The Role of Coal in Asia

29 November 2022 – by Viktor Tachev

Developing countries in Asia still heavily rely on coal. Transitioning away from coal power isn’t as straightforward as simply adding more renewable energy. It requires careful planning, international support and the adequate use of available funding. Most importantly, coal-dependent nations should ensure that the transition won’t leave coal workers behind but help them reskill or join other industries.

COP27’s Decisions on Coal

At COP26 Glasgow, countries agreed to phase coal out, and the decision was added to the final resolution of the climate conference.

At COP27 Egypt, the topic of fossil fuels was mostly taboo. While India tried to go further and proposed a commitment to phase down all fossil fuels, in the end, it failed. The final resolution mirrored the one from 2021. According to some experts, the agreement targets the phasing down of “unabated coal,” which opens the door to new fossil-based hydrogen and carbon capture and storage projects. Similar sentiments are also expressed about adding a paragraph targeting “low-emission” energy, which is a potential loophole, enabling a broad interpretation.

The IEA’s ‘Coal in Net-Zero Transitions’ Report

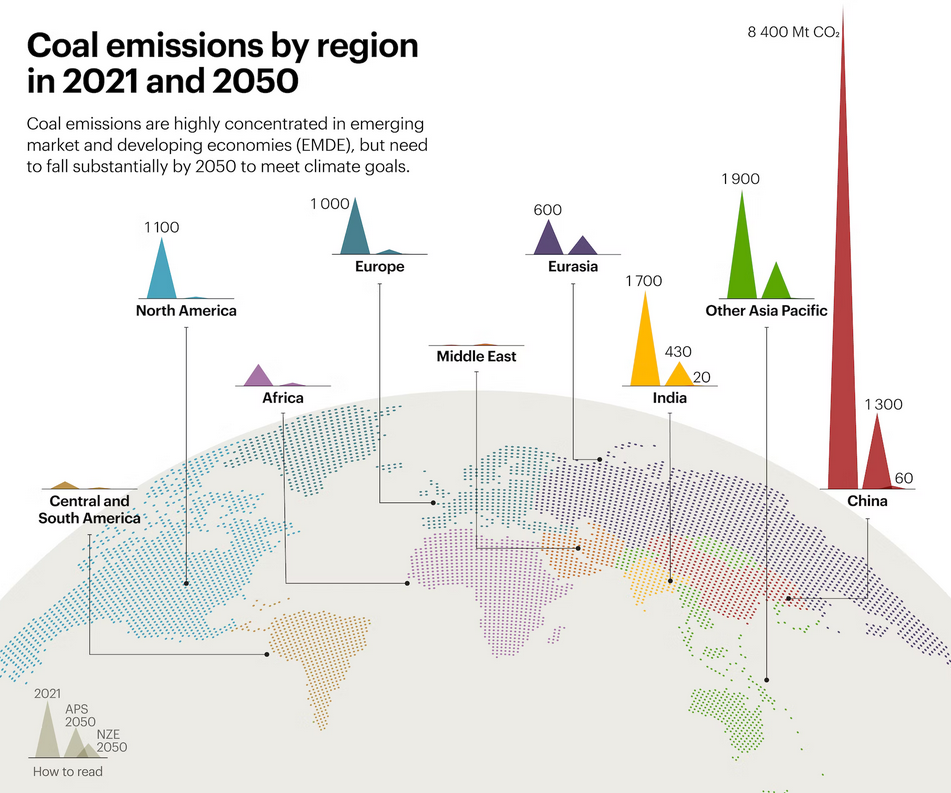

All this came despite the findings of the IEA’s Coal in Net-Zero Transitions report presented on Energy Day at COP27 2022. The analysis again highlighted the importance of the rapid and significant decline in coal-related emissions to avoid severe climate change impacts.

