The Global Natural Gas Pipeline Expansion Plans and Climate Impacts

15 March 2022 – by Viktor Tachev

The natural gas pipeline and its climate impact is a global natural gas production and infrastructure project that scientists, NGOs and climate activists have been vocal about for several years. However, national plans reveal that international natural gas pipelines will expand significantly. The consequences of this are far-reaching such as more carbon dioxide emissions and greenhouse gases emissions, but won’t be limited to climate impacts but include financial and energy security risks.

Climate Impacts of Global Natural Gas Pipelines Expansion 2022

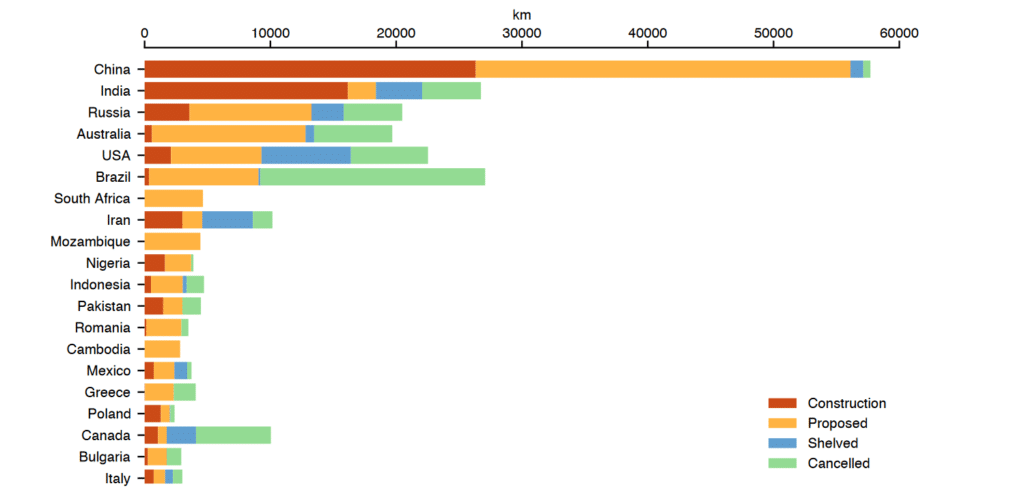

The latest survey by the Global Energy Monitor (GEM) revealed that countries like China, India, Russia, Australia and the United States plan to expand their natural gas fleet significantly. Seemingly, they are all moving ahead with commissioning tens of thousands of kilometres of gas pipelines in 2022.

Natural Gas Infrastructure Expansion and Greenhouse Gas Emissions

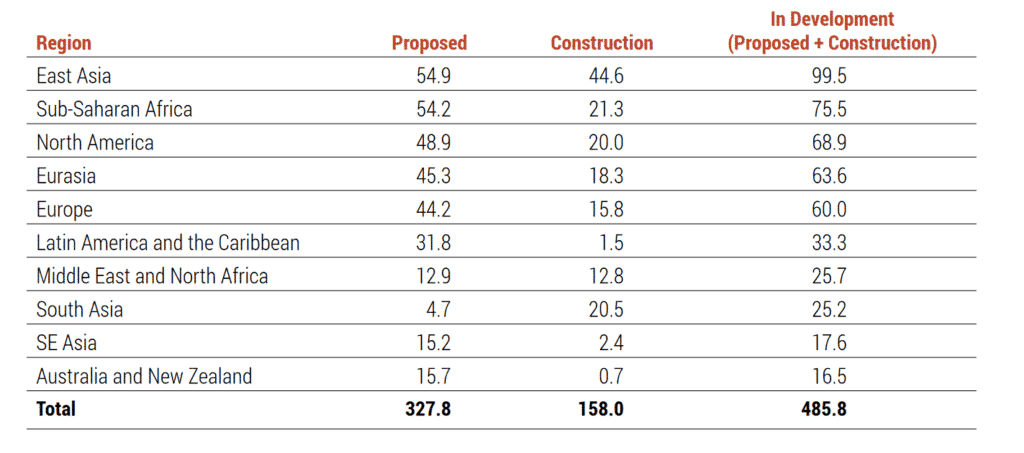

According to GEM estimates, the looming global gas fleet expansion will total USD 485.8 billion in capital expenditure. In the context of the global net-zero goals, this is USD 485.8 billion in stranded asset risks. However, looking beyond the financial implications, such plans also run opposite to climate goals. Currently, natural gas and its connection to leaking methane emissions have extremely detrimental climate impacts. Moreover, growing evidence suggests natural gas threatens the energy security of dozens of countries.

