US Tariffs on Southeast Asia: What They Mean for Global Trade

15 May 2025 – by Viktor Tachev

After the assault on domestic and global climate and environmental action, US President Donald Trump’s administration is now in the game of imposing economic tariffs on trade partners and adversaries alike. While developed countries such as the UK, Canada and EU members were among the first to be slapped with tariffs, they also have the resources and flexibility to weather the storm.

Southeast Asia, on the other hand, finds itself in a precarious situation, with its solar panel manufacturing industry the main target of the unfolding economic war. Still, Trump’s move, intended to boost the US economy and stimulate cooperation, can backfire. And in the process, it might push the region, including some of its strongest partners, into the welcoming arms of China and the EU. For Southeast Asian nations, the US tariffs might very well prove a blessing in disguise.

The Trump Administration Slaps Southeast Asia’s Solar Panel Manufacturing Industry With Record Tariffs

Solar power-producing companies from Cambodia, Thailand, Malaysia and Vietnam are the latest victims of President Trump’s tariff policy. As a result, 29 companies from the Southeast Asian countries are now subject to tariffs. The move comes after an accusation by American solar panel manufacturers that Chinese companies were flooding the US market with cheap and subsidised goods.

Imports from Cambodia would face up to a combined 3,521% since its companies didn’t cooperate with the ongoing investigation, while those from Thailand would be subject to up to a total of 972% in duties. Solar panels produced in Malaysia would face import duties of between 15% and 205%, depending on the company. For example, the tariffs on Jinko Solar’s production, the world’s biggest manufacturer, are over 40%. Vietnamese producers are facing a total of 814% in tariffs.

The Solar Energy Industries Association, the American national nonprofit trade association of the solar energy industry, criticised the move as counterproductive, warning that imposing the tariffs would hurt US solar producers, since they would cause a price spike on imported cells assembled at American factories.

Although Southeast Asia’s industry expected the measure, experts see it pricing some companies out of the US market and significantly disrupting the sector.

If confirmed by the US International Trade Commission, the tariff will come into effect on June 9.

What Motivated the Tariffs?

