Solar 53% Cheaper than Fossil Fuels in Malaysia

09 September 2024 – by Viktor Tachev

In 2018, Malaysia switched from a net energy exporter to a net importer of power generation fuel. According to estimates, the country’s natural gas demand will continue increasing by up to 5.2% annually until 2050. Amid the gas market situation, if Malaysia continues to rely on imports, it will significantly undermine its energy security and net-zero journey. In addition, it will accumulate significant economic costs. On the other hand, capitalising on the vast untapped solar power potential in Malaysia and improving grid stability and connectivity can generate substantial savings. In addition, it will ensure power sector self-sufficiency and an accelerated journey towards net zero.

Ember: Peninsular Malaysia’s Solar Energy Generation 53% More Affordable than Fossil Fuels in 2023

In a dedicated report on Malaysia’s solar market, Ember finds that the country is enjoying a steep decline in solar generation costs. The think tank notes that, from the beginning of the Large Scale Solar program, between 2016 and 2021, the lowest auction rates for 30-50 MW solar plants decreased by 64% in Peninsular Malaysia. As a result, solar generation costs dropped to USD 0.029 per kWh by 2023. Alternatively, they became 53% cheaper than fossil fuel generation costs (USD 0.063/kWh).

“The 64% reduction in utility-scale solar generation costs in Malaysia from 2016 to 2021 presents a significant opportunity to expedite the country’s journey towards achieving net zero ambitions in its power sector,” explains Shabrina Nadhila, Southeast Asia electricity policy analyst at Ember and an author of the report.

Remarkably, the drop in Malaysia’s solar generation costs exceeds the global rate over the same period (55%).

Malaysia Needs to Tap Into Its Solar Power Potential

While solar power’s decreasing generation costs offer a promising future, the country needs more ambitious targets to maximise the prospective economic gains from its deployment. As per Malaysia’s National Energy Transition Roadmap (NETR), the country aims to reach a 29% share of renewables in the generation mix in 2035, while fossil fuels will account for 71%. Malaysia plans to phase out 50% of its coal plants by 2035 and nearly all by 2045. By 2050, renewable capacity should account for 70% of the energy mix.

However, Ember estimates that realistically, solar power will contribute about 52% of the power generation mix in 2050. Gas will account for the remaining 48%. According to the think tank, this will leave Malaysia’s power sector vulnerable to fuel price volatility and domestic reserve depletion.

As of 2023, coal and gas accounted for 43% and 37% of total generation, respectively. In comparison, solar contributed just 1.7%.

Scaling up clean energy, particularly solar and wind, can protect the country from high power costs, energy insecurity and unreliable supply.

According to Ember, a viable and technically feasible strategy is using solar power to meet daytime demand, while the demand for non-solar hours could be addressed by utilising hydropower and building more storage facilities over time.

A recent report by Global Data, covered on Energy Tracker Asia, revealed that Malaysia is progressing towards its 40% renewable energy target by 2035. However, most of the growth is thanks to hydropower, which holds a 69.9% share in the clean energy mix.

According to Ember, the country needs to increase its solar power generation fourfold to align with a 1.5°C-compatible scenario. Currently, almost all of Malaysia’s energy transition pathways see solar power as the prominent renewable source for the coming decades.

While the country has the technical potential, with up to 268 GW of untapped solar power capacity, the NETR plans to utilise only around 5% (14 GW) by 2035. As a result, it is critical for Malaysia to improve its clean energy targets.

According to the ASEAN Climate and Energy Project, renewables should constitute 99.5% of ASEAN countries’ electricity generation in 2050, with solar responsible for 61% of the energy mix.

Regarding Malaysia, in particular, IRENA warns that the country would need more ambitious targets to align with a 1.5°C-compatible scenario. More specifically, it should be fully powered by renewables in 2050, with solar power as the dominant source.

Climate and energy security reasons aside, another crucial factor that should motivate the increased adoption of solar is the growing energy demand from Malaysia’s data centre industry. By 2029, it is forecast to grow by 13.9% annually.

“The striking demand from the data centre industry can be seen as an opportunity for Malaysia to foster its untapped solar power resources. As electricity demand from this industry rises, Malaysia will need not only a large capacity of stable electricity supply but also strategies to align this growth with its clean power agenda,” explains Nadhila.