The Asian Countries in Favour of Natural Gas

The analysis found that over 70,000 km of natural gas pipelines are in construction globally. Another 122,500 km are in the pre-construction development phase. Furthermore, over 36,000 km are scheduled for commissioning in 2022 and 59,500 km between 2023 and 2030. These natural gas infrastructure projects will increase air pollution.

Several Asian countries are amongst the most significant contributors to this expansion.

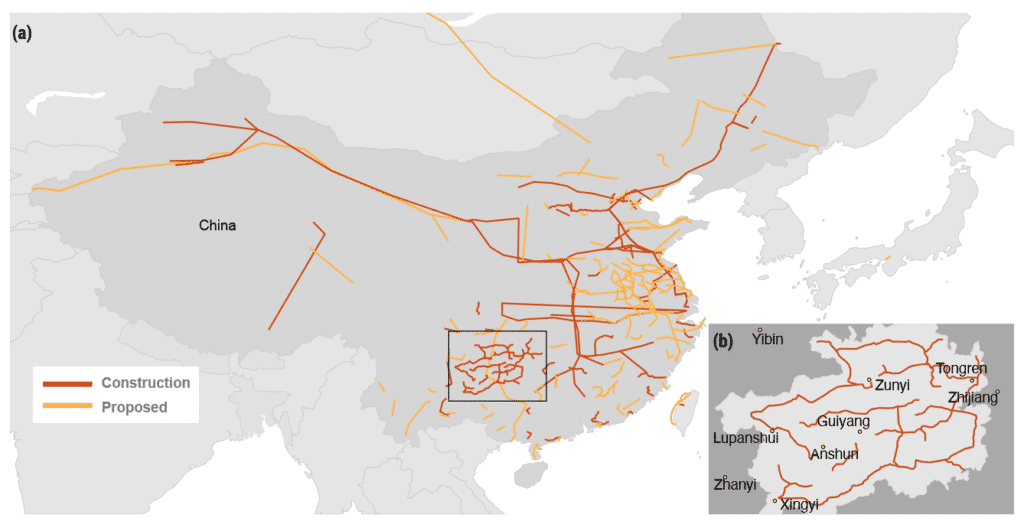

China – Top Liquefied Natural Gas Importer

Despite being a leader in clean energy, China also has the largest LNG market and is the top LNG importer globally. Moreover, the country also tops the chart for the most significant natural gas pipeline development plans. This sees 26,300 km in construction, with another 29,800 km in the pre-construction phase. The GEM analysis found that China is exposing itself to a stranded asset risk of USD 89.1 billion.

Directing these plans is PipeChina, second only to Gazprom in pipeline development.

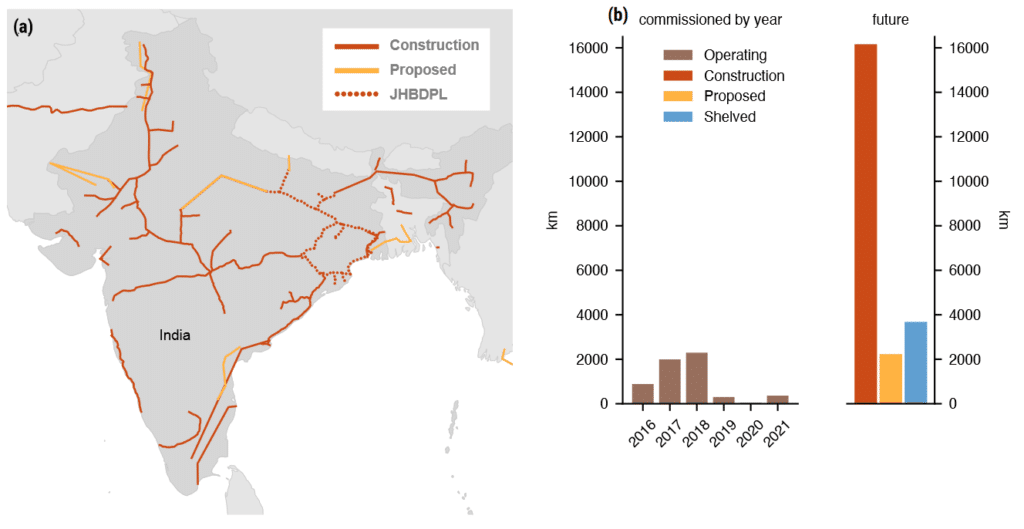

India Needs More Gas

India aims to increase the gas fraction in its total energy mix to 15% by 2030. This is an increase from 6% today. To achieve this target, though, India sorely needs better infrastructure.

