South Korea’s Renewable Energy Transition and Its Barriers

22 June 2022 – by Viktor Tachev

Amongst the most prosperous countries globally, South Korea is a benchmark that others look at and draw inspiration from. This is especially true regarding renewable energy sources, its overall energy mix and energy transition. With the latest declaration to achieve net-zero by 2050, South Korea acts as a role model. However, when looking under the surface, there are plenty of barriers that risk derailing the renewable energy transition in South Korea.

South Korea’s Energy Mix and Renewable Energy Transition Progress

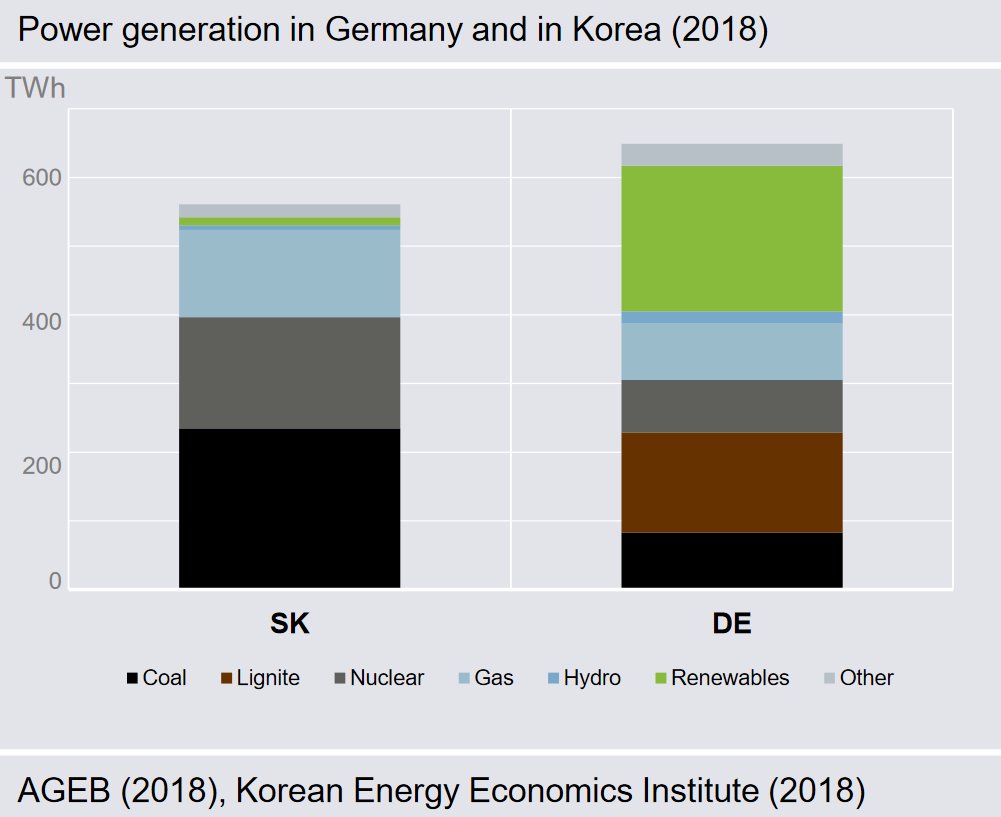

Data from the Korea Energy Economics Institute (KEEI) revealed that fossil fuels (82.5%) dominate South Korea’s energy sources, along with importing 94% of its energy from overseas. For example, South Korea is the world’s fourth-biggest importer of LNG after Japan, the EU and China.

