The Factors Determining the Energy Transition in Asian Economies

01 February 2022 – by Viktor Tachev

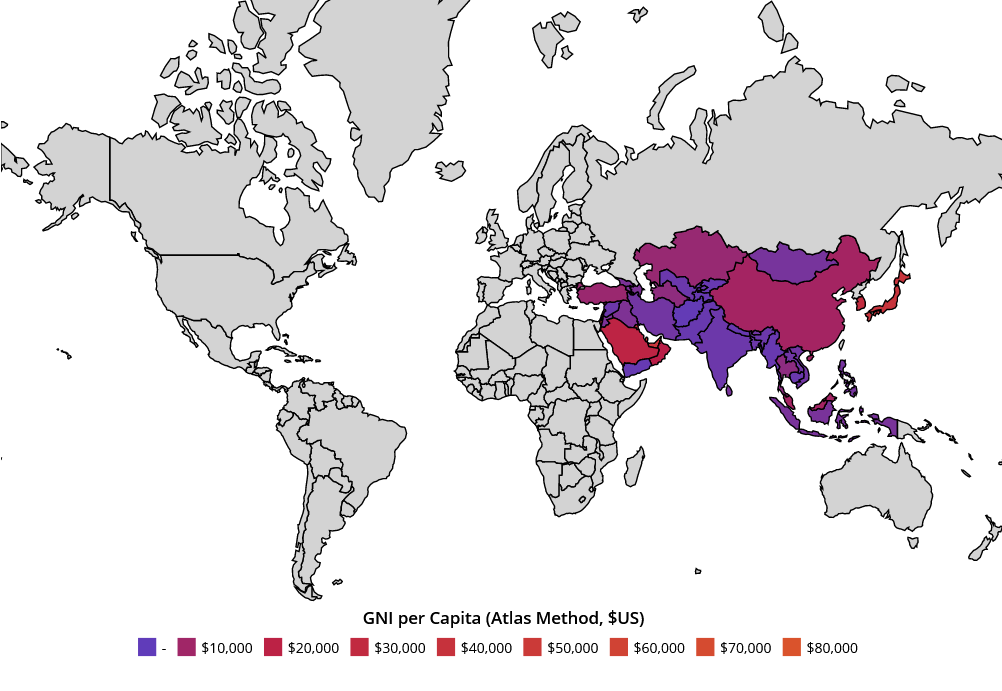

Asian economies are vital for the world to succeed in the net-zero transition. Yet, developing countries across Asia remain in the challenging situation of balancing the simultaneous pursuit of economic rapid growth and sustainability. However, plenty of evidence suggests that progress on both is possible with the proper regulatory measures, economic reforms, foreign direct investment and financial support.

Rapid Economic Growth and Economic Development in Developing Countries of Asian Economies

There is undeniable evidence that clean energy progress positively affects economic growth. And in return, economic growth has a positive relationship with the energy transition. This relationship is also reflected in the variation of policy support across Asian economies, which often reflects the diversity in their GDP growth and economic development levels. Importantly, for the most part, real-world results confirm these findings.

Developed Countries Leading the Way in 2020

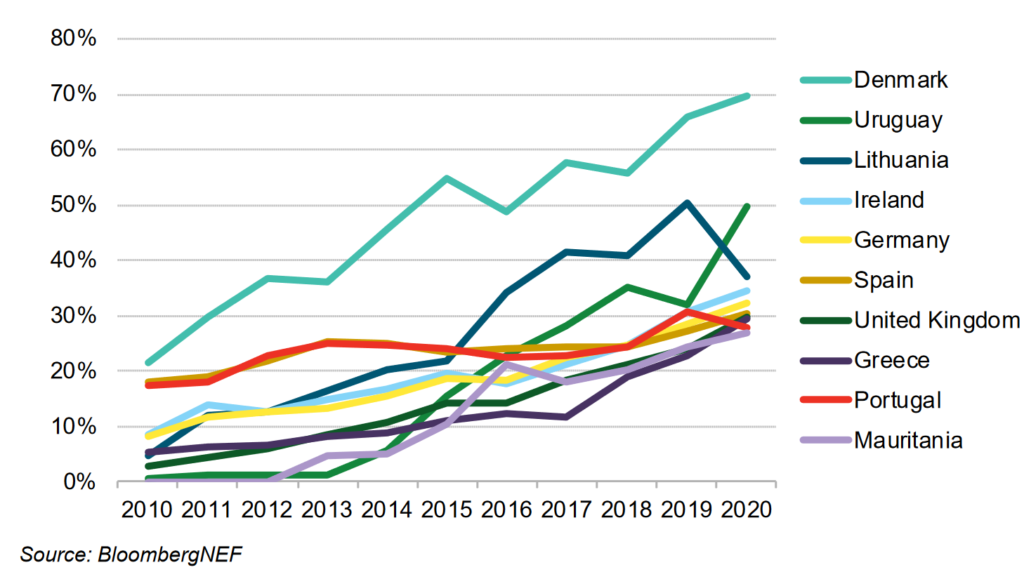

The latest results from the Energy Transition Index reveal that developed countries are achieving better energy transition results in economic sectors. Moreover, most of the top 10 markets, in terms of solar and wind penetration in 2020, were developed European economies. No Asian or Southeast Asian countries make the top 10.

