What Decreasing Renewable Energy Costs in Vietnam Mean for Investors?

17 May 2021 – by Viktor Tachev

The transition to renewable energy in Vietnam is at an inflection point. The country that had long been reliant on fossil fuels is now embracing an ambitious journey towards a carbon-neutral future in not only their industry and trade, but national power development. While challenges remain (read more here), some of the main obstacles like the high costs of renewable energy, are now in the past. Over the last years, the costs of wind and solar power in Vietnam have been progressively decreasing. Today, they reached a point where they are becoming cheaper than coal- and gas-fired power generation. And the trend is just starting.

The Trend of Continuously Decreasing Renewable Energy Costs in Vietnam

For just five years, Vietnam made the jump from an emerging PV market to one of the top 10 countries with the biggest installed solar energy capacity.

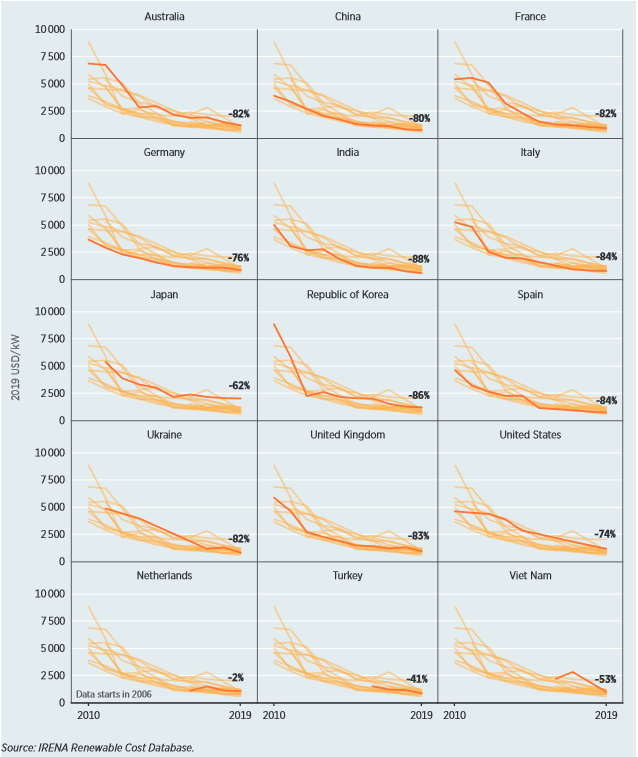

A significant enabler for this remarkable energy development transition is the continuous decrease in the costs of electricity generated by PV. For the period 2016 – 2019, it has fallen over 55%. The trend is similar when it comes to wind power generation, where the drop is 38%. For the same period, the coal power development saw a 6% increase in cost.

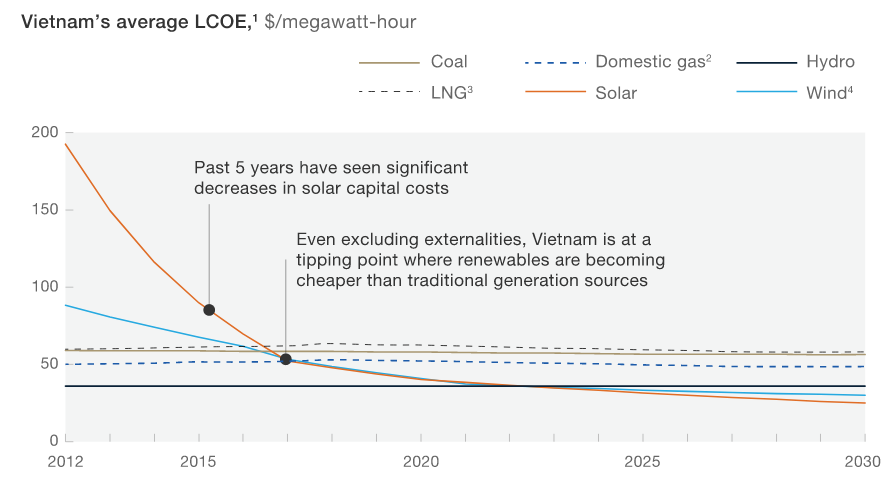

McKinsey reports that renewables are now the cheapest form of new power generation in Vietnam on an LCOE basis. This change is attributed to the country’s natural endowments and the significant reduction in the capital costs of solar and wind (75% and 30% decrease respectively, between 2014 and 2019).