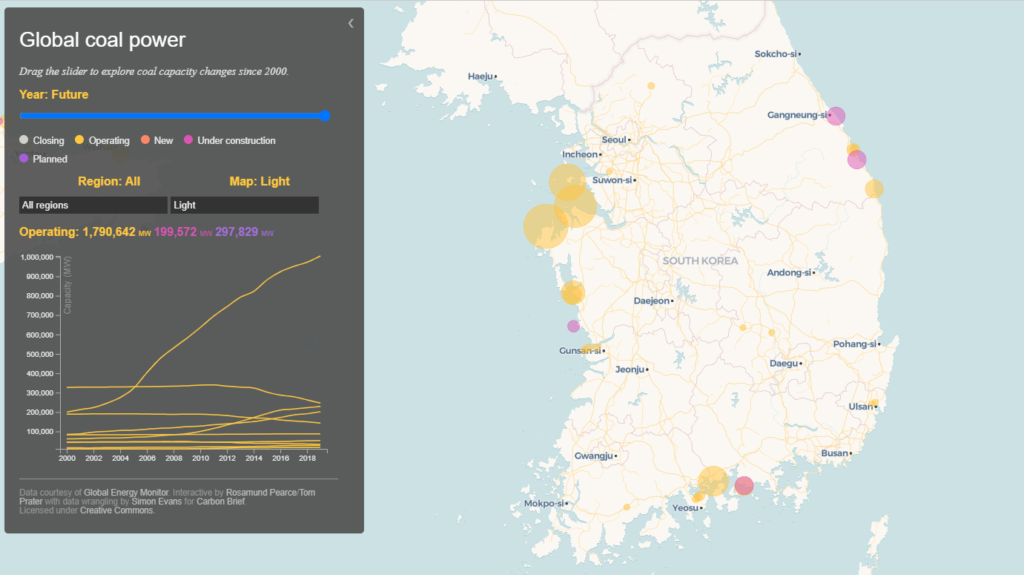

Additionally, despite net-zero pledges, the country is in the process of building a new 7.3 gigawatt (GW) coal-fired power plant. This runs contrary to its ambition to retire all of South Korea’s coal plants by 2029 to align with the Paris Agreement.