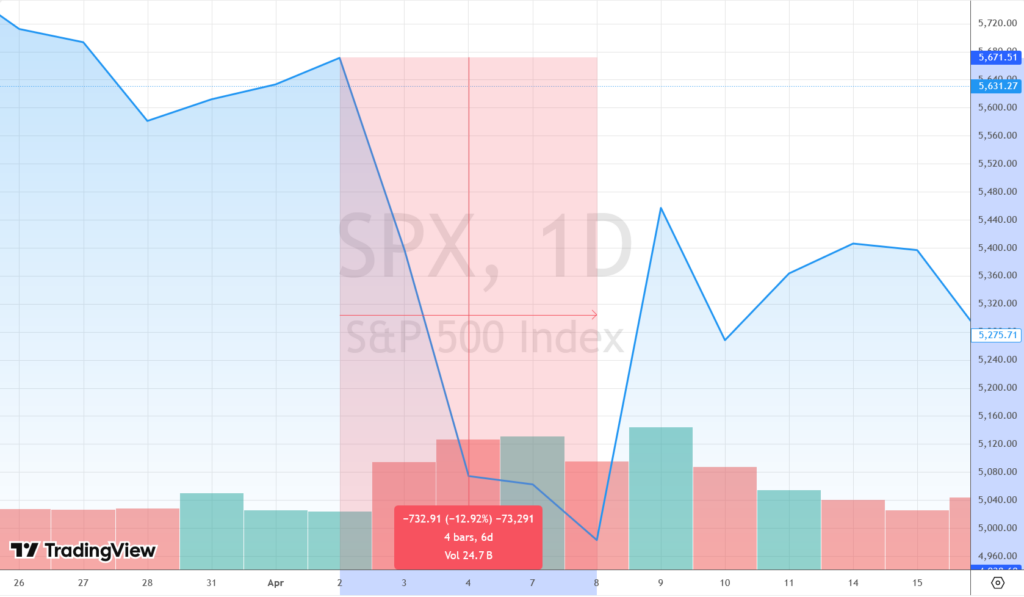

In theory, the economic reasoning suggests that tariffs originated from President Trump’s aggressive protectionist policy and efforts to strengthen the domestic economy. However, in practice, things are different. His second term became the first in history during which markets saw dramatic losses. While Trump inherited a bull market, his actions led to a nearly 18% drop in the S&P 500. In total, his tariffs erased USD 5.4 trillion of value from equity markets.

In fact, the market freefall ended on April 8, which coincided with the date that he announced a pause to the tariffs regime. Between the day of the US tariffs announcement and the day they were paused, the S&P 500 lost nearly 13%.

According to JP Morgan, there is a 60% chance the US will enter a recession by the end of the year, while researchers have found that the policies are likely to reduce economic growth and personal incomes rather than anything else. Economists also think that the move could backfire on the US economy by fueling inflation and retaliatory tariffs, making imported goods more expensive. In fact, Trump himself also said a recession might be a possibility, although reports reveal he wasn’t too fazed about it.

At the time of writing, there is no certainty if the tariffs will actually be imposed, whether the initially announced rates will be retained, and for how long. According to The New York Times, Trump himself selected the “formula” for calculating the tariffs for every country, which eventually made Cambodia and Thailand some of the top economic threats to the US. Furthermore, he put tariffs even on Australia, a critical security ally that has a trade surplus with the United States and on uninhabited islands near Antarctica, raising concerns from the Australian government.

Furthermore, while Trump’s tariff policy would hit solar panel producers in Southeast Asia the hardest, it would also negatively impact American companies from other industries that have been operating in the region for decades. One such example is the apparel sector, particularly leading shoemakers like Nike, which have outsourced their manufacturing processes across Southeast Asia. Some US brands have already announced that they would transfer the tariffs’ impact to US consumers, making the prices of imported US goods significantly higher. US consumers and companies now face roughly 28% tariffs on imports overall — a stark difference from the 2% average during former President Joe Biden’s administration.

So, if not economic, what are the reasons for the aggressive tariffs on Southeast Asia?

According to some experts, the goal was to pressure these developing countries to seriously reconsider their close economic ties with China. Others struggle to see any real plan behind it and consider Trump’s actions “chaos”. While this is highly probable, there might be another underlying reason.

Since his first term, President Trump, an outspoken critic of efforts to tame climate change and the clean energy transition, has followed a consistent policy, including quitting the Paris Agreement twice, scaling up fossil fuel production, assaulting environmental protection laws, permitting drilling on public lands, working to undermine global climate dialogue and action and more. In that sense, those ending up on the wrong side of his actions will likely have a crucial role in the global clean energy transition and decarbonisation progress. Southeast Asia and its booming solar power industry are no exception.

The United States Tariffs As a Major Hit on Southeast Asia’s Solar Panel Manufacturing Industry, But Also a Potential Blessing in Disguise

The move will have a major impact on Southeast Asia since the US is a key export market, with around 80% of its solar panel deliveries coming from Malaysia, Thailand, Vietnam and Cambodia.

Chinese solar panel manufacturers have started closing plants in Malaysia and moving production to the US in anticipation of the tariffs. While bigger and more flexible firms can adapt, smaller producers with less capital are likely to suffer the biggest consequences. As a result, thousands of workers employed in the industry could find themselves at risk of losing their jobs.

If tariffs are enforced next month, Southeast Asian solar power manufacturers must seek alternative markets, which might prove a challenging task considering the global oversupply and China’s dominance.

Still, experts believe Southeast Asia has a way out, mainly through capitalising on the demand from emerging markets.

