The Post-oil Economy in the UAE and How It Is Preparing

12 June 2024 – by Eric Koons

Can we say that a post-oil era is the future of the UAE? What would the post-oil economy look like? Nestled in a small corner of the Arabian Peninsula, the UAE is one of the world’s energy powerhouses. While ranking 116th in size, the country is also the world’s 8th largest producer of crude oil. Oil production is a major industry in UAE and its economic growth is dependent on it. Welcoming a post-oil era will be a challenge for its economic growth, yet as the globe begins to move beyond a post-oil economy, the challenge must be met.

Is UAE Dependent on Oil in 2024?

In 2024, the UAE is undergoing a significant transformation in its economy, gradually moving away from its heavy reliance on oil. The country has been proactive in diversifying its revenue streams, with an increased focus on sectors like tourism, technology, and renewable energy.

What Expedited the Shift for the UAE’s Post Oil Economy

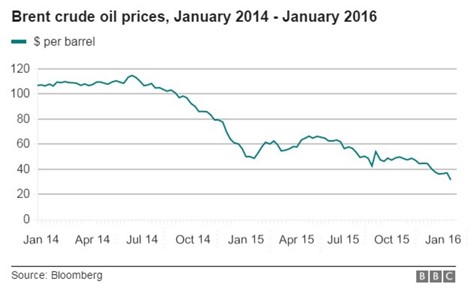

Spurred by the crash in oil prices in 2014, the UAE realised its vulnerabilities in a fluctuating global market. So much of its economic growth is dependent on oil production. With all its economic activity revolving around oil, the UAE was setting itself up for enormous challenges. The world’s sensitivity about climate change also pushed UAE towards economic diversification.

The Oil Industry UAE and A Post Oil Economy

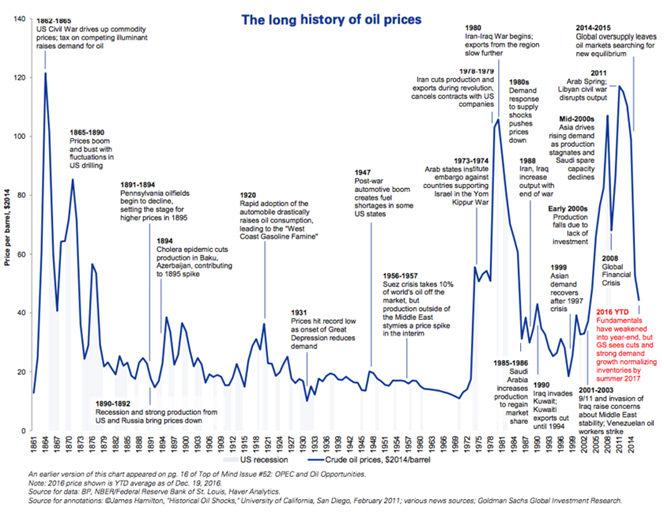

Oil demand rises and fall, but is expected to increase in the post-pandemic era. Generally speaking, this is normal, as over the past 150 years, oil and gas have witnessed regular boom and busts. However, when oil demand eventually plunges from a globe transitioning to clean energy, the UAE will be left behind. To stay ahead, it must be pro-active in a post-oil economy.

For example, the 2014 crash had a significant impact on the UAE’s economy. Yet, it came with a silver lining in the form of a wake-up call. The fluctuation in oil prices and natural gas prices, coupled with the realisation that fossil fuel resources are finite, spurred a shift in the economic thinking of the oil-rich nation. To ensure long-term prosperity, they would need to ease their reliance on crude oil and would have to adopt energy efficiency. Similarly, Saudi Arabia has also planned to reduce its oil dependency.

UAE’s Diversified Post Oil Economy

Today, rather than betting everything on oil, the UAE is now diversifying its activities. It is investing in sectors that hold promise in a post-oil era. These sectors include technology, health, education, renewable energy and transportation.