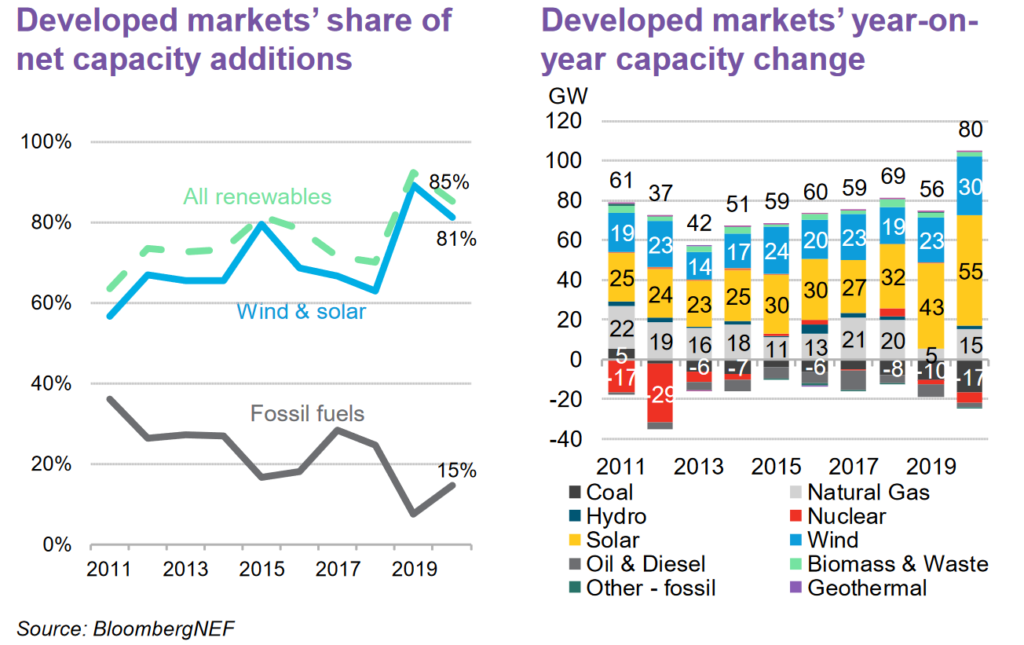

Notably, in 2020, rich countries saw an increase of wind and solar capacity by 85 gigawatts (GW), a 93% increase in a decade. Additionally, these countries set records for phasing out coal.

Fastest-Growing Economies of Asia and Southeast Asia

Going forward, if countries in Asia, especially developing ones, can make the right choices, the trend could shift. Today, Asian economies are by far the fastest-growing economies. And more economic output means higher energy demand. However, as the globe considers the net-zero commitments made, Asian economies will likely push energy policy towards clean energy to satisfy growing demand. This will potentially turn many developing countries into renewable energy powerhouses. In other words, they could out-compete even the most developed world markets.

BloombergNEF’s rankings recorded such a possibility, according to which developing countries, many found in Asia and East Asia, offer the most fruitful environments for clean energy investors.

Population Growth in Asian Countries Risks Slowing the Energy Transition Down

A study in the journal Frontiers of Energy Research found that an increase in population across Asian economies, especially China and India, could slow down the energy transition process. The key to how such a trend pans out would be whether countries in Asia plan to satisfy their growing energy demands through fossil fuels or renewables.

While renewables should be the go-to choice, there is a risk that some developing countries will continue to rely on existing fossil fuel capacity. However, such a move would exacerbate existing issues related to health, the environment, and would undoubtedly make stranded assets more of a certainty. It would also hurt the clean energy transition by slowing the pace of adding new capacity and smart grid improvements.

Fortunately, such a scenario might not pan out. The International Renewable Energy Agency (IRENA) found that increased energy demand spawning from population growth could be met with improved energy efficiency measures. Much of this energy would also come from an increased renewable energy capacity.

The Energy Transition Isn’t All About Economics

While there is evidence that developed countries in global economy are transitioning to clean energy better than developing Asia, this isn’t always the case. For example, the share of renewable energy in final energy consumption in Cambodia is over 60% compared to 15.8% in Germany. In other words, these trends are the same across many countries in Asia, especially in Chinese economy. China has grown into a renewable energy superpower in just over a decade, dwarfing all developed countries.

On the other hand, South Korea, an advanced economy, shows subpar results in the share of renewable energy in their energy mix and is far behind their regional peers. In other words, the difference lies in a country’s determination related to pursuing its net-zero goals.