The consultancy estimates that the increased rate of innovation in design and manufacturing of renewables in energy projects continues to bring down their cost by 10% per year.

The decreasing costs of renewable energy in Vietnam are likely to slow down as the market matures. Yet, the gap between renewables and fossil fuels in terms of cost efficiency in Vietnam and globally will continue to increase.

Comparison with Other Countries in wind & solar power

The dramatic decrease in renewable energy costs in Vietnam is a reflection of the global trend.

Today, in terms of renewable energy projects’ cost-efficiency, Vietnam can rival leading markets.

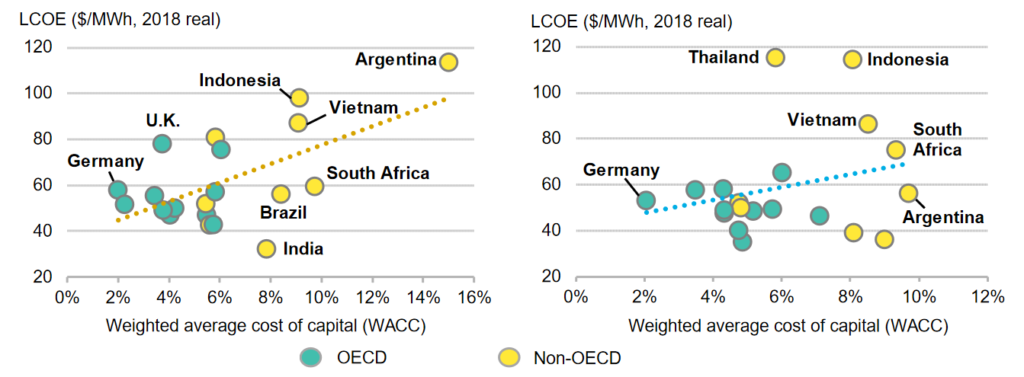

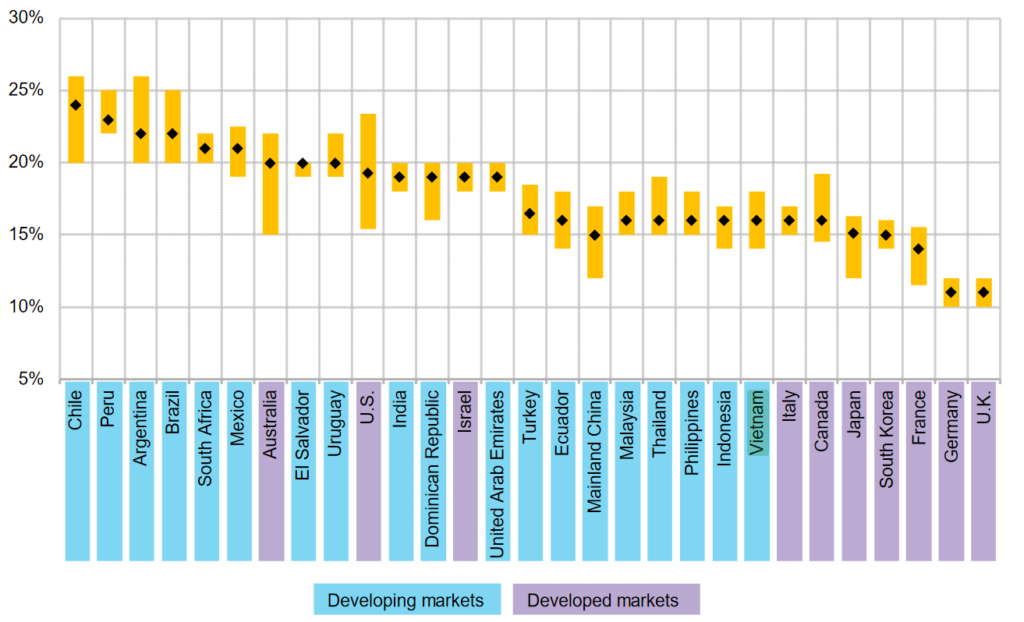

According to Bloomberg NEF’s latest report, the country is right there with the best non-OECD markets regarding the weighted average cost of capital (WACC) for renewable energy development projects. Developers and investors in clean energy in Vietnam can access some of the most optimal rates among emerging market economies for financing solar PV and onshore wind projects.