“US tariffs should not become a distraction from the opportunity the global energy transition represents for Southeast Asia. The US represents a mere 7% of the global market for newly installed solar power plants. Emerging and developing economies will account for 70% of solar PV, 60% of wind, and 60% of battery storage market share by 2030, according to the International Energy Agency’s World Energy Outlook,“ explains Lauri Myllyvirta from the Centre for Research on Energy and Clean Air.

Eco-Business reports that neighbouring nations are already stepping in to fill the gap. For example, Indonesia’s imports of solar panels from Laos between January 2024 and January 2025 have reportedly increased by nearly 4,800%.

Ben McCarron, managing director of Asia Research & Engagement, sees another potential positive. “Overall, the tariffs and trade war are likely to accelerate the energy transition in Southeast Asia in our view.”

Christina Ng from the Energy Shift Institute sees the situation also as a way for Southeast Asia to reposition itself on the global stage.

“This is a chance for SEA to move up the value chain — from being seen as mainly low-cost assemblers to becoming leaders in designing and building more advanced clean energy technologies. That means investing in research and development, high-value components and developing complete clean energy systems.”

Furthermore, Southeast Asian nations increasingly recognise the importance of decoupling their economies from fossil fuel import reliance to strengthen energy security, lower power prices and speed up their decarbonisation progress. This, paired with promoting more ambitious clean energy deployment targets, can safeguard the local solar panel manufacturing industry by harnessing domestic demand. It could also safeguard the thousands of job positions in the sector currently at risk due to Trump’s tariffs and provide a solution for potentially displaced workers across the entire value chain with minimal need for reskilling.

The Solutions to Help Overcome the Short-term Instabilities and Capitalise on the Long-term Opportunities of the US Tariffs

To try to appeal to Trump, lower trade imbalances and delay or reduce tariff rates, various developed and developing Asian nations are exploring ways to meet Trump’s demands, including through investments in US gas infrastructure or LNG shipments. However, Asian countries now have a clear indication that, under Trump, Washington is not a trustworthy partner. And experts warn that buying US LNG will not only fail to offset trade concerns but also deepen existing problems.

“Signing long-term commitments to buy US LNG would be a costly mistake. US LNG prices are already uncompetitive with other energy sources and are growing more expensive by the day,” explains Sam Reynolds, research lead for the IEEFA.

“Instead of bowing to Trump’s bullying, Asian countries should listen to their communities, who have seen firsthand the damage caused by increased LNG import dependency enabled by Japan’s public financing for overseas LNG and long-term fossil gas contracts. LNG hasn’t delivered energy security or affordability; instead, it has caused blackouts, rising debt, and devastating climate and health impacts,” said Laurie van der Burg, global public finance campaign manager at Oil Change International.

Experts see the solution to alleviating the economic impacts of the tariffs in scaling up renewable energy deployment and accelerating regional cooperation. Solar and wind technology, as well as battery storage costs, continue to drop. As a result, today, renewables are the lowest-cost solution for every Southeast Asian country, particularly where utilities are trying to meet new, incremental demand.

“Rather than locking in expensive, long-term deals for US LNG, Southeast Asian countries can seize renewable energy opportunities by diversifying energy mixes and maximising the deployment of clean technologies like wind and solar. Not only would this help support domestic renewable manufacturing industries, but it would also present a hedge against volatile commodity prices and currency exchange rates,” Reynolds explains.

Increased Focus on Regional and International Cooperation

A key priority for companies across Southeast Asia’s solar panel manufacturing value chain is to seek alternative export markets in the short term. Diversifying exports is also integral to minimise concentration risk.

“Southeast Asia has an opportunity to reorient toward emerging markets, such as Africa, the Middle East and South America, as well as other advanced markets, where clean energy demand is booming and trade barriers are fewer,” explains Ng.

According to Caroline Wang, China analyst at Climate Energy Finance, redirecting some exports to the EU and India can also be an option, although with limited scale. Instead, the expert sees more room for growth in the regional market.

