LNG’s Stranded Asset Risk in Asia: Warnings, Project Delays and Cancellations

Photo ShutterStock

21 December 2022 – by Viktor Tachev

The stranded asset risk of LNG infrastructure in Asia has been known for a while. However, the warnings have mostly fallen on deaf ears. While developing Asia continues to push ahead with LNG expansion plans, this stranded asset risk has become even more evident.

The Stranded Asset Risk of LNG Infrastructure in Asia

On a global scale, half of the world’s fossil fuel assets could be worthless by 2036. Developing Asia is among the most exposed to stranded asset risk.

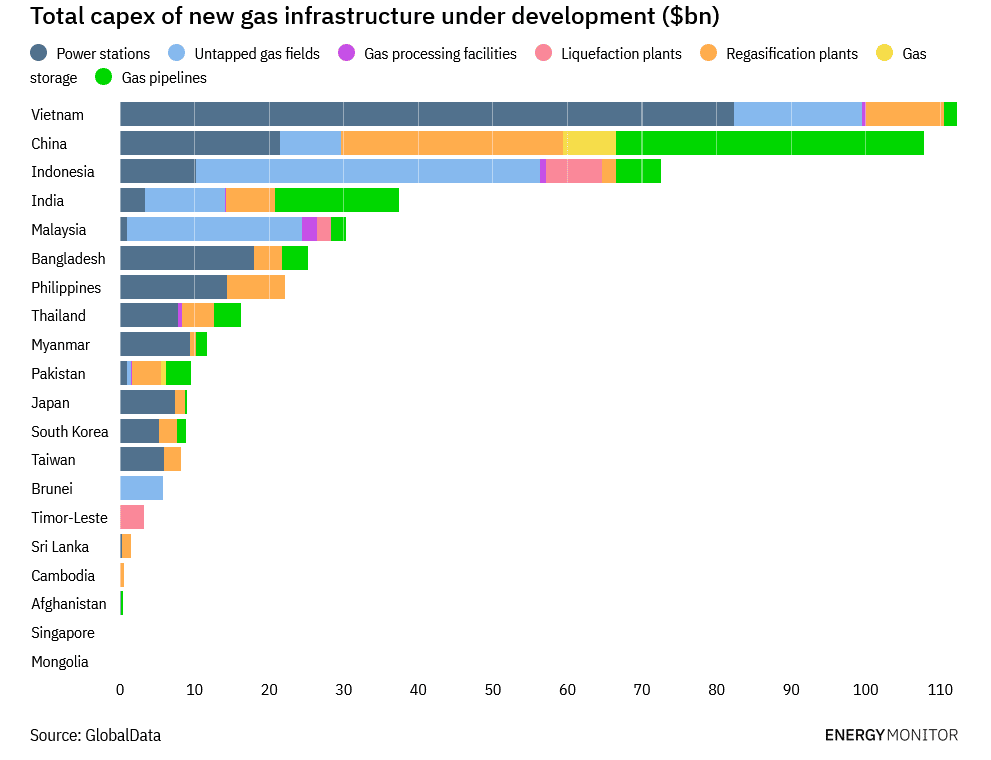

In October 2021, Global Energy Monitor warned that USD 379 billion in new gas infrastructure across Asia faces stranded asset risk. In a later report, the organisation increased this estimate to USD 500 billion.

An IEEFA analysis from October 2021 warned that there might be no guaranteed future for LNG imports in the Philippines. Analysts estimated that just 29% of the LNG projects in the country were viable. As a result, LNG-to-power investors in the Philippines face USD 14 billion in stranded asset risk.

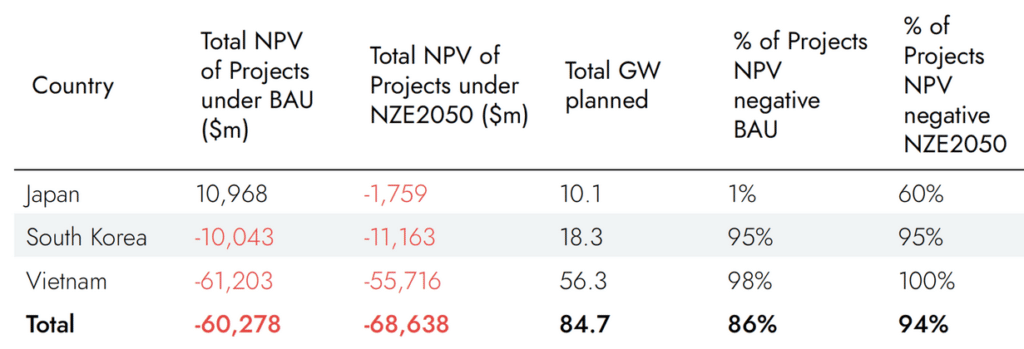

After thoroughly analysing the liquefied natural gas infrastructure in South Korea, Japan and Vietnam, Carbon Tracker warned new gas plant developers that they would have minimal time to build and start operating their units before they become unable to compete with renewable energy. Furthermore, the think tank concluded that in a net-zero by 2050 scenario, 94% of all gas projects in the three countries would have a negative NPV.

In August 2022, the IEEFA warned that over USD 96.7 billion in proposed LNG-related infrastructure in Pakistan, Bangladesh, Vietnam and the Philippines may be at risk of underutilisation or even cancellations.

