How Banks Are Making It Hard to Fight Climate Change

18 January 2022 – by Viktor Tachev Comments (0)

Of late, the banking industry and climate change have become a hot topic, especially in Asia. They have a vital role to play in climate risk management and to help financially support developing nations transition toward clean energy. Their role is also vital in monetary and financial stability. In addition to physical risks, banks have to prepare for “transition risks” that come with a shift to a net-zero economy. Yet, instead of backing a sustainable future and fighting climate related financial risks, many central banks and other banks continue to discreetly champion coal.

Coal – The Common Thread Between Banks and Climate Change

Ever since coal began powering vast swaths of industrialisation across the globe, the banking industry has been backing it. Even in the post-Paris Agreement years, where it was made clear that climate change required action on all fronts, the banks continued to support coal and other fossil fuels strongly in the global economy without any regard for the climate risk factors and financial stability implications.

How do banks contribute to climate change?

Banks contribute to climate change through indirect activities such as financing. Bank financing comes in two forms. Firstly, through corporate finance toward project developers, and secondly, with project finance and project-related corporate loans.

Today, many in the industry emphasise environmental, social, and governance (ESG) guidelines to lead their funding decisions.

Climate Related Financial Disclosures

Despite ESG commitments, a recent study found that only 45% of the banks examined have portfolios aligned with climate goals of 2°C, or below. Furthermore, only 23% disclosed their finance emissions, and 49% did not understand how their portfolios impact climate change. Another review of 56 international banks found that eight, including leading Chinese banks, lack coal policies at all.

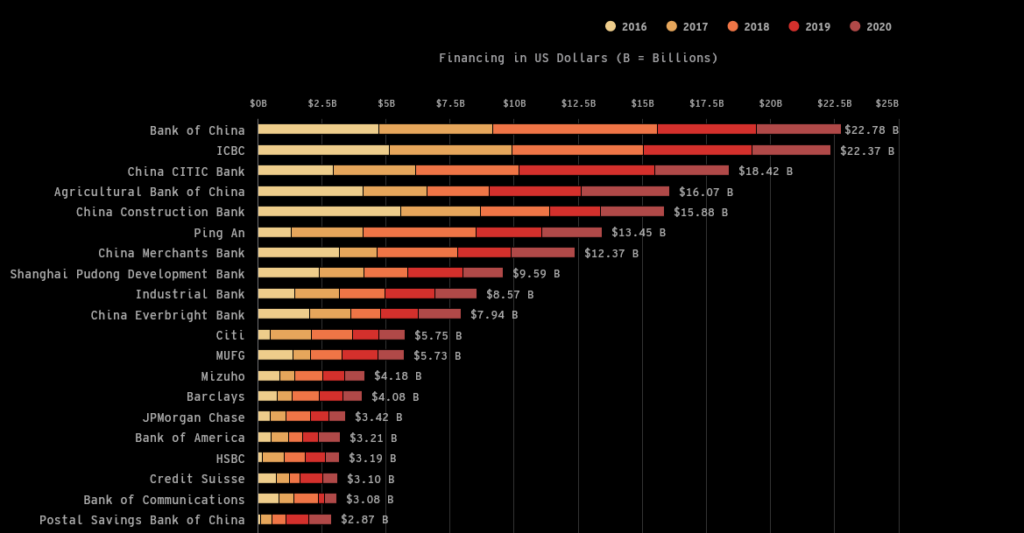

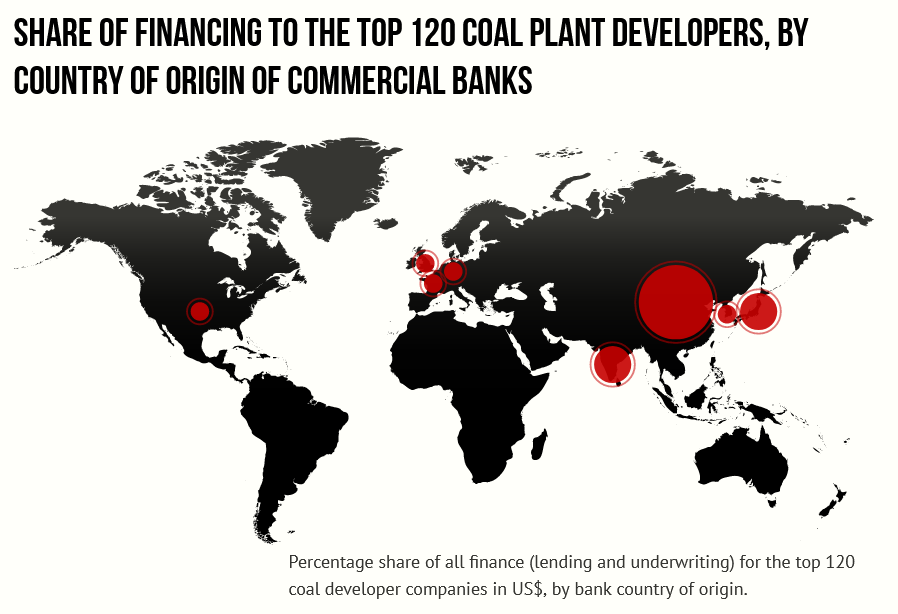

According to BankTrack, a financial tracking organisation, the leading banks financing coal power today are Chinese. Between 2016-2020, the Bank of China and ICBC collectively invested USD 22 billion into coal power. Other banks, including Barclays, HSBC, JP Morgan and Citi, also continue to finance coal. However, when it came to financing for fossil fuels as a whole, the world’s 60 largest banks have invested USD 3.8 trillion since 2016. This mostly came in the forms of lending and underwriting policies.

