The Global LNG Market and Long-Term Contracts – A Barrier to Net-Zero 2050

01 March 2022 – by Viktor Tachev

Despite the urgent need for global net-zero progress, the Liquefied Natural Gas (LNG) market in Asia looks to thrive in the coming years. While proponents of gas constantly prop up its benefits, it threatens to derail decarbonisation efforts and the financial stability of Asian economies.

The Mechanics of the LNG Contracts Market

The dominant LNG market model is based on long-term take-or-pay LNG imports contracts. They require the buyer to purchase specific quantities of liquefied natural gas (LNG) regardless of whether it’s delivered or not. Alternatively, the buyer is locked in a contract with a length that can last between 20 and 25 years.

According to some analysts, 20 year long LNG contracts lock profits in for LNG producers and corporations while passing the high electricity prices to consumers. On the other hand, LNG industry proponents regularly claim that that medium and long-term contracts are necessary to ensure sustainable and secure supplies.

Covid-19 Pandemic and the LNG Industry

The COVID-19 pandemic also took its toll on the gas markets. According to the Oxford Institute for Energy Studies, the pandemic surfaced the need for change on three aspects. First, abandoning the dominant oil-linked pricing models; second, increasing operational flexibility; and thirdly, reexamining contract adjustment mechanisms.

Today, the norm for long-term contracts is around ten years, which is less than the contract durations in the earlier stages of the LNG market (20 to 25 years). Yet, buyers’ preferences range between three to five years, but contract length isn’t everything.

The International Energy Agency, an energy forecaster, suggests that the problem isn’t long-term contacts but rather the terms. In several cases, the terms favour sellers while buyers get the short end of the stick.

Liquefied Natural Gas Market Implications for Asia

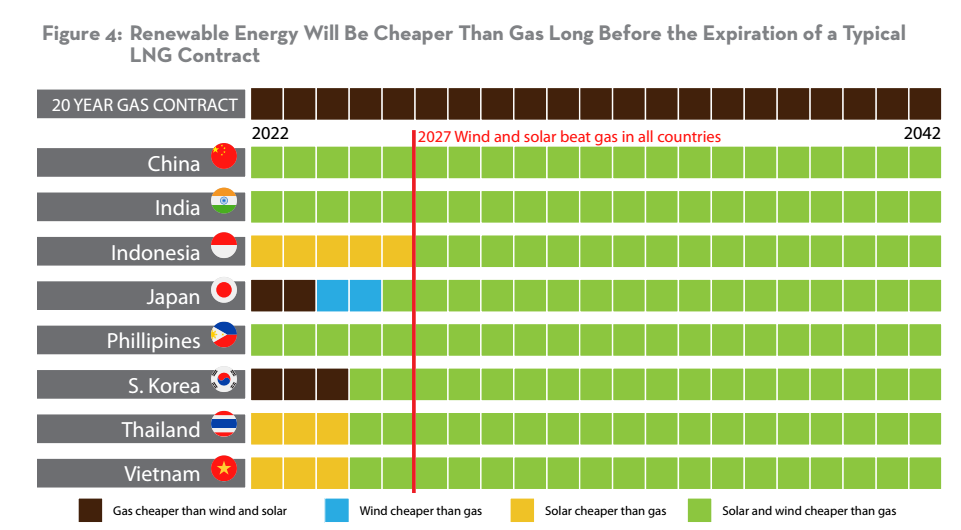

For Asian countries, as buyers of natural gas, locking long-term contracts can be precarious. First, the world is actively trying to move away from fossil fuels. Second, clean energy sources will become cheaper than natural gas in most Asian countries in the next five years. There are, however, other market-specific concerns and market dynamics.

LNG Market Supply-Demand Mismatches – Is LNG Demand Growing?

