Asia’s Net-zero Transition Outlook 2050: Opportunities and Challenges

07 May 2024 – by Viktor Tachev

While Asia’s net-zero transition outlook offers a glimpse of hope, challenges remain. These include strong fossil fuel reliance and plans for new capacity, a lack of ambitious climate policies and limited financing. Addressing these issues remains crucial not only to unlock the massive economic gains of the clean energy transition, like ensuring energy security, but also to mitigate climate change’s impacts, the consequences of which are particularly stark for Southeast Asia, as the IPCC warns.

Asia’s Net-zero Transition Outlook: Where Asia Stands Today in 2024

The world is witnessing unprecedented growth in clean energy deployment, and Asia is a major reason for this. According to Zero Carbon Analytics, the region has demonstrated the fastest growth in wind and solar power capacity addition, with a 35% growth rate per year since the Paris Agreement. The installed wind and solar energy capacity has increased by 300% to over 1 TW since 2015. As of 2022, Asia accounts for 52.5% of global wind and solar capacity, making it the global leader. In 2023, Asia accounted for 69.3% of the new renewable energy capacity.

Clean energy investments have also been steadily rising, with an annual average growth rate of 23% since 2004. In 2022, Asia saw USD 345 billion in renewables investments, with China responsible for 80%. By 2030, renewable energy generation investments will double to USD 1.3 trillion.

Between 2000 and 2022, China marked the fastest-growing wind and solar power deployment globally. The country has managed to double its wind capacity every 1.5 years and its solar capacity every 2.5 years.

According to forecasts, China will increase its solar and wind capacity to over 1,200 GW by 2030. The country is also the leading manufacturer of green technologies, including solar panels, wind turbines, batteries and storage and EVs.

Other Asian countries are also demonstrating remarkable progress. Between 2018 and 2022, Vietnam increased its solar power capacity by 18,380%, surpassing the government’s targets.

In India, sales of EVs have increased by 3,000% from 2015. Between 2016 and 2022, the country doubled its solar and wind capacity over fivefold. As a result, its clean energy growth outpaces that of coal power.

Still Falling Short

Climate Action Tracker’s evaluation of Asian governments’ actions, policies and measures to achieve the Paris Agreement target reveals that no country is currently within the “1.5°C compatible” or “almost sufficient” categories. The best Asian performers are Japan and the Philippines, both of which fall in the “insufficient” category.

The efforts of China, India and South Korea are ranked as “highly insufficient”.

Indonesia, Singapore and Vietnam are among the worst performers. If all countries followed their approaches, warming would exceed 4°C.

The research group warns that China, Japan and the ASEAN are moving in the wrong direction regarding crucial net-zero transition policies. These include fossil fuel production and operation, as well as using gas and coal-fired power stations with CCS, co-firing ammonia in coal plants and reliance on carbon offsets and CO2 removals.

The Challenges for Asia’s Net-zero Transition

Despite the significant progress, Asia has a lot of work to do. For example, the emissions intensity of Asian economies is 41% higher than the rest of the world. Moreover, some of the biggest emitters, including Japan and Korea, also demonstrate the weakest ambitions to change.

However, reducing the energy intensity of Asian economies and accelerating progress towards their net-zero goals won’t come without its challenges.

Weak Policy Support and Financing

There is a risk that without policy support, clean energy investments won’t grow as needed to unlock the net-zero transition. Asian financial institutions, which remain among the top financiers of fossil fuel projects, have a significant role in this process.

According to IRENA Director-General Francesco La Camera, the NDC updates in 2025 are a prime opportunity to leap forward with more ambitious policy support for the net-zero transition.

Regarding financing, experts warn that climate investment still isn’t on track to deliver on the Paris Agreement. They estimate the needs of developing countries, excluding China, to be USD 1 trillion in 2025 and USD 2.4 trillion by 2030. According to the IMF, meeting climate mitigation and adaptation needs in emerging and developing Asia requires at least USD 1.1 trillion annually. While funding falls short by USD 800 billion, governments can close the gap simply through adequate policy reforms.

