LNG Demand Decline in Japan To Cause Oversupply Through 2030

19 March 2024 – by Viktor Tachev

The LNG demand in Japan is steadily declining, and utilities are facing a significant surplus problem. According to the IEEFA, to salvage the situation, Japanese companies aim to create gas demand in East and Southeast Asia. However, developing Asia has already experienced the drawbacks of its strong reliance on LNG, including unreliable supply, price volatility, project cancellations and a severe energy crisis. While the projected falling gas prices in the years up to 2030 might seem tempting for importers, investments in new infrastructure will only prove reasonable if they complement an exponential growth in renewables as the primary focus of the energy transition.

IEEFA: Japan LNG Demand Declines While Utilities Face Surplus Problem

In its dedicated report from March 2024, the IEEFA concludes that the LNG demand in Japan’s domestic is slowing down. As a result, Japanese utilities will face a continuous surplus problem in the years leading up to 2030.

According to the IEEFA, Japan’s four largest utilities, JERA, Tokyo Gas, Osaka Gas and Kansai Electric, are over-contracted. This means they have committed to securing more gas than they need or can sell, given the current demand.

The analysis estimates the surplus to reach around 12 million tonnes in the coming years. Furthermore, IEEFA warns that the situation of the utilities might worsen due to changing market dynamics in the near future.

On the domestic stage, the authors find that Japan’s LNG demand could fall by one-third compared to 2019 if national electricity generation plans are achieved. Increasing shares of nuclear and renewable power in the energy mix, as well as demographic shifts and progress towards long-term energy and climate targets, would also influence gas demand. By 2030, LNG-fired power generation is expected to more than halve. Furthermore, the IEEFA notes that, since 2017, incumbent utilities have lost significant market share due to the introduction of retail competition in the gas sector.

According to the authors, on the global stage, Japanese utilities will face increasing competition from global suppliers when attempting to sell their excess LNG from the new supply capacity expected to come online in the middle of the decade.

Japanese Utilities Are Facing a Dilemma

Since domestic gas demand will fall faster than Japanese utilities’ LNG purchase commitments, the IEEFA sees two possible scenarios. In the first, the companies will incur additional costs from exercising existing contractual volume flexibilities and cancellation rights. In the second, they will aim to resell the excess LNG abroad.

The agency considers the latter a more realistic scenario due to several factors. First, Japan’s Ministry of Economy, Trade and Industry (METI) has set a target that pushes companies to transact close to 100 million tonnes per annum (mtpa) of LNG by 2030. This exceeds the current buyers’ contracts, which are for 79 mtpa.

Furthermore, the IEEFA notes that Japanese utilities’ corporate strategies indicate their determination to continue playing a crucial role in LNG transactions despite the declining domestic demand. For example, JERA plans to become a major global LNG player. Meanwhile, Tokyo Gas has set a target to form a Southeast Asia LNG value chain.

Japan Likely to Solve the Oversupply Problem By Offloading Liquefied Natural Gas to Southeast Asia

The IEEFA notes that to avoid the financial losses associated with failing to sell gas on the domestic market, Japanese utilities are now moving from being major gas consumers to marketing and reselling the fuel abroad. Their strategy includes cultivating demand to offload their surplus LNG volumes by investing in gas infrastructure projects. These include regasification terminals and LNG-fired power plants, mainly in emerging South and Southeast Asian countries.

According to the report’s authors, the Japanese government has actively encouraged utilities to trade higher LNG volumes with emerging markets. The initiative has proved successful. Between FY2018 and FY2021, LNG sales from Japanese companies to other countries have more than doubled.

Currently, over 60% of the global gas-fired capacity in development is in Asia. Around half of it is in East and Southeast Asia.

Emerging South and Southeast Asian countries, particularly Vietnam, Indonesia, Malaysia and Thailand, are projected to drive global LNG demand in the future. However, the projections for those countries are fragile and rely on price stability, which the LNG market has proven to lack. The 2022 energy crisis, spurred on by extreme price volatility, has cemented gas as a fiscally unsustainable fuel that undermines energy security.

LNG Projects in Southeast Asia Are Struggling

Due to rising costs, around 81 GW of planned capacity was cancelled in Asia between 2022 and 2023.

Several projects across the Philippines and Vietnam have faced delays or even cancellations, causing power outages in major cities. Countries like Pakistan and Bangladesh were priced out of the gas markets and left starving for power. The situation is likely to continue in the years ahead. Furthermore, many developing Asian countries remain fully exposed to spot market volatility due to a lack of long-term contracts.

The unpredictability of gas power has made some Asian countries reassess their priorities. Pakistan has announced plans to phase out imported LNG as a power generation source in the long run. Instead, it will prioritise domestic power generation, including solar and wind.

Thailand has also decided to accelerate its shift to renewable energy to reduce its dependence on foreign fuels. The country plans to double its renewable capacity by 2030.

The first LNG terminal commissioned in the Philippines has been facing a risk of underutilisation due to high costs.

