Wind Energy in South Korea – Opportunities and Challenges

04 April 2024 – by Viktor Tachev Comments (0)

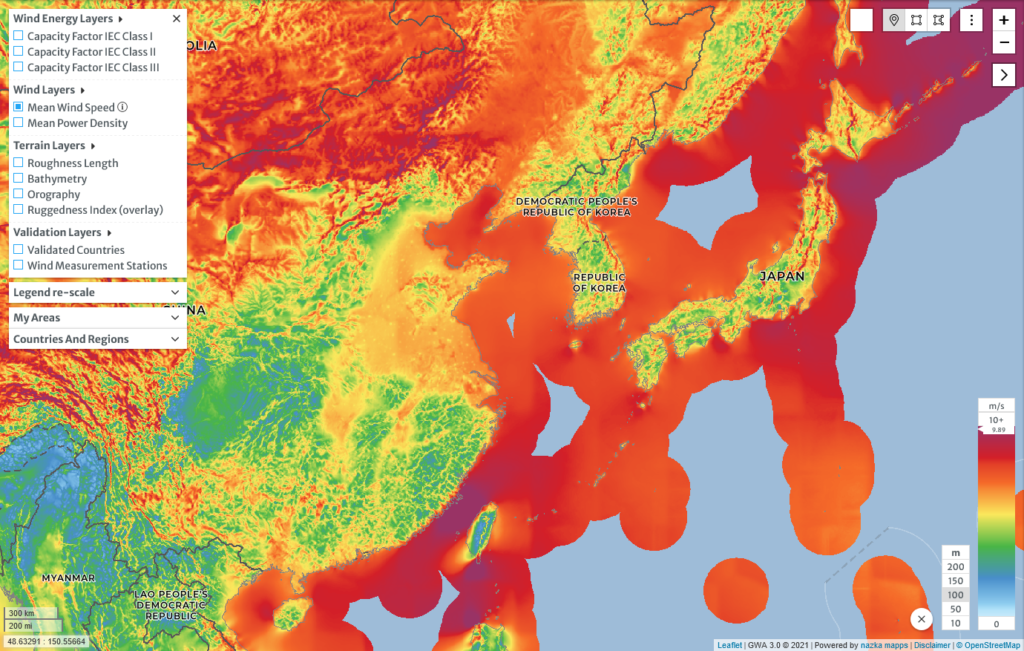

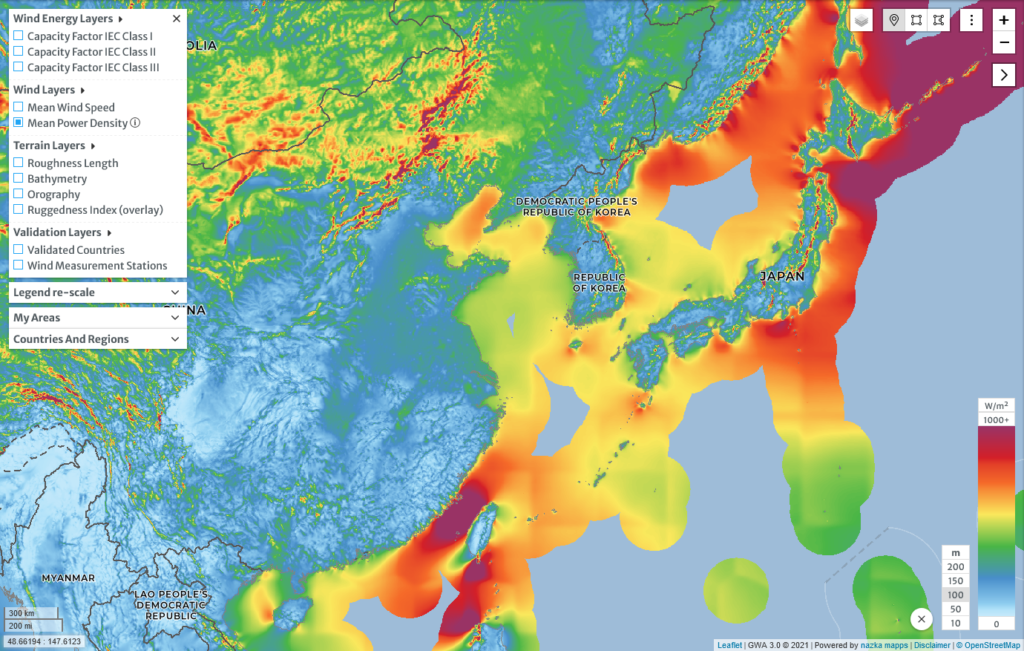

While South Korea has long been stalling on its renewable energy transition and remains far behind other developed countries, things are starting to change. A major enabler for the steady growth of clean energy in the country is wind energy. With a climate and topography perfectly suited for large-scale onshore wind power generation, the government is now looking towards the untapped potential of offshore wind. However, before South Korean wind energy presents meaningful results, there is work to do.