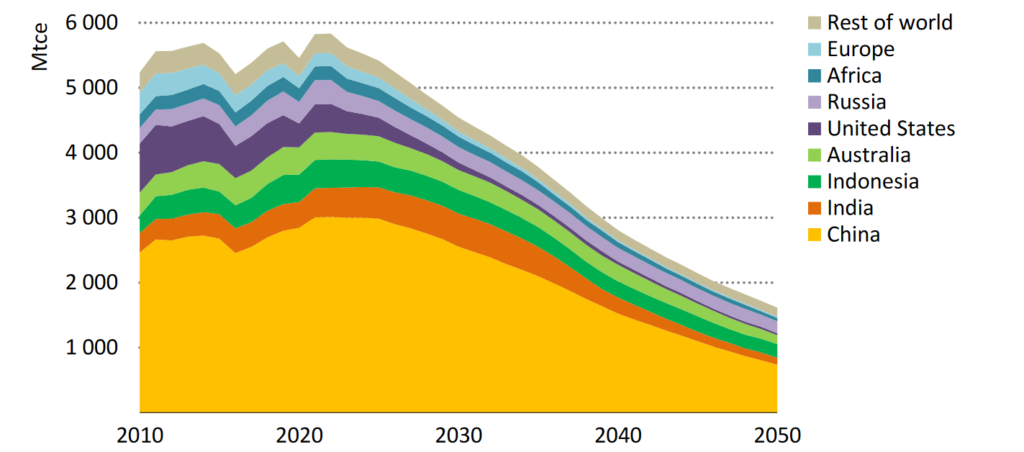

The failure to accelerate the decommissioning of coal power plants comes when coal consumption is at an all-time high. In 2021, emissions from coal generation rose 6.6% year-over-year, or over 100 million tonnes above the previous peak in 2018.

Furthermore, the IEA warns that coal demand is still growing. In fact, it has been hovering at near‐record highs for the past decade.

“Net zero pledges cover 95% of coal consumption, so coal phase-out is not a question of ‘if’, but “when” and ‘how’. The IEA says the world must stop burning coal for electricity by 2040 to put us on track for 1.5 degrees. That’s 18 years away, so the issue here is planning and urgency. For such a stretching target for so many emerging economies, a coal phase-out needs to be bold, and planning needs to start now.”

Dave Jones, Global Lead at Ember

Countries in Asia Are Still Highly Reliant on Coal to Meet Energy Demand

At the start of COP27 in Sharm El Sheikh, Egypt, Fatih Birol, executive director of the IEA, warned that without any action, emissions from existing coal projects alone will tip the world over the 1.5°C threshold. Alternatively, this means that coal use can singlehandedly seal a future of climate disasters.

Countries in South and Southeast Asia are among the most vulnerable to climate risks and are also the biggest coal consumers.

Coal is responsible for 63% of China’s power generation. The country accounts for more than 50% of the global coal demand. Its power sector alone is responsible for a third.

Coal accounts for 72% of India’s power generation. The country is the second biggest source of coal power emissions and also plans to increase coal-fired generation by 56 GW to 266 GW between 2029 and 2030.

Indonesia, alongside China and India, is in the top 3 of the biggest coal producers. In 2021, it was also the largest exporter by weight.

Vietnam gets half of its power from coal. The country’s PDP8 also targets additional coal power capacity by building new coal power plants.