However, providing financing on a similar scale requires collaboration from various parties, including developed nations, multilateral development banks (MDBs), the private sector and philanthropic organisations.

Since the pledges made at COP28 fall short of what is needed, developing countries should create a welcoming environment to lure private capital. Asian governments should introduce transparent, ambitious and actionable policies to ease clean energy project permissions and remove administrative burdens for developers.

Another effective step is introducing fossil fuel subsidy reforms. The IEA warns fossil fuel subsidies are inefficient in helping consumers and urges governments to invest in clean energy instead. The COP28 final text also called for phasing out inefficient fossil fuel subsidies as soon as possible. Furthermore, analysts argue that just a small portion of the fossil fuel subsidies can cover the energy transition’s costs. Moreover, countries like Indonesia and India, for example, have already successfully applied subsidy swaps. That way, they have ensured that some of the savings from fossil fuel subsidy reforms will fund the clean energy transition.

Next, significant policy changes are necessary to facilitate renewable energy investment while disincentivising fossil fuel use by removing subsidies and implementing carbon taxes.

Scrapping plans to pursue questionable technologies like CCS, hydrogen and ammonia, which experts see as being “killed by the economic reality,” is an integral step in convincing investors that they are ready to benefit from energy transition financing.

Promotion of Technologies That Will Perpetuate the Use of Fossil Fuels

Just an 18% share of offshore wind by 2035 would put Japan on track for a 90% decarbonised power sector. Yet, the country is pushing ahead with technologies that will expand the life of fossil fuels. Among them are LNG, ammonia co-firing schemes, blue hydrogen and CCS. Furthermore, the country considers ASEAN countries to be the primary export target for its technologies. Japan will fund or assist the development of ammonia co-firing and hydrogen plants in India, Indonesia, Vietnam, the Philippines, Malaysia, Thailand and Singapore.

Experts describe these technologies as “Band-Aid” solutions for delaying rather than speeding up decarbonisation. Price of Oil International refers to Japan’s strategy as “a greenwashing exercise.” According to BloombergNEF, its ammonia plans are “expensive and very dirty“.

Young Fossil Fuel Fleet

Closing Asia’s coal plants before the end of their effective lifespan is critical, yet poised to bear significant economic damages.

A typical coal power plant has an average lifespan of around 40 years. According to McKinsey, Asia’s plants are young, with an average age of less than 15 years. For example, the average coal plant in China, Indonesia, Malaysia and the Philippines is 13 years old. In Vietnam, the average age is eight years. Furthermore, the majority of the existing plants have long-standing power purchase agreements.

Closing the plants will reduce the significant stranded asset risk of fossil fuel infrastructure across Asian countries. Studies reveal that emerging economies in Asia have the largest new and planned coal fleets. China has the highest value of stranded asset risks, representing up to 55% of the global total. India and Southeast Asia also see large amounts of asset stranding.

On top of these are the USD 379 billion of stranded asset risk of the proposed gas infrastructure.

The Economic Case for Accelerating Asia’s Net-zero Transition

According to a study by the Potsdam Institute for Climate Impact Research, global damages from climate change will reach USD 38 trillion annually by 2050, potentially increasing to USD 59 trillion. They result mainly from rising temperatures, changes in rainfall and temperature variability. However, the scientists warn that accounting for other weather extremes, such as storms or wildfires, costs could rise further.

Furthermore, the research reveals that even if CO2 emissions were to be drastically cut down starting today, the world economy would still experience an income reduction of 19% until 2050 due to climate change. These damages are six times larger than the mitigation costs needed to limit global warming to 2°C. Southeast Asia will be among the most affected regions.

Deloitte estimates the cost of climate change inaction in the Asia Pacific to be USD 96 trillion by 2070. On the other hand, demonstrating strong climate action can deliver USD 47 trillion to their economies.