Liquefied Natural Gas (LNG) Project Delays and Cancellations

In a dedicated eReport, Energy Tracker Asia analysed the potentially permanent natural gas and LNG demand growth destruction across the world. The report also documented how developing Asian nations were going against the grain in their choice to build new infrastructure. Southeast Asia’s fossil gas capacity in pre-construction phases is 117 GW. This is more than any other region in the world. In total, 138 GW of new gas-fired power plants and 118 LNG terminals are being proposed or already being built in the region.

However, the process isn’t smooth, and many projects are facing delays or cancellations. Global Energy Monitor finds that of all the LNG import projects in plans in Asia, just a single 1-mtpa terminal went online in 2022. This comes on top of the mere 17.1 mtpa of new import capacity that began operating in 2021.

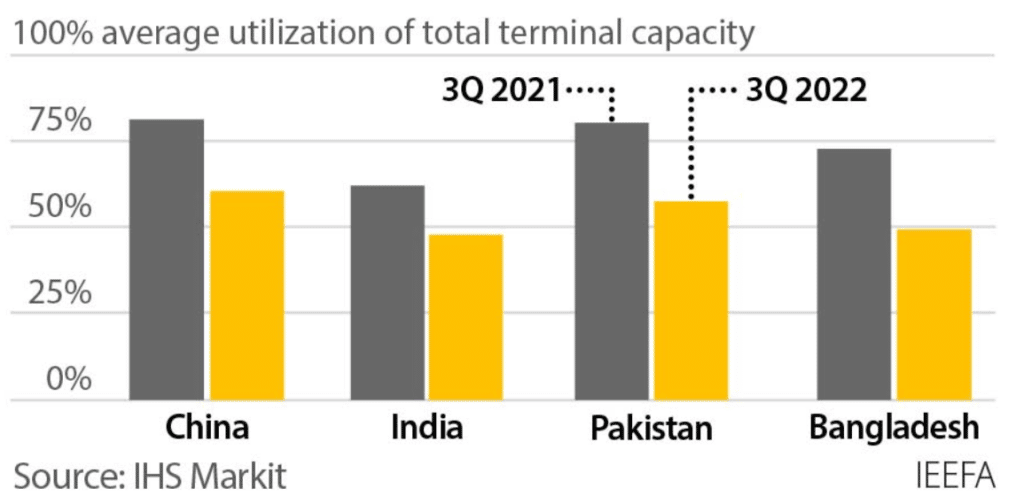

The IEEFA’s analysis from December 2022 warns that the underutilisation of existing import terminals can lead to new projects facing further delays and cancellation. Sam Reynolds, an energy finance analyst with the IEEFA and the author of the report, notes that high gas prices are among the leading causes of project delays. Meanwhile, LNG prices in Asia in October were up by 300% compared to last year.

India

In India, none of the six new terminals anticipated this year were commissioned at the time of writing. While some are still targeting an end-of-year launch, most have been postponed to next year. According to the IEEFA, of the six operational LNG terminals in the country, three were running at below 20% capacity. The prospects for underutilisation will likely continue through 2025.

China

Just two of the eight new terminals targeting a launch in China this year have gone online. Among the key reasons are the high gas prices and the lack of demand in the region.

Bangladesh

Earlier this year, the Bangladeshi government cancelled an LNG-fired power plant project. It cited the high gas prices in global markets as the main reason.

Vietnam and the Philippines

Vietnam and the Philippines postponed the launch of their first LNG terminals for 2023. Eight power projects from San Miguel Corp., whose gas expansion plans Energy Tracker Asia has covered extensively, face a risk of delay.

To Wrap Up

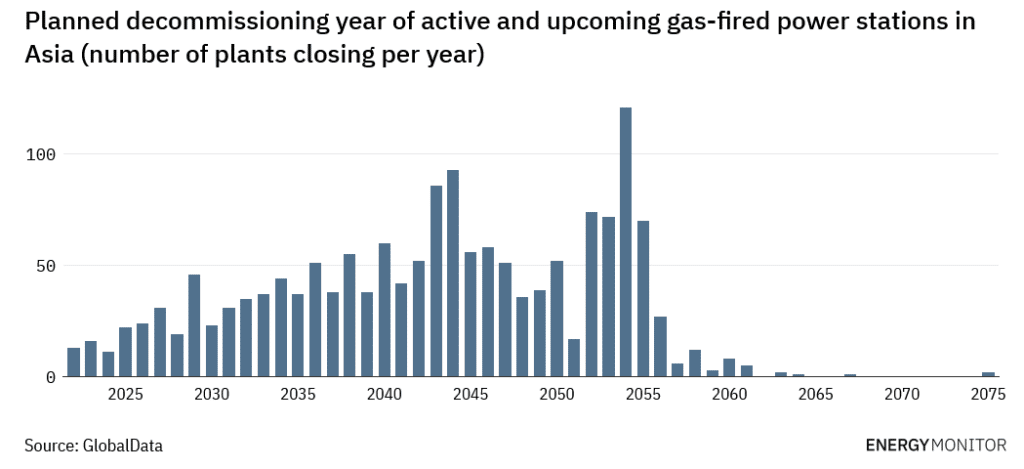

Developing Asian nations have affirmed their support for gas and its role in the net-zero transition. On top of the plans to continue building new gas infrastructure, countries also intend to push back the decommissioning of existing and upcoming gas-fired power stations as late as possible.

Aside from the environmental costs, this choice also bears massive financial and stranded asset risk, with gas prices likely to remain high for the next few years. At a time marked by a global energy crisis and recession fears, this isn’t a viable short-term or long-term strategy.

As the current situation shows, the public and private sector actors that didn’t listen to experts’ warnings the last time are suffering the consequences. Now, it is in the region’s best interests to pivot.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more