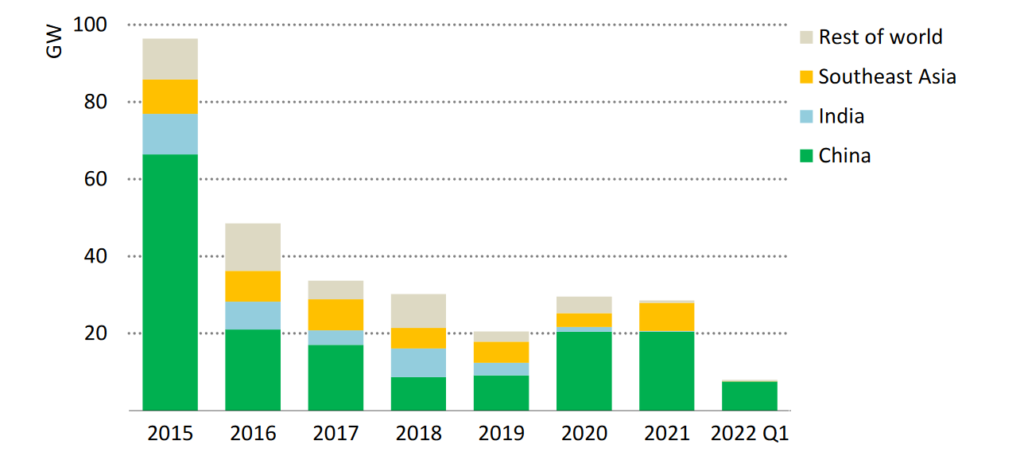

Over the past year, the number of new coal plant approvals was the highest in China, followed by Southeast Asian countries like Vietnam and Indonesia.

How Asian Countries Can Switch From Coal-Fired Power Generation to Renewables

The main challenge for phasing out coal is that while being the primary source of carbon emissions, it is also the single biggest source of electricity generation.

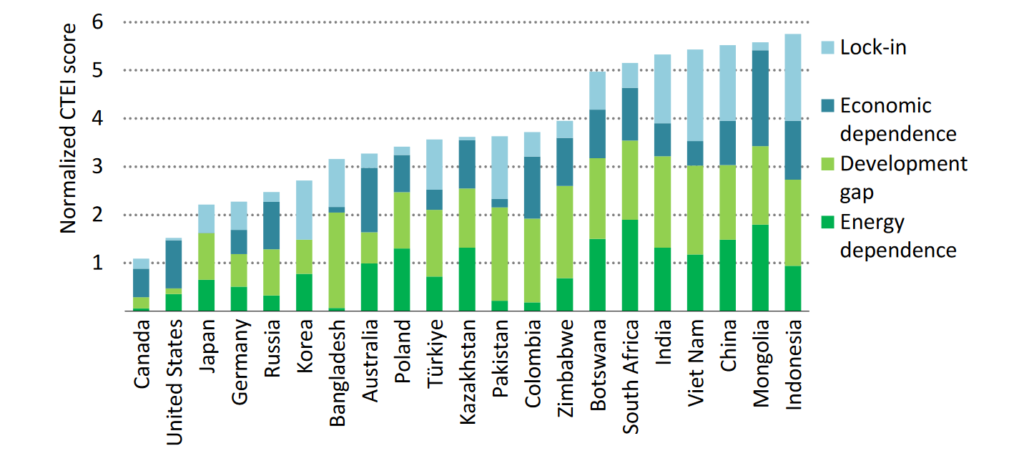

According to the IEA’s Coal Transitions Exposure Index, the five countries most dependent on coal are in Asia. The agency sees this as a reason for the transition to be more challenging.

While the oil and gas lobby has forced natural gas as a bridge to ease the coal transition, experts are clear – it is a bridge to nowhere. It can exacerbate the climate crisis and further highlight the problems of energy security, high power costs and unpredictable supplies.

Renewable energy technologies, on the other hand, offer a solution. And the switch has to happen quickly.

“Coal-fired power plants are on the decline, but not at the pace we need to save lives and win the battle against climate change. By scaling investment in clean energy, we can achieve a complete phase-out of coal plants in advanced economies by 2030 and the rest of the world by 2040.”

Michael R. Bloomberg, UN Secretary-General’s Special Envoy on Climate Ambition and Solutions and founder of Bloomberg LP and Bloomberg Philanthropies

Reducing Coal-Fired Power Plants Construction and Early Retirement of the Existing Fleet

In many developing Asian countries, the coal fleet is less than 15 years old. For example, the average coal plant in China is 13 years old. In Vietnam, the average age is 8 years old. On average, coal-fired units in Indonesia, Malaysia and the Philippines are 13 years old.

While the average life span of coal plants is around 40 years, the IEA finds that the global coal-fired fleet would emit 330 Gt of CO2 if operated at typical lifetimes and utilisation rates. This is more than the historical emissions of all coal plants to date.