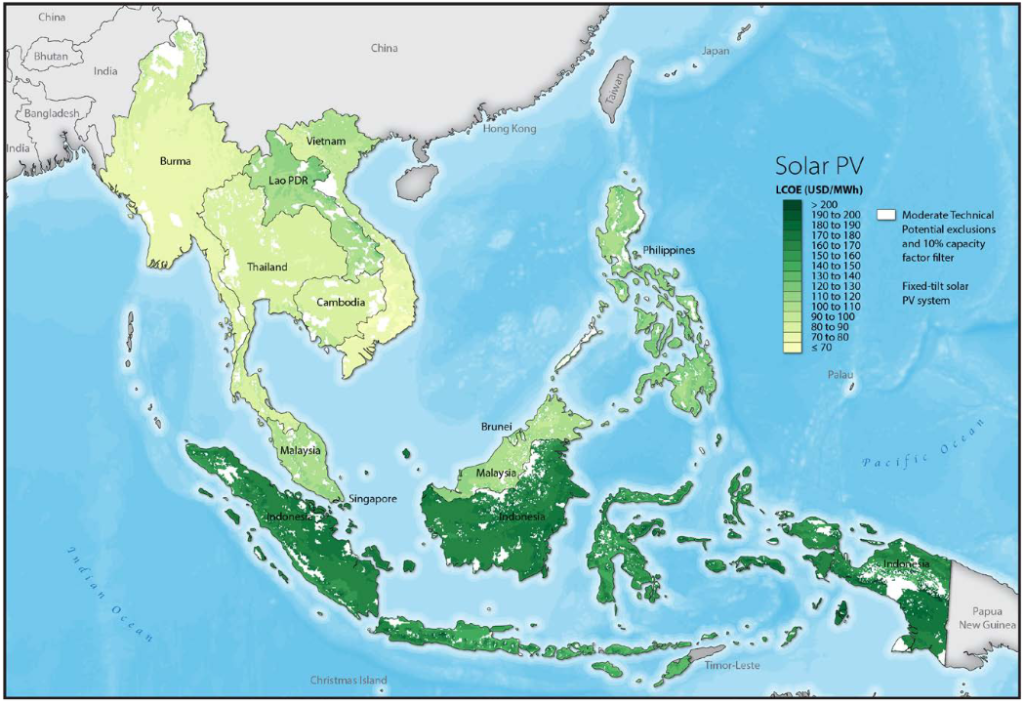

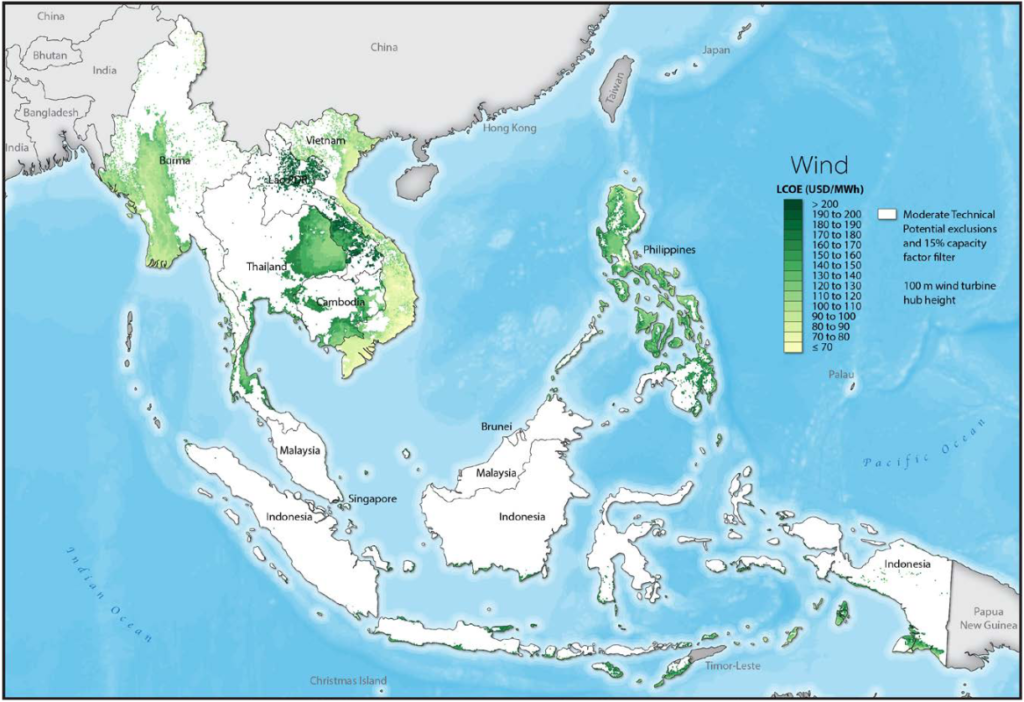

On a regional scale, Vietnam offers some of the most competitive LCOEs for solar PV and wind energy.