“Prioritising the deepening of regional supply chain integration in the medium-long term (e.g. Indonesian nickel processing, Malaysian solar wafers) could build ASEAN countries’ economic resilience and increase their global competitiveness in the clean tech sector,” she adds.

Boosting regional cooperation would prove crucial to safeguarding the industry, accelerating the renewable energy transition and ensuring cleaner, more secure and affordable power to fuel economic growth and meet the needs of the growing population.

“The region can also stabilise its clean tech sector by urgently building its domestic deployment. Countries such as Indonesia, Vietnam and the Philippines have massive untapped solar and wind capacity, which could become a buffer against export volatility,” Ng says.

In fact, regional cooperation is already gathering pace. After the tariffs were announced, Malaysia, the chair of this year’s ASEAN Summit, kick-started consultations with Indonesia, the Philippines, Brunei and Singapore to exchange views and explore the best solutions.

Developing Local Renewable Energy Markets

“A strong manufacturing base requires vibrant home markets for clean technology as a basis for developing the industry in a stable and sustainable way,” explained Myllyvirta. However, according to the expert, the region is underinvesting in the industry. As a result, its potential largely remains untapped.

“Asia leads the world in renewables growth, yet over 99% of solar and wind potential in Southeast Asia remains untapped,” says Van der Burg.

This opens up huge opportunities for the sector. According to the IEEFA, since technology represents a one-time, upfront investment with no ongoing USD-denominated fuel costs, developing Asia should prioritise maximising domestic energy supply from low-cost renewable energy.

“Developing a strong home market is also what China did 10 years ago when the European market for solar panels slumped — the country sped up domestic deployment to absorb the supply, laying the foundation for its world-leading solar industry,” notes Myllyvirta.

Experts believe investments could start flowing toward Southeast Asia, enabling access to some of the cheapest solar power technology available.

“Investors who once had their sights set on the US may begin redirecting capital toward emerging markets. And with Chinese solar PV already oversupplied and flooding global markets, the Global South can absorb some of the cheapest solar technology available. We witnessed a similar scenario already, ultimately leading to Pakistan importing 16 GW of panels in FY 2024,” explains Muhammad Basit Ghauri, manager of the Special Initiatives & China Program at Renewables First.

Warming Up to China and Drawing Inspiration From Its Clean Energy Market Expertise

The Council on Foreign Relations (CFR) reports that ASEAN opinion leaders increasingly align with China. The former is trying to seize the moment, with President Xi Jinping embarking on a tour of Southeast Asia to sign economic cooperation agreements. The CFR notes that Beijing is now promoting itself in the region as the only stable economic power left, and ramping up aid and foreign investment to shore up the vacuum left by the US.

“Now China will supercharge efforts in Southeast Asia markets, which it sees as critical and well-aligned destinations for its green technologies,” explains Ben McCarron, managing director at Asia Research & Engagement.

“China will be powerfully incentivised to ensure policy and implementation plans enable fast adoption of green energy across the region, in support of its exporters. The green products will likely be at competitive price points, offering a compelling proposition.”

Southeast Asia can also draw inspiration from China and its remarkable progress in deploying solar power. In 2024, for example, the nation installed farms at a rate of 759 MW per day, the IEEFA notes. In fact, the solar power industry contributed over 10% to the country’s GDP growth.

Trump’s Tariffs Might Backfire on the US But Bring APAC and Europe Closer

The bottom line of Trump’s move could be increased multilateralism and cooperation between Southeast Asia and Europe, South Korea, Japan and Australia. Furthermore, it also disengages the region from the US, pushing it into the welcoming arms of China, which is increasingly shaping itself as the world’s new economic and climate leader. In that sense, the tariffs could prove a blessing in disguise for Southeast Asia.

“If the region takes this moment seriously and diversifies, it won’t just weather the disruption; it will emerge more resilient and competitive,” says Ng.

“The region would become central to the global clean energy transition.”

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more