The ARE Banking Report – How the Banks That Have Financed Emissions Can Change

21 April 2022 – by Viktor Tachev

The developments across Asia on a corporate and national level will significantly impact the world’s pursuit of its 1.5°C target. This is because Asian banks have financed emissions the most and because the region has the most considerable financing needs when it comes to tackling climate change and greenhouse gas emissions. Asian decision-makers should take action urgently, not only for their own interest but also for the whole region’s interest.

The Asia Research and Engagement (ARE) Banking Report Says Those Who Have Financed Emissions Continue to Drag Their Feet

Grading Asian Banks’ Climate Action, a report launched by Asia Research and Engagement (ARE), states that although the majority of the Asian governments have net-zero targets, regional banks have not kept pace. This finding bears critical importance on a local and global level.

Firstly, Asia’s banks are vital to supporting the transition toward low-carbon economies and can be the decisive factor in whether the continent succeeds or fails. The stakes are incredibly high, considering that the Asia-Pacific is the most disaster-prone region. Millions of people who live there are affected by climate change, especially the populations of developing nations.

The inaction also affects the banks themselves. ARE’s report finds that financial institutions have taken up various risks. The report also concludes that none of the 32 leading banks across the nine major Asian markets assessed are taking sufficient action to meet the Paris Agreement’s objectives.

Unfortunately, these banks’ finances are locked up in carbon-intensive assets that are increasingly difficult to refinance or transfer. The massive stranded asset risk accumulated in the banking system is well-documented. However, ARE’s analysis concludes that the widespread misallocation of capital will continue without an urgent course correction.

The report’s bottom line is that most banks’ actions do not align with their national decarbonisation policies.

The Grading Methodology and Where Banks Are Failing

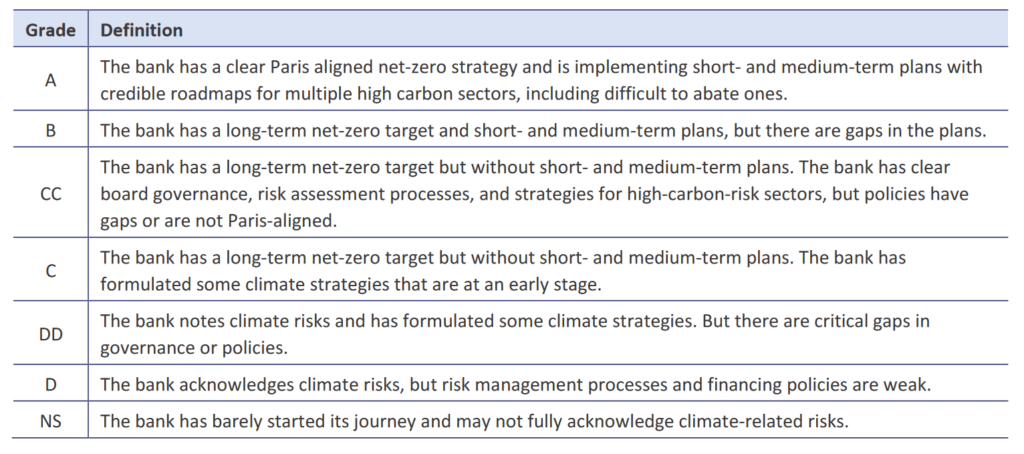

The report’s grading methodology covers factors like governance, risk management, policies and opportunities to review banks’ approaches to climate risk management. The results reflect how banks align their practices and financing to national and global climate objectives, thus future-proofing their business.

For a banking institution to earn the highest rating, it has to have a clear net-zero strategy aligned with the Paris Agreement. It also needs to be implementing short and medium-term plans with credible roadmaps for different sectors.