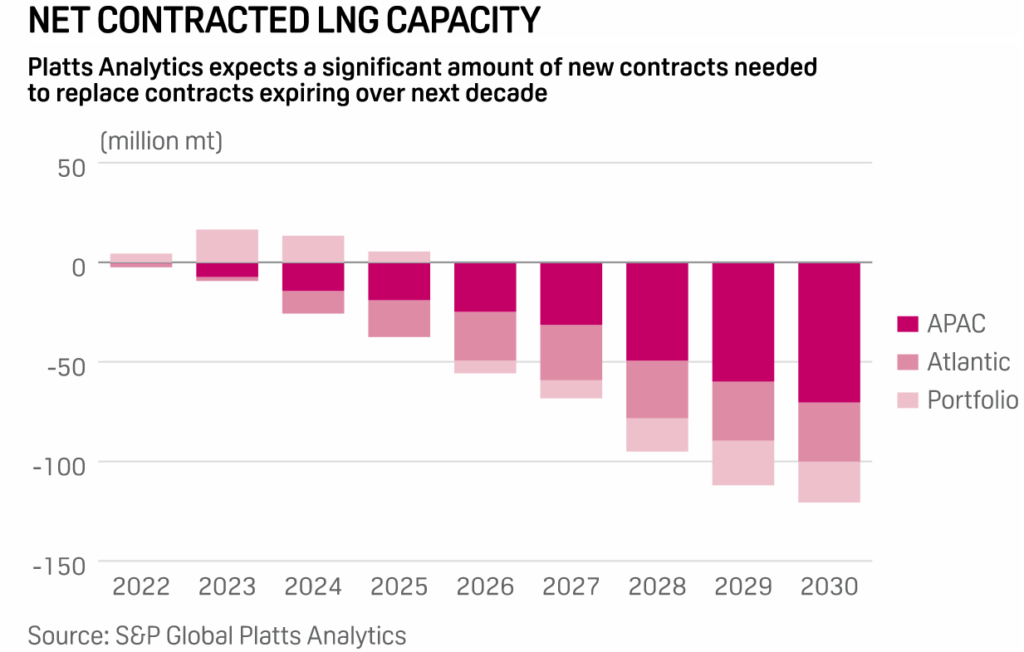

Forecasting LNG demand is a complicated task. This has led buyers across Asian markets like Japan, Korea, Taiwan and China to sign long-term contracts to purchase excessive amounts of LNG. This led to problems as improvements in energy efficiency and growth in renewable energy in some areas reduced power demand. As a result, the same regions faced an oversupply issue.

On the other hand, the robust COVID-19 recovery has led to rapid gas demand growth elsewhere in Asia—leaving some buyers requiring more than their contractual terms.

Energy Dependency Risk and the Struggle to Hold Suppliers Accountable

Market analysis reveals that Asian buyers often can’t hold suppliers accountable for not honouring their contractual obligations. For example, S&P Global cites situations where gas suppliers have diverted LNG cargoes to other countries to profit from high spot LNG prices. Buyers affected gained limited compensation. However, in cases where energy security is at stake, payments won’t keep the lights on.

Adding to Asia’s woes, the ongoing tension between Russia and Ukraine may see some of its gas supplies diverted to the European Union. Despite not having a hand in the conflict, Asia may once again be a loser in the LNG supply wars.

Volatility and the Unpredictable Prices on the LNG Markets

Between April 2020 and January 2021, gas prices saw a 1,000% leap. Such price jumps have proved very costly to countries like Bangladesh. For example, despite demand plummeting in 2020 due to COVID-19, it continued to import gas to fulfil contract obligations. These payments resulted in Bangladesh paying almost three times the global price.

Additionally, wild price fluctuations in 2021 contributed to further uncertainty. In January, gas prices soared to USD 33 per million British thermal units (MMBtu). Yet, fell to USD 7 MMBtu the following summer. On some days, prices rocketed upwards by 60%.

Adding insult to injury, Asian LNG buyers also pay an “Asian premium”. This raises prices far higher than markets in North America and Europe. Asian countries were paying up to six times more for gas than the United States in some cases.

Making Long-Term LNG Contracts Flexible

The lack of flexibility in gas contracts is a well-documented issue causing problems for both buyers and sellers. In Japan, for example, the stability of supply has been prioritised over price. This is in part because utilities can pass on costs to consumers.

Due to market specifics, locking prices and supplies for the longer term will favour buyers. In other situations, it favours sellers. Overall, however, the uncertainty on both sides is equally risky, which is not good for LNG infrastructure and the LNG production capacity of different countries.

Governments, utilities and producers need to seek more flexibility in their contractual obligations for more certainty. Firstly, contractual volumes need adjustment options based on whether they are over or undersupplied. Secondly, periodical price reviews should be built-in to reflect current market conditions.

According to a report by Squire Patton Boggs, a law firm, contractual terms need to be revised to level the playing field:

- They suggested that contractual terms should cover downward quantity clauses.

- If recipients don’t need the imports, the ability to divert LNG cargoes to other markets is required.

- Enable all parties to address undersupply issues.

To pull this off, however, it’s essential to broaden the scope of contractual rights available to both parties. In other words, to find solutions and mutual agreement to address challenges.

Only One Way Forward – Future For LNG

While gas goes by the wayside across the globe, Asia is the only region where it’s projected to grow. Asian countries risk living in uncertainty if they continue with the dominant long-term contractual model. This endangers the region with restrictive take-or-pay and destination clauses that lock countries into unfair agreements.

Asia doesn’t have to look further than Europe—the gas price battlefield to see the risk. While many Europeans can afford higher prices, many in developing Asia cannot. The EU is beginning to comprehend the pitfalls of long-term gas agreements and is now working to ban them for imports coming from non-EU countries post-2049.

Europe’s situation gives Asia an ideal blueprint for addressing issues associated with long-term gas contracts—from energy security to finances. Without action now, Asia risks undermining their net-zero future, a future where there is little room for gas.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more