Oil and Gas Sector: The Prospects of a Transition Fuel

Source: UpStream

08 December 2021 – by Eric Koons

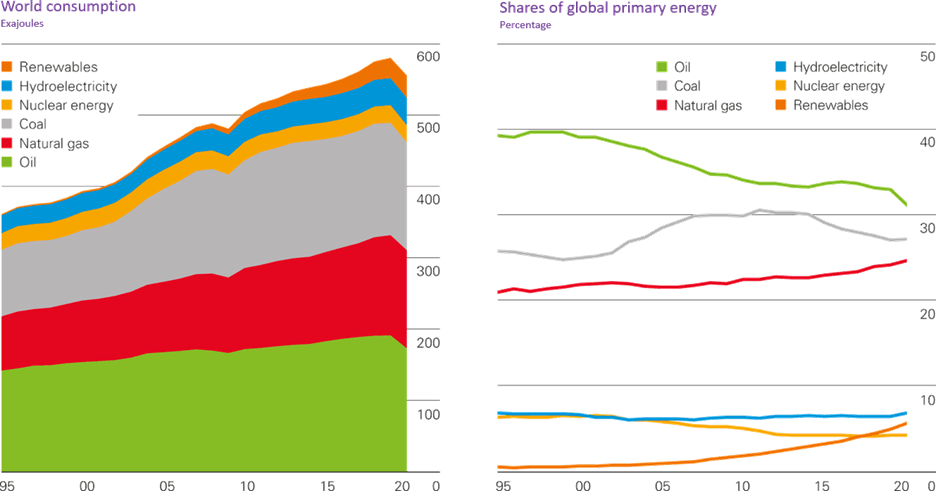

We are living through the midst of an energy transition, and much focus is on the oil and gas sector. The reliance on fossil fuels is quickly dissipating in contrast to investments soaring in renewable energy in the global economy. Companies in the oil and gas sector see the tectonic shift. Now some want to align themselves with a renewable energy future.

Leading the charge is Malaysia’s oil giant Petronas. Beginning in 2013, Petronas has been investing in the solar PV industry. Today, over 1 GW of solar arrays are under its umbrella. While most of the companies’ interests are in fossil fuels, the mood for change is growing to decrease their dependence on fossil fuel.

Moves like Petronas’ are seen as good investment decisions. They ensure that energy companies can capitalise on the soon-to-be skyrocketing demand for renewable energy and long-term prosperity. But many other oil and gas companies are lagging.

Asia’s Attachment to the Oil and Gas Sector

For some continents, the transition is easier said than done. Asia’s attachments to the gas industry and oil industry fall largely on its existing infrastructure. The physical characteristics of crude oil play a role, too – the energy-dense fossil fuel is meeting the needs of a rapidly growing Asia. Advancing technology, like those seen in vacuum gas oil, makes the transition away from oil harder.

Renewable energy, on the other hand, has high startup costs. Added pressure comes from investors to deliver returns year after year, like the oil and gas sector. Investments in renewables will likely cut into short-term gains.

Overall, the oil and gas producers are reluctant to invest in the transition, despite the momentum seen in renewable energy. However, the hesitation instead focuses on renewables being unable to compensate for oil and gas – so far.

How can Oil and Gas Companies Adapt to the Changing Landscape?

The transition to renewables won’t happen overnight, and it won’t happen on its own. There will need to be a concerted effort across energy production, including financiers and consumers.

As part of COP26 in Glasgow, many financial institutions made commitments to stop funding fossil fuel projects. They are collectively adding to the list of financiers that have already done so. Governments also need to invoke concrete legislation to curb carbon emissions – more so than the non-binding commitments made at COP26.

Is Natural Gas a Viable Transition Fuel?