Pursuing Clean Energy More Beneficial For Southeast Asian Countries

According to the IEEFA, the gas oversupply will lead to a price decrease in the years leading up to 2030. While this might seem like an opportunity for Southeast Asian countries to strike reasonably priced contracts, one notable challenge remains: legacy LNG infrastructure. This means the region will require massive investments in new infrastructure, potentially costing trillions of dollars.

The shaky financial and energy security fundamentals of gas power highlight clean energy as the more viable and reasonable path for developing Asia. Studies project that switching to green energy could save trillions of dollars. The main reasons include the quickly decreasing technology costs, which directly translate to cheaper energy for end users. Today, renewables are the cheapest source of new power in countries comprising two-thirds of the global population and responsible for 90% of electricity generation, including much of Southeast Asia. China, for example, has even managed to bring the cost of solar power down to under USD 0.014 per kWh.

On top of that, the clean energy transition will ensure additional economic benefits. Among them are job creation, more stable power prices and indirect gains from averted losses due to climate change.

IRENA estimates that the energy transition will help Southeast Asia reduce energy costs by USD 160 billion by 2050. In addition, it will save up to USD 1.5 trillion in cumulative costs from health and environmental damage caused by fossil fuels by 2050.

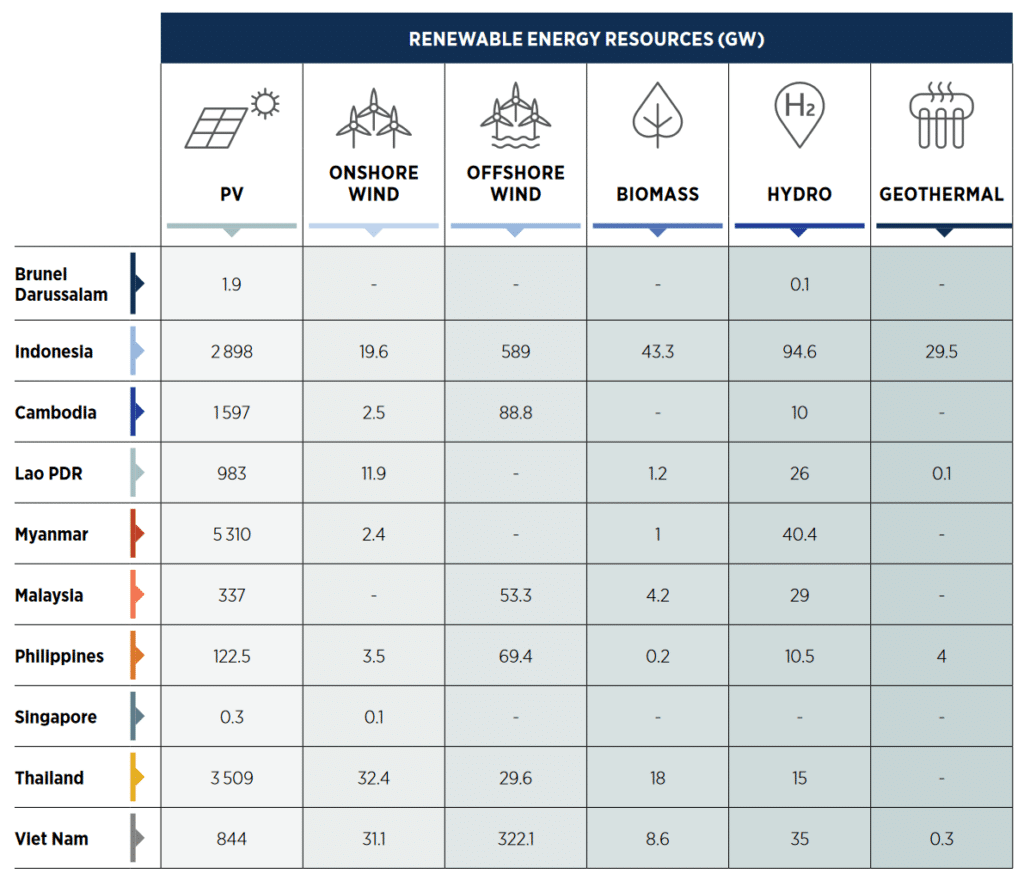

Considering the abundant, untapped technical potential for green energy in ASEAN countries, the economic gains through prioritising renewables instead of gas are within arm’s reach. IRENA finds that the region can transition from just a 19% renewable energy share in 2018 to 65% by 2050.

Looking Ahead

Asian countries are already making notable progress with clean energy adoption. Zero Carbon Analytics finds that Asia has demonstrated the fastest growth rate in wind and solar power capacity addition globally. At a remarkable 35% growth rate per year, the sector has outpaced all other regions since the Paris Agreement.

With the short time-to-market of clean energy projects and the stable transmission networks already existing in many ASEAN countries, governments have a cheap and quickly deployable sustainable solution.

Considering the economic, environmental and energy security arguments, investing in new LNG capacity to accommodate the oversupply of Japan’s utilities, instead of clean energy, will prove a short-sighted, strategic misstep for developing Asia.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more