This need is reflected in its gas pipeline expansion plans. India ranks second with 16,200 km gas pipeline in development, with another 2,200 km planned. The authors of the GEM report estimate the stranded asset risk for India at USD 14.7 billion.

Other Asian Countries

As a whole, Asia has the highest estimated capital expenditures for proposed and under construction natural gas power plants and projects.

Other countries with natural gas pipeline expansion plans—in development and proposed—include Indonesia (3,306 km), Cambodia (2,824 km), Vietnam (915 km), Taiwan (898 km), Myanmar (670 km), South Korea (392 km), amongst others.

The Financial Implications for Pro-Gas Countries in Asia

Generally, gas pipelines have an approximate lifetime of 50 years.

Considering that many major economies are pursuing net-zero by 2050, with drastic mid-term goals by 2030 and the fact that renewable energy is getting cheaper by the day, the natural gas infrastructure built today is likely to become impractical. At the same time, such investments put hundreds of billions of USD at risk.

GEM’s findings come on top of an earlier report by the Institute for Energy Economics and Financial Analysis (IEEFA). It found that 62% of LNG import terminal capacity and 61% of gas-fired power capacity in emerging Asia countries is unlikely to be built because of “unfavourable fundamental project and country-level factors.”

Financing for more natural gas projects is also becoming scarce. At the COP26, countries committed to ending international public finance for unabated coal, oil and gas projects by the end of 2022. Furthermore, restrictions from private institutions on oil and gas company financing are already underway in the EU, following the example of the EBA. As a result, gas projects risk following coal’s fate and become un-bankable.

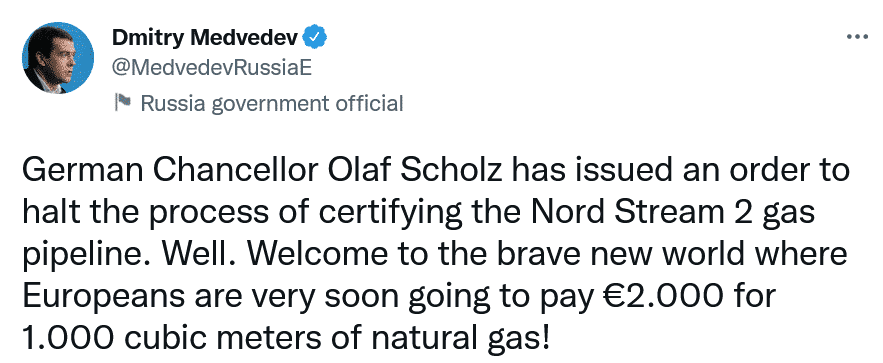

Asian countries should monitor the situation in the EU to get a sense of the magnitude in pricing risk. The increased reliance on Russia for gas deliveries has led the continent to the brink of an energy crisis. Europe has also seen a period of unprecedented natural gas price increases. In the context of the latest conflict in Ukraine and the imposed sanctions on Russia, Dmitry Medvedev, Deputy Chairman of the Security Council of Russia, threatened Europe with prices of up to EUR 2,000 per cubic meter of natural gas.

If Asian countries don’t want to end up in a situation where natural gas imports are used as leverage against them, they need to reconsider their gas pipeline expansion plans.

The Bottom Line

According to the International Energy Agency, to reach net-zero by 2050, the world needs to immediately halt oil and gas investments. The decision to expand the global natural gas pipeline solidifies a scenario incompatible with a net-zero and clean energy future. Even if Asian countries completely ignore the natural gas pipeline climate impacts, it is in their best interest to reconsider the major expansion plans for purely financial and energy security reasons. Natural gas is an unnecessary distraction for European and Asian countries alike.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more