The report, based on estimations by the Renewable Energy Mapping Tool concludes the lowest LCOEs in the Southeast Asia region are in Vietnam.

Vietnam also outranks many developed markets when it comes to solar PV capacity factors. However, it remains behind other countries from the Southeast and East Asian region, including Thailand, Indonesia, and Malaysia.

What Does the Decreasing Renewable Energy Costs in Vietnam Mean for Investors?

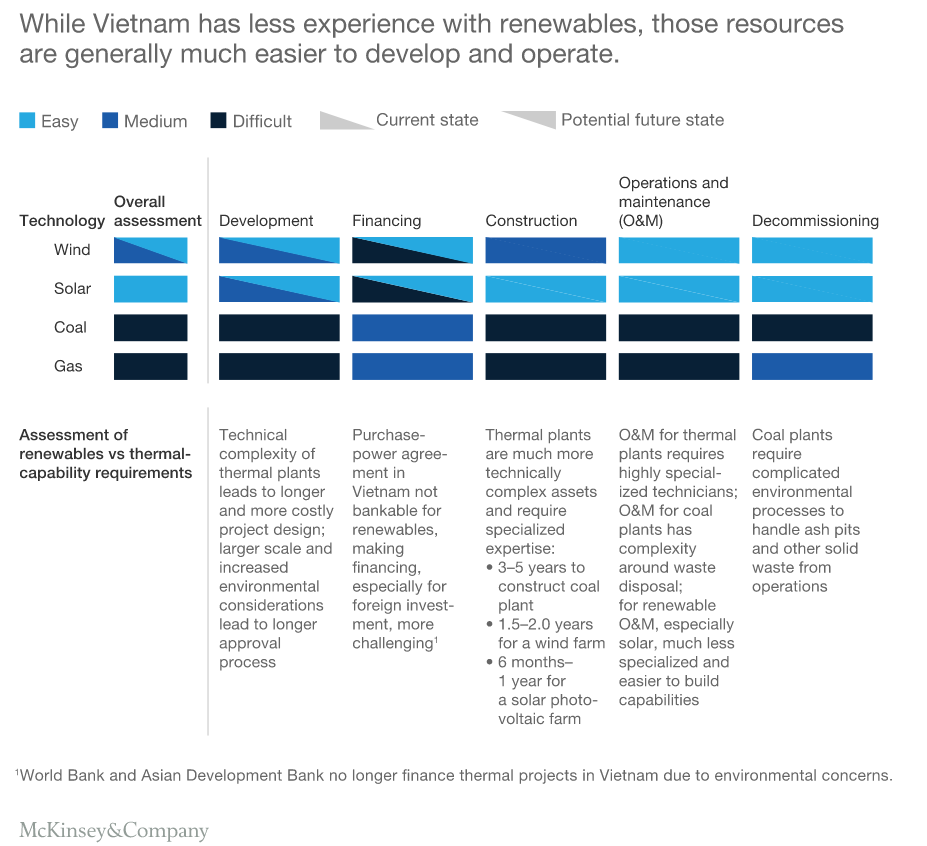

According to McKinsey, investing in renewables in Vietnam is a lower-risk opportunity for investors when compared to traditional sources. The reasons are that clean energy power projects can be developed more quickly and also located more flexibly to meet Vietnam’s expected energy demand growth. Furthermore, investors enjoy a much lower cost of capital due to low operating costs.