As a result, Asian countries would need to decommission coal plants prematurely. The fact that over USD 1 trillion of capital is locked in today’s coal plants might make continuing their operation a tempting idea. However, the early retirement of the coal fleet is critical for achieving decarbonisation targets and ensuring more affordable power.

Wherever retirement isn’t feasible, coal plants can be repurposed to contribute to the clean energy transition, including renewable energy generation, battery power storage and more.

Countries would also need to stop building new coal plants, and many of them have already promised to do.

China, which has accounted for over 50% of the total new coal plants built since 1970 and more than 60% of the global total in the past decade, will start limiting coal consumption by 2025. The country plans to reduce it by 2030 to achieve net-zero by 2060.

India and Indonesia also aim to reduce new coal plant construction this decade.

Increased Clean Energy Investments

According to the IEA, by 2030, developing economies outside China require investments of up to USD 500 billion (Announced Pledges Scenario) and USD 1 trillion (Net Zero Emissions scenario) to transition securely away from unabated coal.

The agency considers the massive scaling up of clean energy, which is essential to limiting coal use and reducing emissions. Such a move will also help bring energy costs down.

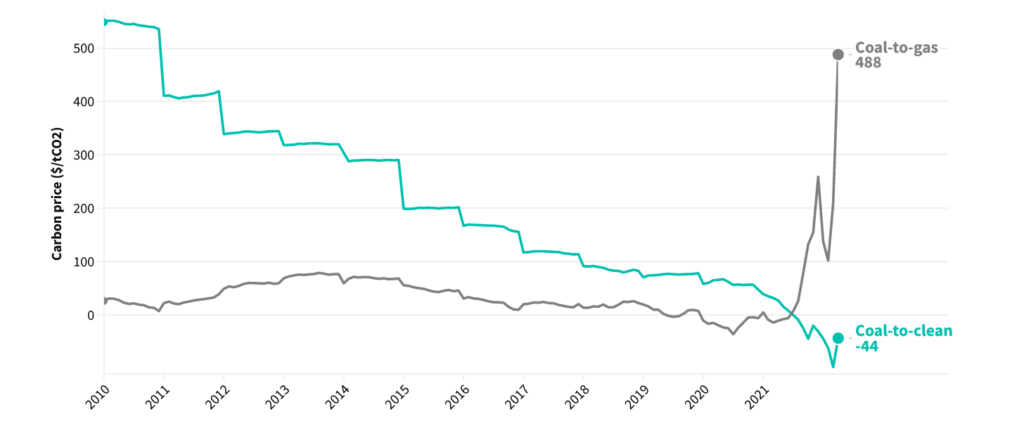

TransitionZero finds that switching from coal to clean energy is now cheaper than switching from coal to gas.

Furthermore, this transition won’t require raising electricity costs for consumers.

Furthermore, Bloomberg NEF finds that renewables are now the cheapest new power source for two-thirds of the global population. This reverses the narrative that coal is the cheapest fuel.

What’s more, these costs are projected to fall further for both developed and developing economies.

Protecting Coal Workers

The steps above are the backbone of the transition. On top of them, Asian countries must pursue a fair and just people-centred transition. As the IEA notes, those employed in the fossil fuel industry must be protected and eased through reskilling or switching to new sectors like mineral mining.

