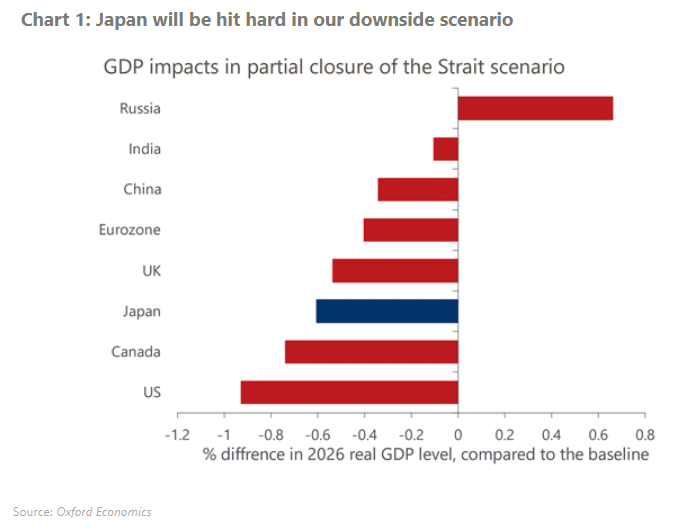

A sustained USD 120 to 130 oil price would increase Japan’s import bill and widen its trade deficit, putting fresh downward pressure on the yen and complicating the Bank of Japan’s efforts to combat inflation. Predictions indicate that this would push the Japanese economy into stagflation, resulting in a 0.6% lower GDP than expected for 2026.

Power markets are vulnerable too: as spot LNG prices increase, so do domestic electricity prices. This adds more strain to the economy and increases annual generation costs by tens of billions of yen. With the recent 2022 Russia-Ukraine conflict-related LNG price spike still at the forefront of the minds of many, there are several signs that fossil fuel price volatility will continue to increase.

Strategic Response Options

Short-term Shock Absorbers

Japan maintains government and industry stockpiles equal to about 180 days of crude demand. This can help fill demand, particularly if it is efficiently distributed and allows Japan to look for alternative importers. However, if a blockade extends beyond 180 days, it would be nearly impossible for Japan to fill the supply gap with other importers completely.

Long-term Resilience: Renewables First, Lessons From Europe

Japan is not short of domestic clean-energy resources. The country has a technical potential for more than 2,000 GW of solar PV and around 1,000 GW of wind, which are enough to cover current electricity demand more than 10 times over. Tapping even a fraction of that capacity would drastically improve the country’s energy security.

Domestic renewables also hedge commodity-price shocks. Once built, solar and wind provide zero-fuel-cost electricity, shielding households and industry from the volatility that a Strait of Hormuz crisis would create.

Europe offers a recent playbook. After Russia’s 2022 invasion of Ukraine, EU governments fast-tracked wind, solar and efficiency measures that helped drive an 18% drop in natural gas consumption by 2023. This helped keep storage full and wholesale prices in check despite collapsing pipeline inflows from Russia.

Beyond the Strait: Securing Japan’s Energy Future

The Strait of Hormuz risk triangle — geographic choke point, geopolitical conflict and near-total fossil dependence — puts Japan at risk during any Gulf crisis. The country’s post-Fukushima stall on renewables has deepened that exposure, but on the flip side, there is opportunity.

Decisive investment in wind, solar and electrification could slash fossil fuel imports before 2030, transforming today’s liability into a competitive, low-carbon edge for the world’s third-largest economy.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more