The Renewable Energy Profile of South Korea

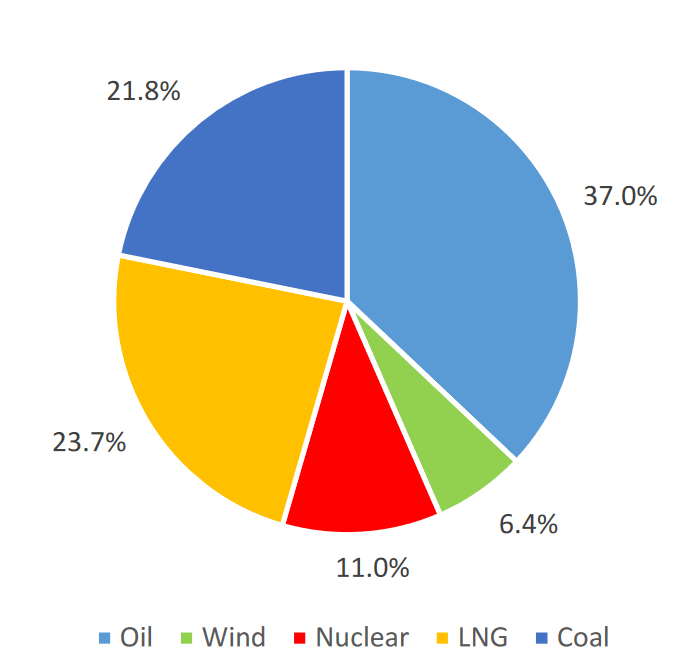

Currently, fossil fuels dominate the energy mix of the country. The leading source is oil (37%), followed by coal (21.8%) and LNG (23.7%). Nuclear power accounts for 11%, while renewables are responsible for just 6.4% of the generated energy.

Only 3.8% (21 TWh) of the generated electricity in South Korea comes from wind and solar. Saudi Arabia aside, this is the worst ratio among all G20 countries.

Korea’s Offshore Wind – the Difference Maker

As a part of its Green New Deal, South Korea aims to generate 20% of its power with renewables by 2030. The target for offshore wind capacity is 12 GW, a significant increase from the 124.5 MW the country has today.

State of the South Korean Offshore Wind Energy Sector

Currently, the majority of the public Korean offshore wind developers are state-owned power generation companies (GENCOs). They are subsidiaries of the Korean Electric Power Corporation (KEPCO). As such, they are obligated to generate a certain amount of power from renewables and purchase renewable energy certificates (REC) using a fixed price contract regime administered by the New and Renewable Energy Center.

Private developers in South Korea wind energy market are usually major construction and heavy industry companies. Many small and medium-sized enterprises also develop offshore wind farm projects.

As of March 2021, 42 offshore wind projects with a total development capacity of about 7.7 GW had acquired an Electric Business License (EBL). The EBL is awarded after a successful wind measurement campaign. It is considered a good indicator of early project development.

South Korea’s Wind Farms Compared With Leading Countries

Today, Europe has the biggest offshore wind markets globally. The total installed capacity is 25 GW. The Netherlands and Denmark are among the most mature wind energy markets and currently have 2.6 GW and 1.7 GW installed capacity.

It may seem unfair to compare Korea’s wind energy generation to those markets. However, according to research by COWI, an international consulting group, it is in a strong starting position for future growth. Other experts suggest that the country could catch up with its competitors. Moreover, South Korea has the potential to lead the world in offshore wind power if the government and companies work together.

Such initiatives are already starting to pop up. The government plans to build an 8.2 GW offshore wind facility and a 6-GW floating wind power complex by 2030.

Challenges Facing the Wind Energy South Korea

The South Korean wind energy transition will not be seamless. The main challenges are complicated regulations, lengthy and unreliable permitting processes, and supply chain and grid uncertainties. Furthermore, there is an imbalanced risk profile for developers, who bear the burden of early-stage development costs. In addition, they experience opposition from locals, which, according to Bloomberg, could make South Korea miss its wind power target by 4.6 GW.

There is also the challenge of ensuring energy production at the lowest possible cost. Estimates reveal that wind power in South Korea costs about USD 220 per megawatt-hour, among the highest in the world. Paired with the rising costs of installation and operation due to the involvement of inexperienced contractors, this may be a significant hurdle towards the South Korean wind energy transition.