The government also set up a national fund to help smooth the transition away from crude oil – The Sandooq Al Watan. The fund is dedicated to boosting social entrepreneurship and equipping UAE’s youth with the tools needed to succeed and thrive in the post-oil era.

The fund is heavily focused on the technology sector with goals to teach Emirati children how to code, support Emirati researchers and high-tech startups, and support small and mid-sized enterprises that encourage positive social impacts.

The Alternative Economic Driver to Crude Oil – in the Post Oil Economy

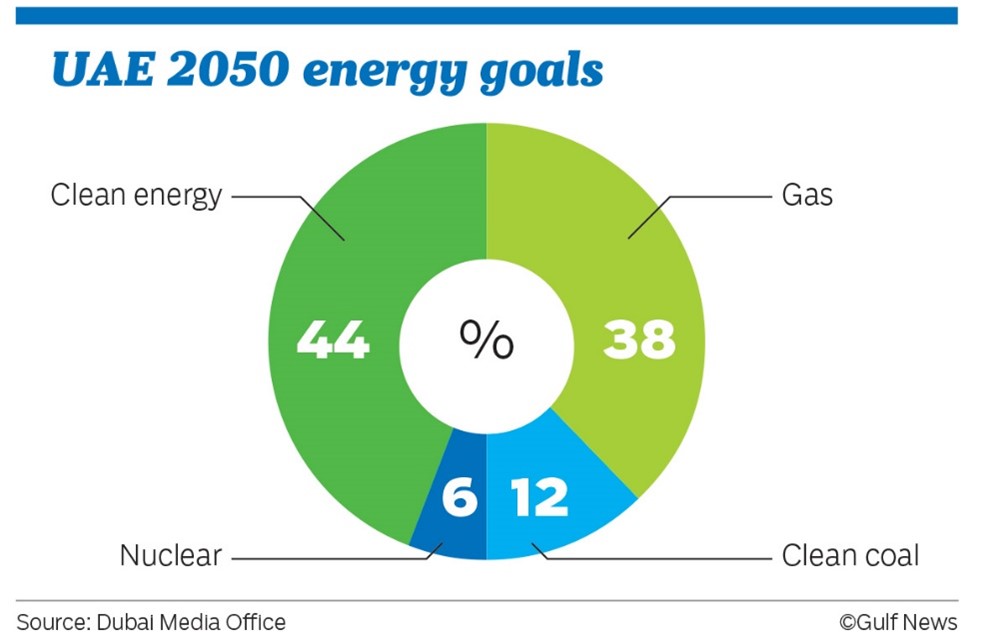

Although the UAE is reducing its oil production, they have no plans to relinquish their status as a global energy leader. Instead, the country is positioning itself to become a renewable energy production leader. The UAE wants renewables to be responsible for 44% of its energy mix by 2050. To achieve this, it will invest USD 163 billion into renewable and clean energy technology, with solar playing a significant role.

The Mohammed bin Rashid Al Maktoum Solar Park, which is in phase four of its development, has a capacity of 1,000 MW. By 2030, this capacity aims to rise to 5,000 MW and will offset 6.5 million tonnes of carbon emissions.

However, renewable energy is not the only economic replacement that is receiving investment. Over 50% of foreign direct investment in Dubai in the first half of 2020 went to technology projects. No longer solely reliant on the oil industry, the UAE is catching up in several sectors.

The UAE Is a Role Model for Fossil Fuel Reliant Nations

While other countries state their intentions to move away from fossil fuels, the UAE is putting its money where its mouth is and adopting economic diversification. They have realised that the global shift away from crude oil is not only necessary but inevitable.

Other nations in Asia and worldwide should be looking to follow the UAE’s lead. Playing catch-up when the post-oil era dawns will leave economies floundering and scrambling to jump on the bandwagon. While it is not too late, the longer countries wait, the more challenging the transition will become.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more