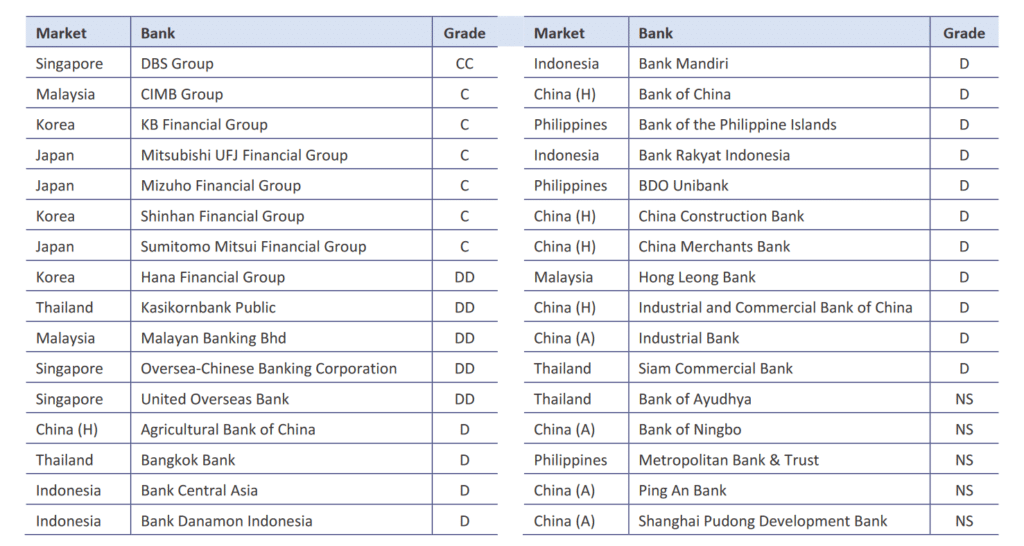

The highest-ranked bank on the list is Singapore’s DBS Group, which was awarded a CC grade. A CC rating means the bank has a long-term, net-zero target, but it does not have short and medium-term plans. It means the bank has transparent board governance, risk assessment processes and strategies for high-carbon-risk sectors. However, there are gaps in their policies, or they are not aligned with the Paris Agreement.

A significant portion of the banks has a C rating, meaning they only have long-term net-zero strategies. However, their commitments are at an early stage. Those with a DD rating have critical gaps in their governance or policies. Most banks in the report fall in the D rating category, meaning they acknowledge climate risks such as carbon emissions and the carbon footprint of their clients. However, they have weak risk management processes or financing policies. Five banks have barely started their journeys and barely acknowledge the climate risks.

Governance and Risk Management Processes

The report finds that 22% of the banks have dedicated sustainability committees on their boards. Despite this, none of the banks make climate-specific considerations during the board nomination process. Furthermore, eight of the banks state that climate change is a factor in their executives’ remuneration.

Regarding risk management, 66% of the banks identify climate-related risks to financing in their sustainability reporting. However, only 10 of them report these risks. According to the report, this practice will likely lead to credit mispricing. Furthermore, very few banks provide scenario analyses that acknowledge climate impact.

Policies – The Fossil Fuel Gap

The report concludes that all Asian-headquartered banks lack clear commitments or adequate implementation strategies for meeting the Paris Agreement’s targets. Just 28% of the analysed banks have long-term net-zero commitments for their financed emissions. Only KB Financial Group and Shinhan Financial Group have provided interim targets for their financed emissions.

Meanwhile, not a single bank has coal power policies that are fully aligned with the Paris Agreement. Only 41% have some form of no new coal policy. Furthermore, just 19% of the banks have a coal phase-out policy – a requirement of national net-zero plans. Banks are performing even worse in terms of gas, another highly-potent emission source. None of the institutions has imposed any restrictions on gas-fired power. This mirrors regional trends, as many Asian nations are increasingly leaning towards LNG – a high-risk move with costly implications.

Opportunities – Capitalising on Clean Energy’s Potential

The report paints a conflicting picture. On the one hand, banks have taken more steps toward launching green products. On the other hand, however, they have failed to alter existing products or address climate change. While most disclose details about the provision of sustainable finance, at the same time, they do not have frameworks that define green activities.

The report’s authors see this as a possible sign of greenwashing practices, raising concerns that the organisations may have launched their sustainable products to hide their continuous provision of funds for dirty industries.

How Can Banks and Financial Institutions Change Course?

According to estimates, without action, the severe implications of climate change will cost Asia 26.5% of its GDP by 2050. Banks and financial institutions have the power and the duty to take meaningful action. They can help shift funds from the costly and dying fossil fuel industry to renewables by committing to climate leadership. However, for this to happen, banks need to go through a significant transformation, not only in their structure and policies but also in their priorities and commitments.

The Grading Asian Banks’ Climate Action’s authors recommend several changes, including governance, risk management, policies and opportunities.

In terms of governance, clear oversight responsibilities, strengthened sustainability-related capabilities and active climate discussion on a board level are essential. Furthermore, the authors advocate for a heavier focus on sustainability reporting, greater accountability and stimulation of climate actions on a board level.

When it comes to risk management, banks should seek to develop and implement a clear framework to identify climate risks and understand exposure.

In terms of policy changes, banks need to align with national and international goals, particularly the Paris Agreement. More aggressive policies against the use of fossil fuels, including halting financing for new capacity and phasing out existing ones. Decarbonisation roadmaps for hard-to-abate sectors and the disclosure of short and medium-term targets are other essential measures.

To capture global energy transition opportunities, banks need to work on disclosing their standards and developing sustainable finance products. At the same time, they should avoid any involvement or association with greenwashing activities.

Asian Banks Have Finance Emissions, But They Can and Should Change

Asian banks dominate the list of the financial institutions that have financed emissions to the most considerable extent. Everyone across the chain – from senior decision-makers and investors at banks to regulatory bodies and the public – should join forces to change the status quo. Without a collective push to meet climate objectives on industrial, national and global levels, we will be unable to turn the tide when it comes to climate change.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more