However, the Green New Deal addresses some of these challenges, like simplifying permitting and licensing processes. The government also plans to conduct a feasibility study in up to 13 areas. The goal is to find large-scale offshore wind farms locations and ease the research process.

Offshore Wind in South Korea – the Opportunities

The potential of wind energy in Korea will not remain untapped for long. To date, the presence of foreign wind energy developers in the country is scarce. However, the solid expected returns on investment are already starting to attract leading players in the industry.

Orsted, one of the global leaders in renewable energy, plans to develop 1.6 GW of offshore wind near Incheon. Furthermore, the company is ready to work with local partners to contribute to Korea’s energy transition.

In August 2021, South Korea awarded the first license for a 1.5 GW floating offshore wind farm to TotalEnergies and Macquarie’s Green Investment Group (GIG). Once completed, it will become one of the most significant floating offshore wind projects globally.

Through a joint-venture with Korean and Swedish partners, the Dutch fossil fuel giant, Shell, is also considering the opportunity to develop a 1.4 GW floating offshore wind farm near the coast of Ulsan, South Korea.

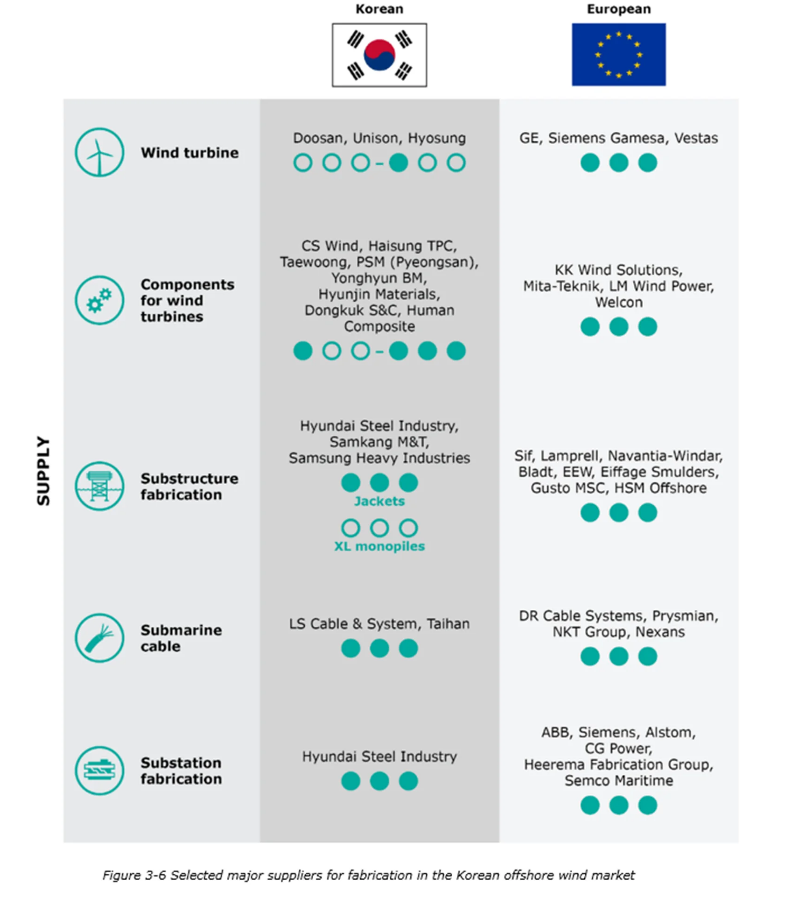

Local players are also making moves. Doosan Heavy Industries and Construction, the company behind Korea’s first 3-MW offshore wind turbine that received international certification in 2011, announced that it is ready to penetrate the local offshore wind market “in full force.“

Some of Korea’s most prominent companies, like Samsung and Hyundai, are also moving ahead. They aim at becoming technology suppliers for leading wind power projects across the country.

South Korea’s Wind Energy Transition and Wind Energy Market

South Korea is not the only market to prioritise wind energy development and offshore wind projects in particular. The EU, for example, is making offshore wind a centrepiece of its climate strategy. It plans to substantially increase its current 12 GW capacity to 60 GW by 2030 and 300 GW by 2050. The US government also announced a 30 GW offshore wind goal by 2030.

What makes the South Korean wind energy transition unique, however, is its tremendous potential. The wind sector in the country remains “underdeveloped,” generating just 1% of the country’s electricity in 2020. The low starting point, paired with the greater potential ahead, means investors who jump on board today are better positioned to capture the expected growth.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more