Raising the Needed Investments Is Possible

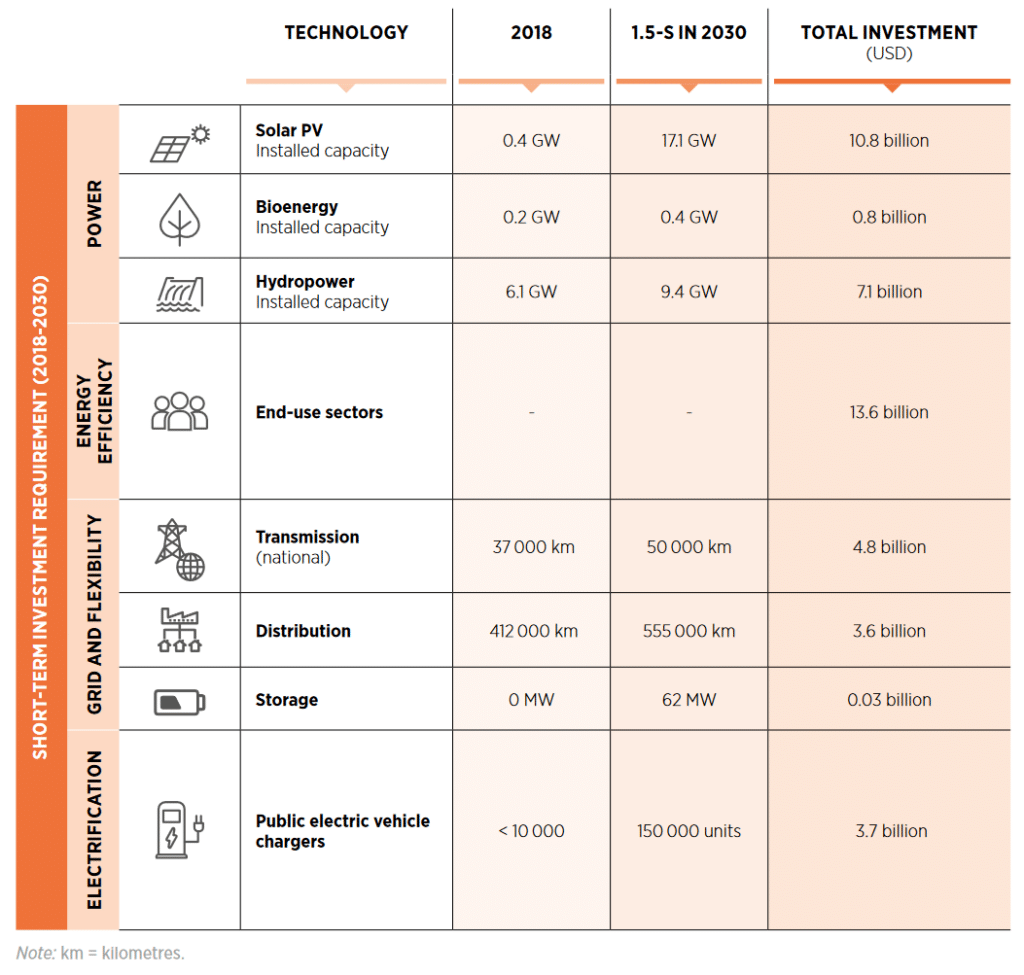

According to IRENA, scaling up solar power to 17.1 GW would require around USD 10.8 billion in investments by 2030. In total, aligning with a 1.5°C scenario would require energy transition investments to top USD 415 billion by 2050.

Clean energy investments in the country are increasing year-on-year. However, they remain far from the levels suggested by IRENA.

Yet, Nadhila sees reason for optimism, noting that the country is well-positioned to attract investments.

“Malaysia has been attracting strong investor interests, with S&P Global Ratings and Fitch Ratings confirming a stable outlook with ‘A-’ and ‘BBB+’ sovereign credit ratings, respectively,” the report’s author noted in an interview with Energy Tracker Asia.

“The ASEAN Investment Report 2023 ranks Malaysia among the top 3 recipients of Foreign Direct Investment in 2022 alongside Singapore and Vietnam, making it a preferred FDI destination in the energy sector.”

Nadhila adds that public-private financing partnerships and Green Sukuk financing are also proving effective solutions for meeting Malaysia’s energy transition investment needs.

In addition, she also notes that Malaysia’s growing reputation as a major hub for the data centre industry, alongside Singapore, further highlights its investment appeal.

In fact, according to the expert, the challenge for Malaysia may not be attracting investment but ensuring that the raised capital is well-allocated and supported by policy frameworks that accelerate renewables deployment.

Supporting Policies and Incentives Crucial for Boosting Solar Deployment

Malaysia has already had success with its supporting mechanisms for solar power deployment in the past. Among them are the Renewable Energy Certificate (REC) and Green Electricity Tariff (GET), supporting companies’ sustainability goals. The reverse auction program from 2016 became a major contributor to the accelerated solar power deployment in the Peninsular region. For example, Ember finds that, by May 2024, 2.33 GW of solar power plant contracts have been awarded. Around 81% of them are already operational.