According to IRENA, ASEAN countries’ clean energy potential can help slash their power sector emissions by 75% and reduce energy costs by USD 160 billion. Avoiding costs related to health and environmental damage from fossil fuels can save up to USD 1.5 trillion cumulatively by 2050.

Thanks to its existing renewable energy capacity, Asia generated over USD 199 billion in fossil fuel cost savings in 2022.

According to Stanford University academics, the investment needed to switch to 100% renewables would pay off within six years.

The Opportunities Are There For the Taking

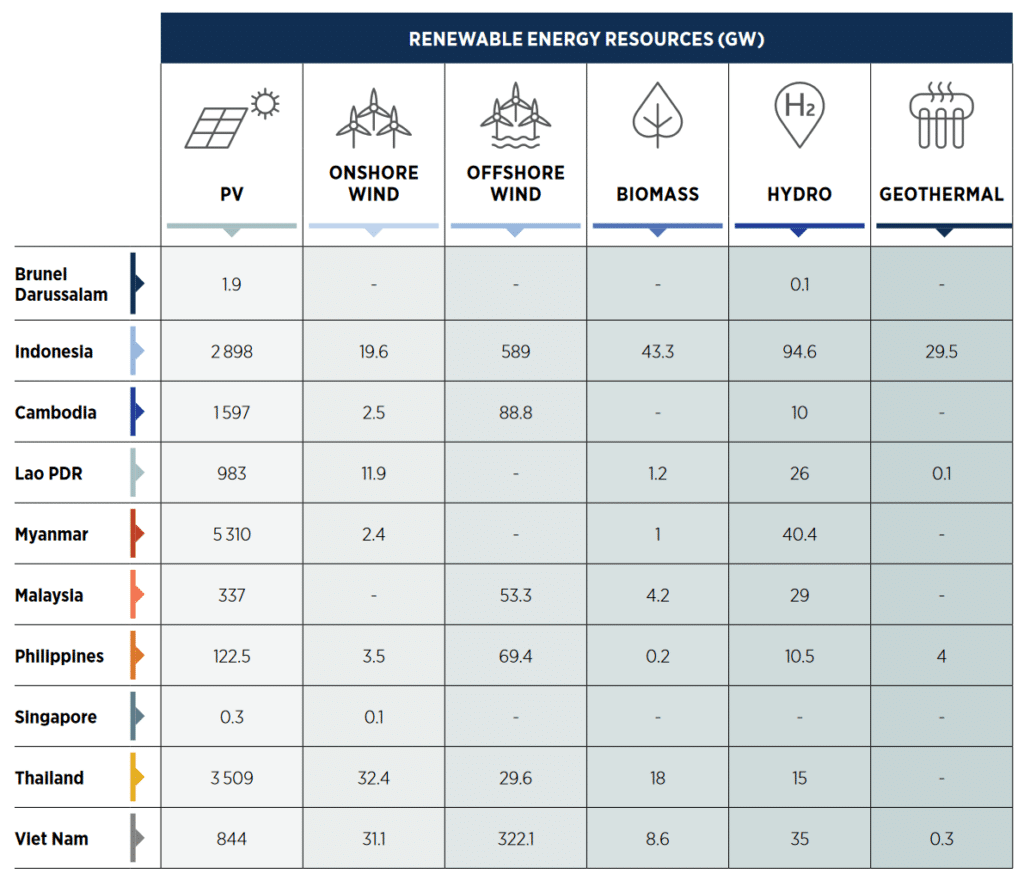

Studies reveal that ASEAN countries have abundant, untapped technical potential for clean energy. According to IRENA, the region can transition from just a 19% renewable energy share in 2018 to 65% by 2050 through renewables.

Capitalising on this potential would ensure cheaper energy, improved energy security and various economic gains, including reduced fossil fuel subsidies, green jobs, reduced climate change costs and more. With appropriate policy support stimulating clean energy development and accelerated fossil fuel phase-out strategies, this potential can materialise into the backbone of their energy systems.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more