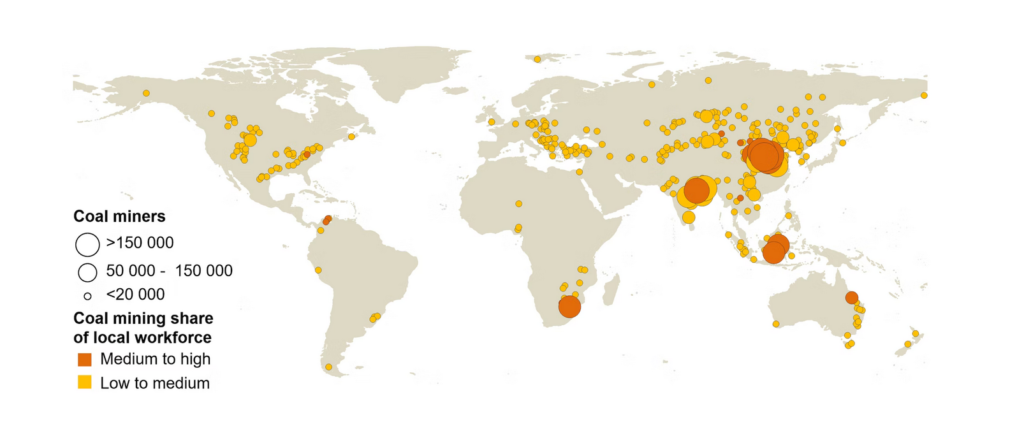

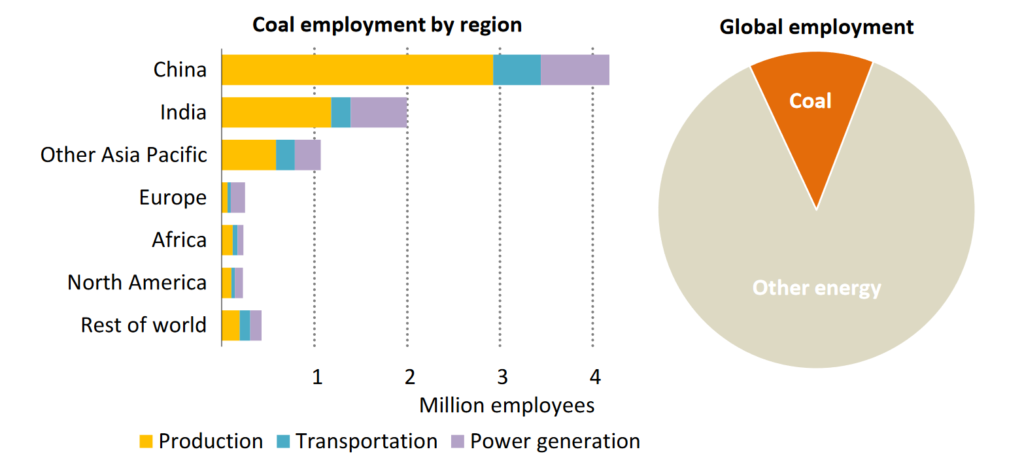

Currently, over 8.4 million people work in the coal industry. The share of coal miners in the workforce is the highest in Asia.

China, India and Indonesia account for 80% of all coal supply jobs in Asia.

However, the IEA notes that just five of the 21 most coal-dependent countries have announced or implemented comprehensive transition policies.

Asian countries must help protect the employed in their coal sectors when the inevitable clean energy transition happens. Just Energy Transition Partnerships can ease this mission.

Taking Advantage of Innovative Financing Models and Support Programs

Through an initial funding of USD 8.5 billion, South Africa’s Just Energy Transition Partnership (JETP) will help reduce its massive coal fleet. The country is expected to retire some of its 15 plants. Furthermore, the aid from the US and leading European economies will enable the country to improve its electricity grid, build more renewable energy capacity and support approximately 80,000 local coal workers with job training and additional services.

Some of the most coal-dependent Asian countries, including India, Indonesia and Vietnam, are also working on JETP deals.

The Indonesian JETP, aiming to go live by the end of 2022, is almost twice the size of South Africa’s deal. The Vietnam JETP, which also expects an announcement in December, will include a package of at least USD 11 billion.

Although not totally perfect, JETPs are considered one of the most promising outcomes of COP summits. Such innovative financial mechanisms can open the door for faster energy transitions for developing countries. The IEA sees JETPs as an effective way to package together different aspects of the coal transition. They can also help gain momentum in mobilising international support.

Furthermore, the proper design of these deals can ensure that public money facilitates much more significant amounts of private investment. This will unlock enough capital in both public grants and loans to empower a rapid, equitable energy transition.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more