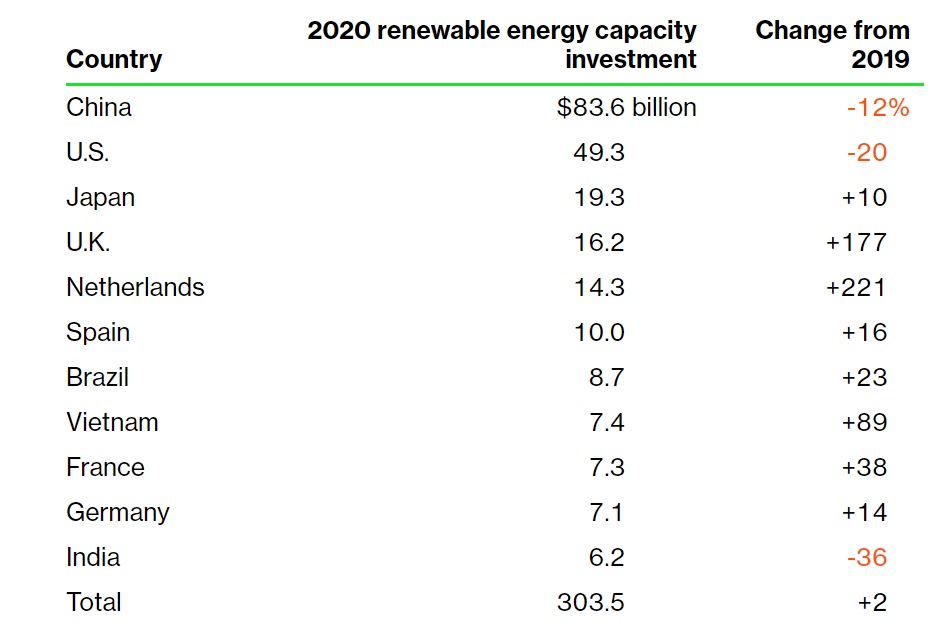

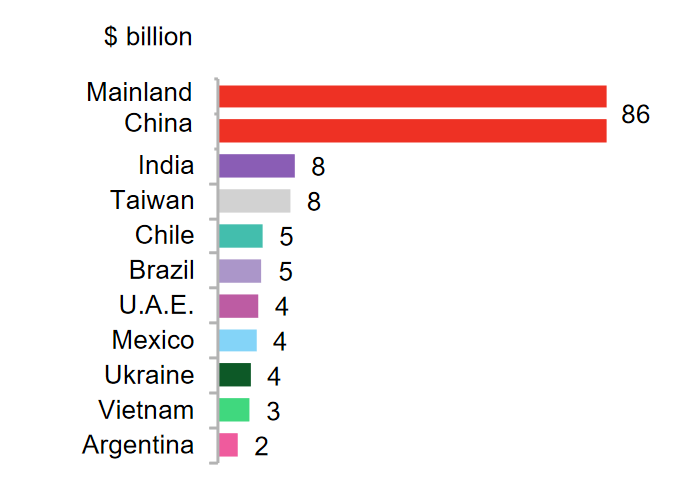

This has helped Vietnam break the status quo and join the elite company of the countries attracting the biggest amount of clean energy investments.

On the back of its renewable energy policies, in the last couple of years, Vietnam managed to garner increased financing in renewables projects, paving the way for further expansion.

The local authorities realize the importance of attracting new investors in renewables projects and are looking to further improve the business environment. While many other countries stick to feed in tariffs (FiTs), Vietnam is looking at more competitive market mechanisms such as renewables auction schemes. As a result, a nationwide solar auction for the direct sale of electricity to EVN will kick off in June 2021. A wind auction system will replace the FiT after 2023.

Investors can also benefit from the fact that Vietnam is a sizable solar panels manufacturer. The country also has a well-developed and reliable power grid. Furthermore, building and operating renewables is easier than thermal assets and contributes to a more diversified local job creation. McKinsey projects that renewable energy investments can create an additional 465,000 jobs through to 2030.

While curtailment risk still remains, market experts project that it can be avoided with the proper measures.

To conclude

Experts suggest that Vietnam’s ambitious plans for renewable energy transition will require significant investments. Fortunately, the local authorities are willing to please foreign investors and project developers willing to join the country’s clean energy transition.

Renewable energy offers the pathway to meet Vietnam’s projected power needs at the lowest cost, least risk, and the best capital formation opportunities. While building a cheaper and cleaner energy future won’t happen overnight, it will surely make the country an attractive market for renewable energy project developers and financiers. In fact, Vietnam’s renewable energy success stories are already proving that the country is on the right path.

With that said, everything needed is on the table. The question is will investors make the most out of it?

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more