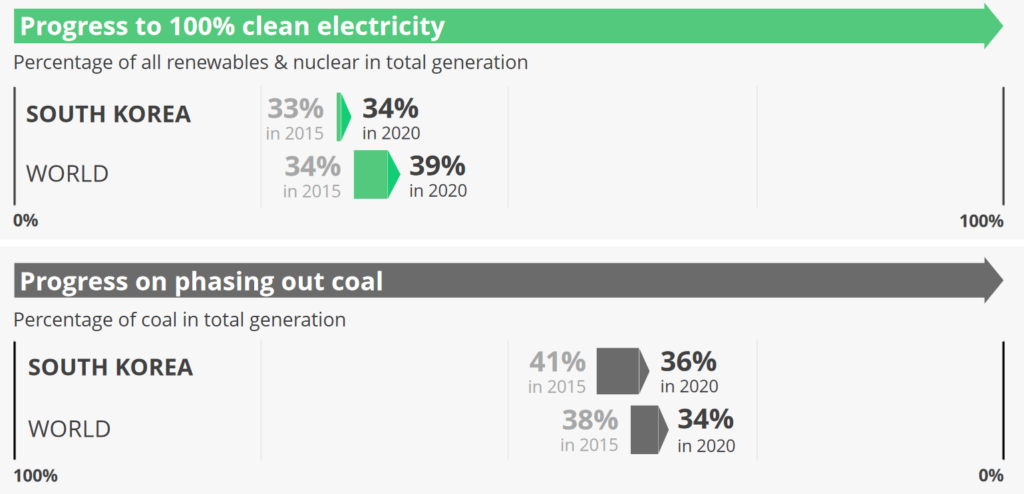

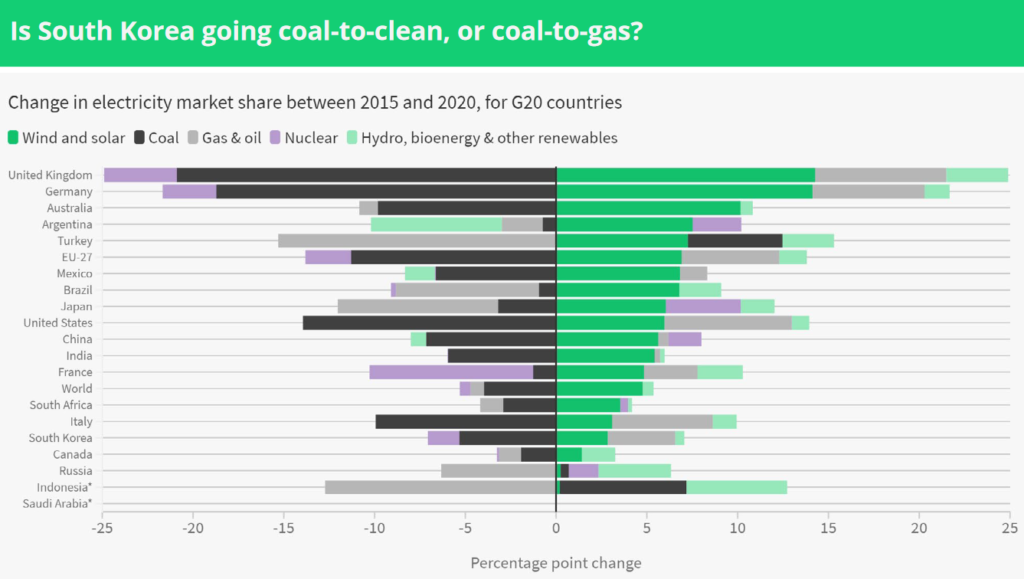

As of 2020 South Korea’s renewable energy sources included wind and solar energy. Yet, they generated just 3.8% of the country’s electricity – up from 1% in 2015. Today, renewables account for just 6.4% of South Korea’s energy mix, the lowest among all OECD members. The government aims to increase the share of renewable energy to 20% by 2030 and up to 42% by 2034.

The carbon emission reduction target of 24.4% compared to 2017 levels. In comparison with other countries, South Korea’s current NDC lack ambition. For example, the US and Japan aim to cut emissions by 50% from 2005 levels by 2030.

According to experts, the minimum goal to remain on course with a net-zero scenario by 2050, South Korea would need to pledge a 66% reduction in carbon emissions.

Roadblocks for South Korea’s Renewable Energy Transition

Under former president Moon Jae-in, South Korea showed ambition to reshape the country’s traditional energy mix and develop new green technologies. This included a large focus on renewable energy.

The Green New Deal, alongside the Ninth Basic Plan, the Emissions Trading Scheme (ETS) and a stimulus package for South Korea’s renewable energy are giving renewables a good start. However, the uphill climb might prove too steep. Due to its starting position and the green energy regress in the past couple of years, South Korea faces a more challenging task than many other nations.

The country is among the biggest carbon polluters and coal importers. It is also the second-largest overseas coal financiers globally, although this recently came to an end.

As a result, South Korea has significant and expensive legacy assets in need of transition. According to Carbon Tracker, the country has the highest stranded asset risk globally. Furthermore, new coal power operations are under construction.

South Korea’s Energy Reliance on LNG

South Korea must retire as much as 13.7 GW of coal capacity by 2034, according to Carbon Tracker. However, instead of renewable energy, it may look to liquefied natural gas (LNG). Furthermore, throughout the Ninth Basic Plan’s legislative lifespan (2020- 2034), gas-fired capacity is set to increase to 55 GW in 2030 – up from 41 GW today. Such a scenario risks substituting one type of stranded asset risk with another. It will also hinder the country’s battle to lower its carbon emissions.

Carbon Tracker also concluded that new gas power is uncompetitive compared with renewables energy when taking into account Levelised Costs of Electricity (LCOE). Due to this, the think-tank suggests that LNG should serve as a substitute and not act as a baseload.

Furthermore, South Korea imports all of its gas as LNG. The fossil fuel is notorious for volatile commodity prices. For example, between October 2020 and January 2021, the Northeast Asian spot price increased from under USD 5/MMbtu to over USD 30/MMbtu.

South Korea’s Divided Public Opinion on Renewable Energy and Energy Transition

Koreans are still divided on renewable energy and the country’s energy mix despite over 86% of the population acknowledging climate change as a major threat to their country.

Not all support the green energy idea. In rural areas, many communities, do not want renewable energy projects close to villages or agricultural land. The growing conflicts between green energy companies and communities prompted policymakers to delay or even reject projects. Today, 123 of the 226 basic municipalities have regulations restricting land available for solar projects.

As a result, the disjointed public opinion means officials and corporations do not feel pressure to adopt a more ambitious strategy.

A Change in South Korea’s Energy Sources

While barriers remain in front of South Korea’s renewable energy transition, there is little doubt that it will happen. The question is how long it will take.

The target of reaching carbon neutrality by 2050 means there is much to do. To accelerate the transition to clean energy, South Korea would have to substantially increase the share of renewables in its total energy mix. This also means phasing out coal, rethinking grid operations and energy markets, design more competitive pricing models for renewables and foster the local hydrogen industry.

The clock is ticking. All eyes are now on South Korea to see whether one of the most advanced economies can move up the ranks of renewable energy adoption. Its current position does not suit the country’s image and potential at all.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more