Loopholes in Financial System Make Coal Financing Possible

Much of the unabated financing by banks toward coal is enabled by corporate policy loopholes. For example, a report by Reclaim Finance, a financial advocacy organisation, shows that HSBC in 2018 invented a new loophole in their corporate policy related to coal. The policy specifically excluded Vietnam, Indonesia and Bangladesh. This gave way for direct international financing of those countries expanding coal power plant fleets. HSBC has also provided USD 1.3 billion to PLN in Indonesia, 736 billion to KEPCO in South Korea, and 372 million to Power Finance Corp in India.

Loopholes also exist for financiers of companies with verified Science-based Targets (SBTs) with questionable practices. RWE, for example, has an approved SBT but will continue to burn coal until 2038.

In other words, without firm government action addressing regulatory loopholes and climate considerations, banks will continue to find ways to finance fossil fuel energy projects. This directly threatens many net-zero commitments made over the past few years, especially post-COP26. As a result, without action, governments will likely have to bear the financial consequences of cleaning up climate impacts.

Banks and Climate Change – the Role Models

To date, 98 banks that hold 43% of global banking assets have joined UN’s Net-Zero Banking Alliance, which commits them to align their portfolios with net-zero emissions by 2050. Similarly, the Net Zero Asset Managers Initiative unites 220 leading asset managers with over USD 57 trillion in assets.

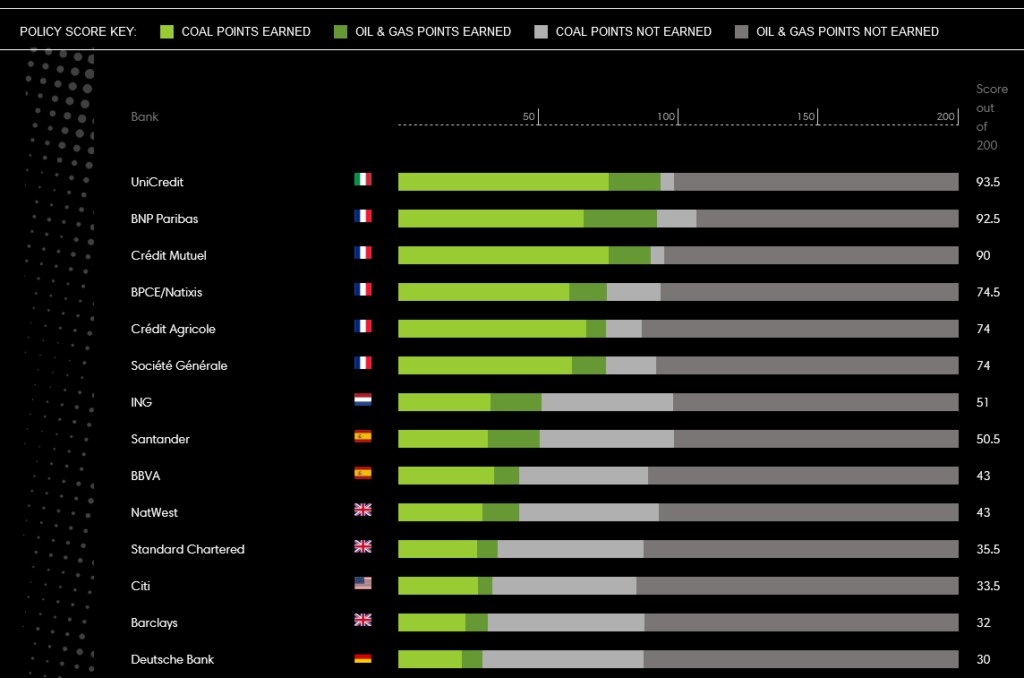

According to the Banking On Climate Chaos report, Banks included in these initiatives and others are making progress with their climate change commitments. For instance, many banks in the European Union (EU) have already published policies that restrict or end financing for fossil fuels – including coal mining and coal power. Notably, nearly all development finance institutions and multilateral development banks have announced their coal exit and pledged support for renewables to fight global warming.

Meanwhile, EU and Australian insurers are also halting their support for coal projects, with their US peers beginning to follow suit. Without viable insurance options, the financial risk of coal infrastructure is bound to become excessive.

With the collective action of banks building momentum worldwide, it came to a head during the COP26 climate conference last year. A coalition of 190 governments, financial institutions and companies signed the Global Coal to Clean Power statement – to end investments in coal. Secondly, the Powering Past Coal Alliance now includes 165 countries, cities, regions and businesses, committed to ending new coal financing and phasing out existing coal power.

Banks and their Importance for Preventing Climate Change and Climate Risks

Banks and climate change are intricately linked. Finance institutions must realise their vital position in determining the speed of clean energy transition. Studies find that the influence of commercial banks can be very high. In some cases, it can even determine the development of the coal power sector within countries relying mainly on public finance. But promises must be transformed into actions, and with public awareness about greenwashing growing, there is little room for rhetoric.

At the very least, banks need to consider their investments and returns. Betting on fossil fuels is quickly proving a risky investment decision fraught with stranded asset risk. In an era as competitive as today, recovering from losses borne from fossil fuels would be nothing but challenging.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more