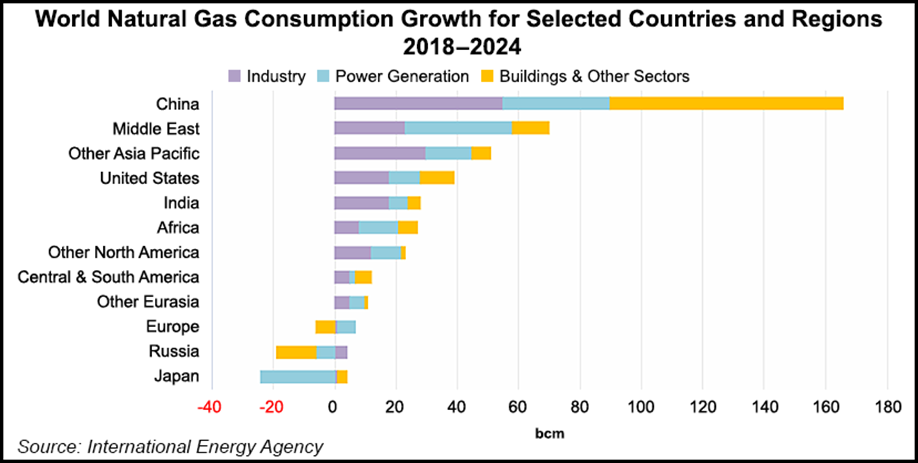

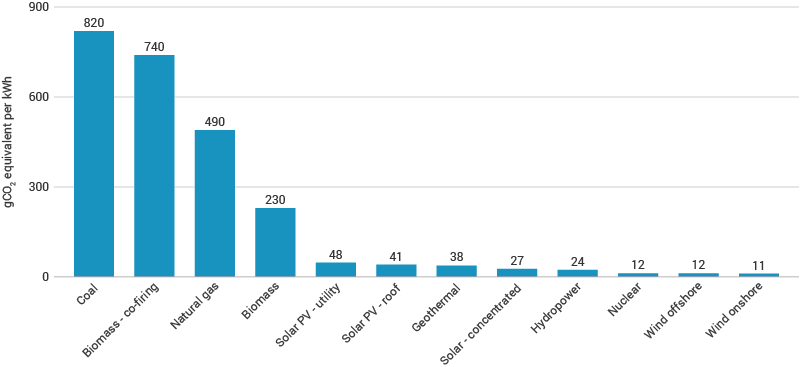

Many pundits suggest that natural gas will be a transition fuel while the world moves from fossil fuels to renewable energy. Natural gas is favoured simply because it is less carbon emissions-intensive than coal or oil. With this, Asia’s natural gas production has increased dramatically to meet the continents surging energy demand. Nevertheless, natural gas remains a carbon-emitting fossil fuel, despite its preferred status above coal or oil.

In equal measure, there is no shortage of experts and commentators advocating that natural gas is nothing but a short-term fix. Reliance on natural gas will, they argue, ultimately be a loss for the environment and climate change.

Major Asian Financiers’ Roles

Major Asian lenders play a prominent role in the transition to renewable energy. The Asian Development Bank (ADB) and the Asian Infrastructure Investment Bank (AIIB) both have significant stakes in the energy outlook for the continent. Already, ADB is pulling out of extraction related projects in coal and oil – their policy does announce for natural gas financing to continue, however. Similarly, AIIB has taken the same stance as ADB but stresses that natural gas is only a short-term bridge fuel.

Both banks are now committing collectively USD 150 billion – ADB with 100 and AIIB with 50 billion – in climate-related financing. This is an enormous leap from USD 5 billion annually reserved for ADB energy projects in the past.

The Oil and Gas Industry is a Key Player

As major Asian banks are moving towards renewable energy, there is even more reason for the oil and gas industry to capitalise on this momentum. Funding is guiding the future of energy development, and not transitioning towards renewables is akin to missing out on significant investments. Commitment from the oil and gas sector to renewables, much like Petronas, will aid in the transition to renewable energies that are already well underway.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more