Other effective measures include the Net Metering Scheme (NEM) from 2016, allowing households, commercial and industrial consumers, and government buildings to export the excess electricity produced by their solar installations back to the grid and receive compensation. The program resulted in the deployment of 1 GW of solar capacity. Around 89% of the approved installations came from commercial, industrial and agricultural consumers.

In a bid to accelerate solar power uptake in the private sector, the Energy Commission of Peninsular Malaysia also launched the Corporate Green Power Program (CGPP) in 2023. It allows small renewable generators, co-generation plants and franchise utilities to become merchant generators, selling energy to single buyers.

However, according to Ember, it is now crucial for Malaysia to build upon its progress by overcoming challenges in the design of the existing policies. According to the think tank, an essential priority is addressing solar intermittency issues due to the conventional grid infrastructure. Succeeding on that front requires introducing supporting mechanisms to incentivise project developers and investors to advance the country’s solar power deployment efforts, grid infrastructure buildup and battery technology development.

IRENA urges the government to shorten project approval times and improve the financing landscape through new and existing mechanisms, like power purchasing agreements and tariff rates to ease and stimulate clean energy project developers.

Aside from introducing supportive policies for clean energy technology deployment and grid buildup, it is also important to facilitate the phasing out of fossil fuels. The IEA highlights the need for a complete phase-out of unabated coal by 2040 to align with the Paris Agreement. In Malaysia, a crucial step in that direction can be addressing fossil fuel subsidies, which cost the country around 12% of its GDP every year.

Complementing Solar With Battery Storage Technologies and Grid Flexibility For Malaysia’s Energy Future

Focusing on accelerated solar power deployment alone isn’t a viable strategy and can result in power curtailment, as Vietnam’s experience has shown. To avoid going down that route, Malaysia should complement it by introducing supportive policies and incentives for scaling up battery energy storage systems (BESS) alongside grid modernisation and buildup across its three regions.

While Peninsular Malaysia’s grid can currently accommodate about 2.4 GW of additional solar power, progress will be halted without energy storage systems. According to Ember, having a reliable grid and integrating BESS technologies with solar power are the ways to significantly accelerate Malaysia’s clean energy transition.

“By adopting a holistic system-wide plan targeting solar and grid flexibility, Malaysia can accelerate its transition to clean energy, thereby reducing its vulnerability to fuel price volatility and mitigating the risk of becoming a net importer of power generation fuels,” explains Nadhila.

Interconnecting Different Regions in Malaysia

Ember’s analysis notes that grid interconnections between the different regions in Malaysia can unlock significant growth, improve power reliability, and encourage greater sharing of renewable resources amongst regions. For example, ample hydropower from Sarawak can help improve low reserve margins in Sabah. In addition, the analysis stresses that the undersea power transmission plan between Sarawak and Peninsular Malaysia can enhance the country’s grid stability. For example, it can allow Sarawak to access more solar during the day, while Peninsular Malaysia will be able to rely on hydropower during evening peaks.

However, Ember stresses the importance of Malaysia’s energy storage technology plans to demonstrate bankability. While the government has started preliminary work on plans for grid upgrades and energy storage facility buildup, the details for how to further advance these technologies are scarce and investments mostly remain limited. According to the think tank, introducing incentives to lure the private sector and capitalise on its expertise and financing to develop battery energy storage systems is crucial for accelerating Malaysia’s decarbonisation journey.

“Lengthy and complex bureaucracy can deter private sector interests, as it can increase project costs. Streamlining approval and regulation processes during project development can maintain and attract more private sector participation in realising Malaysia’s climate agenda,” advises Nadhila.

Policy Support and More Ambitious Climate Targets: The Last Steps Toward Malaysia’s Green Future

With their rapidly decreasing technology costs, solar power and battery energy storage systems provide Malaysia with a viable pathway to decouple its power sector from fossil fuels. Tapping into its vast solar power potential and capitalising on existing hydropower capacity can significantly improve Malaysia’s energy security and help meet its growing electricity demand in a more cost-effective way while bridging the gap with the country’s net-zero target.

However, for the strategy to succeed, the government should prioritise grid modernisation and buildup, policy support and incentives for easing project developers and luring private sector investors. While the journey might seem challenging, Malaysia’s policies to encourage solar adoption and promote its affordability offer a glimpse of hope. Paired with the country’s solid market fundamentals and opportunities, the prospects for Malaysia to shape itself as a regional leader in the green energy transition are bright.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more