Enabling a Fair and Just Energy Transition in Asia

Read morePolicy Measures for Asian Economy

Even though Asia’s energy transition is well underway and growing speedily, acceleration is possible. Despite this, Asian economy need to focus on a handful of policy measures to make this happen.

Supporting Clean Energy Foreign Direct Investment and Ensuring More Capital

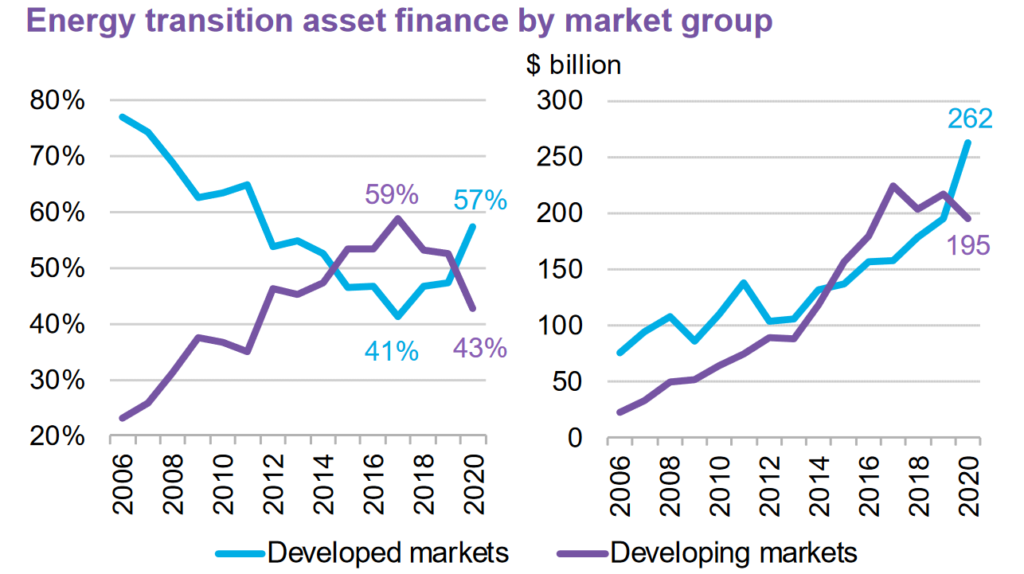

According to BloombergNEF, investors focused on developed markets in 2020. However, this must change if the world is to remain on track with its net-zero goals. Indeed, the International Energy Agency (IEA) suggests that capital spending on clean energy in developing countries has to exceed USD 1 trillion by 2030.

Countries can make this happen by improving their domestic environments for foreign investment and clean energy investments. An essential step in this process would be harnessing the readiness of investors to back renewable energy projects. Similarly, increasing the role of the private sector and international and development financial institutions would help.

This is especially important for countries in Asia, where public finance remains the dominant source of project financing. According to the IEA, the balance needs to shift to a point where over 70% of clean energy investments are privately financed. In the agency’s climate-driven scenarios, public sources still play vital roles but focus on different areas. For example, public sources would continue expanding and modernising grid infrastructure and decarbonising hard-to-abate sectors.

Working Towards Affordable Clean Energy for Everyone

Despite the immense economic growth in Asian economies, hundreds of millions of people on the continent still live in poverty. Changing that requires pursuing a fair energy transition for everyone.

Development finance institutions need to ensure energy access for vulnerable communities in remote areas. It will increase agricultural productivity and agricultural development. Over 600 million people in Asia do not have access to clean energy sources. However, many clean energy technologies like wind and solar require high up-front investments. Furthermore, capital remains significantly more expensive in developing countries than in developed ones.

In other words, international funding is crucial to addressing this, which has been pivotal in the past in de-risking and lowering the costs of renewables in Asian countries like India. Overcoming this challenge rests on collective effort. Without support from governments and financial institutions, the clean energy transition may leave behind those who need it the most.

Designing Supporting Policies and Regulatory Measures

Importantly, the top priority for governments should be to pursue universal energy access, affordability and increased clean energy adoption. Yet, according to the IEA, the actions by policymakers within their countries won’t create enough momentum. They suggest more international engagement and support, especially for developing countries.

However, policymakers could help by making it cheaper and easier for project developers to build clean energy capacity. Governments can also improve domestic access to capital and stimulate local entrepreneurs and enterprises in sustainable technologies. Additionally, they need to hold state-owned utilities accountable for their sustainability strategies. Most importantly, their policies should create equal grounds for clean energy to compete with fossil fuels.

These measures would see Asian economies accelerate in the shift away from fossil fuels if applied simultaneously. Above all, it would ensure a fair energy transition where impacts spread across the socio-economic spectrum.

The time for treating economic development and the energy transition as separate has long passed. They are mutually dependent, and examples across Asian countries and other developing countries now show this. What’s important now, however, is that momentum doesn’t stall and progress and support remain high for years to come.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more