BNEF: Renewables Are Becoming Cheaper than Natural Gas in Southeast Asia

24 September 2025 – by Viktor Tachev

Countries in Southeast Asia face the challenging task of balancing economic growth, increasing energy needs and accelerating climate action and decarbonisation progress. Analysts warn that under the influence of the fossil fuel lobby, countries in the region risk making a costly mistake by investing in new gas infrastructure and scaling up LNG imports, all while cleaner and more energy-secure renewable energy alternatives are becoming significantly cheaper.

BNEF: Renewable Energy Offer a Cheaper, Cleaner and More Secure Alternative than Natural Gas For Southeast Asia

Green technology improvements, economies of scale and supportive government policies in recent years have turned renewables into the most cost-efficient power source across many global markets. The case is no different when it comes to Asia. The latest data for the 2024 power generation costs of renewable energy and gas reveal that the former is already cheaper for many Southeast Asian markets in real, not nominal, dollar terms, rendering gas expansion plans unreasonable.

Bloomberg NEF (BNEF) finds that in the Philippines, the cost of solar power is already cheaper than that of coal and gas (combined-cycle gas turbines) and will continue declining by 2030. Solar PV, paired with storage, is on par with the costs of coal, but cheaper than gas, with the price difference on course to widen by 2030. Even onshore wind, which remains more expensive than coal and gas in 2025, will be cheaper than both by 2028.

According to BNEF, both solar and solar in combination with battery storage are already cheaper than gas in Thailand, with the gap projected to continue widening over the next five years.

In a dedicated techno-economic analysis of power generation in Malaysia, BNEF finds that solar is already cheaper than gas and will become even more so by 2030 in the country. Solar, paired with battery storage technology, has a cost parity with gas in 2025, but will become cheaper over the next five years.

Other research bodies, including the IEA and the fossil fuel-friendly Institute for Energy Economics Japan (IEEJ), also expect renewables to become significantly cheaper than fossil fuels in Asia, with solar the most affordable energy source.

Some Asian countries are already reassessing the importance of gas in their energy mixes. For example, Pakistan plans to phase out imported LNG as a power generation source in the long run and prioritise domestic power generation, including solar and wind. Thailand has also decided to accelerate its shift to renewables, doubling their capacity by 2030, to reduce dependence on imported fuels. Vietnam is another good example, as the country is focusing on large solar farms, increasing its target from 5% to 16% at the expense of coal and natural gas.

Still, according to Bloomberg, the region as a whole is likely to fall short of its renewable energy production goal of 23% by the end of the year.

Southeast Asia Planning Massive Gas Expansion Despite the Risks

According to the IEA, Asia has been driving global gas demand in 2024 and 2025. The Southeast Asian region, where gas already plays a key role in the electricity mixes of countries such as Thailand and Malaysia, plans for massive growth in LNG import infrastructure development. Currently, over 60% of the global gas-fired capacity in development is in Asia, with around half of it in East and Southeast Asia. If all projects in the pipeline are completed, the region’s operational gas power and LNG generation capacity would exceed 200 GW, while the LNG import infrastructure and export capacity could jump by over 80% and 30%, respectively.

Data by Global Energy Monitor (GEM) reveals that Vietnam’s 44 GW of gas power capacity and 12.1 million tonnes per annum (mtpa) of LNG import capacity (of which 1.5 mtpa is already under construction) shape it as the region’s leader.

The Philippines currently has over 25 GW of gas power and 21 mtpa of LNG import capacity in development. Of this, 2 GW and 7 mtpa are already under construction.

Thailand’s gas power capacity under development is 10.5 GW, with 2.5 GW under construction. The country also has around 11 mtpa of proposed LNG import capacity.

Malaysia, the fifth-leading LNG exporter globally, has over 31 mtpa of operating LNG export capacity, with another 4 mtpa in development. The country also plans to develop 6 GW of gas power capacity.

Indonesia has 14 GW of gas power capacity in development, with around 5 GW of it being in the construction phase. The country plans to add 12 mtpa to the more than 23 mtpa of operational LNG export capacity. Indonesia currently has the biggest LNG import capacity in the region, with 15 mtpa in operation and another 2.3 mtpa in development.

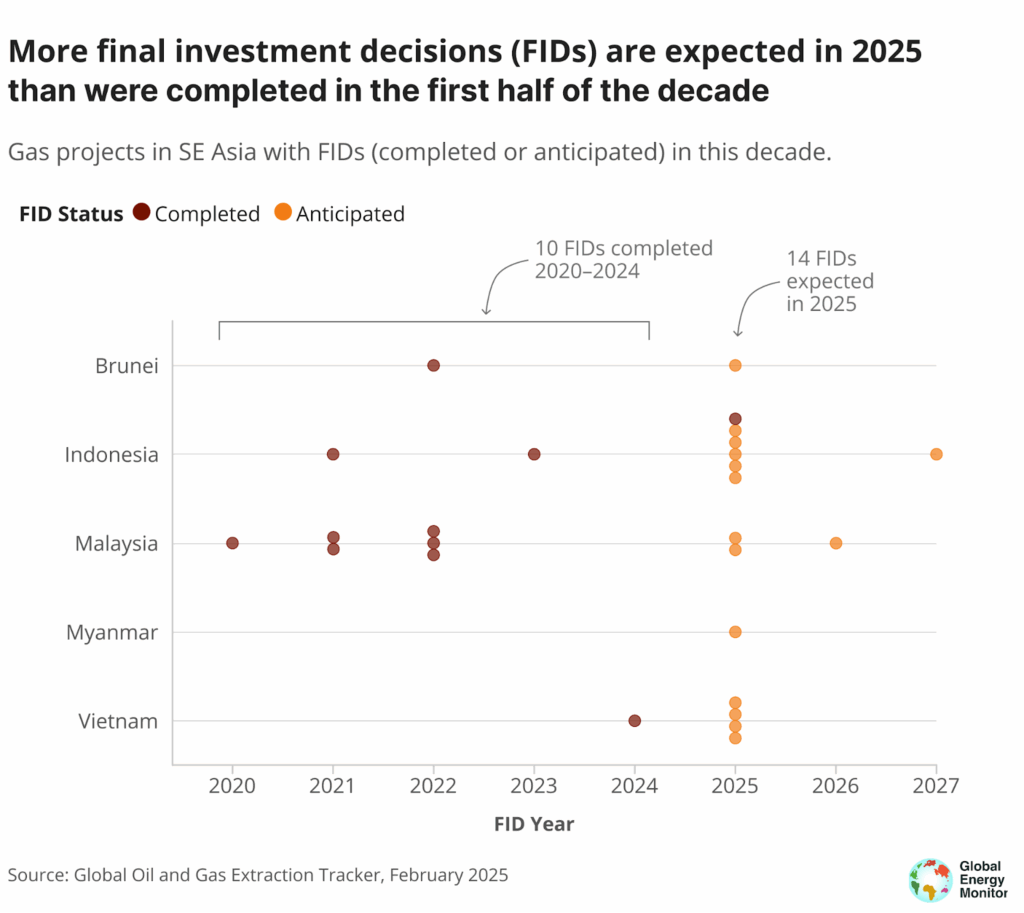

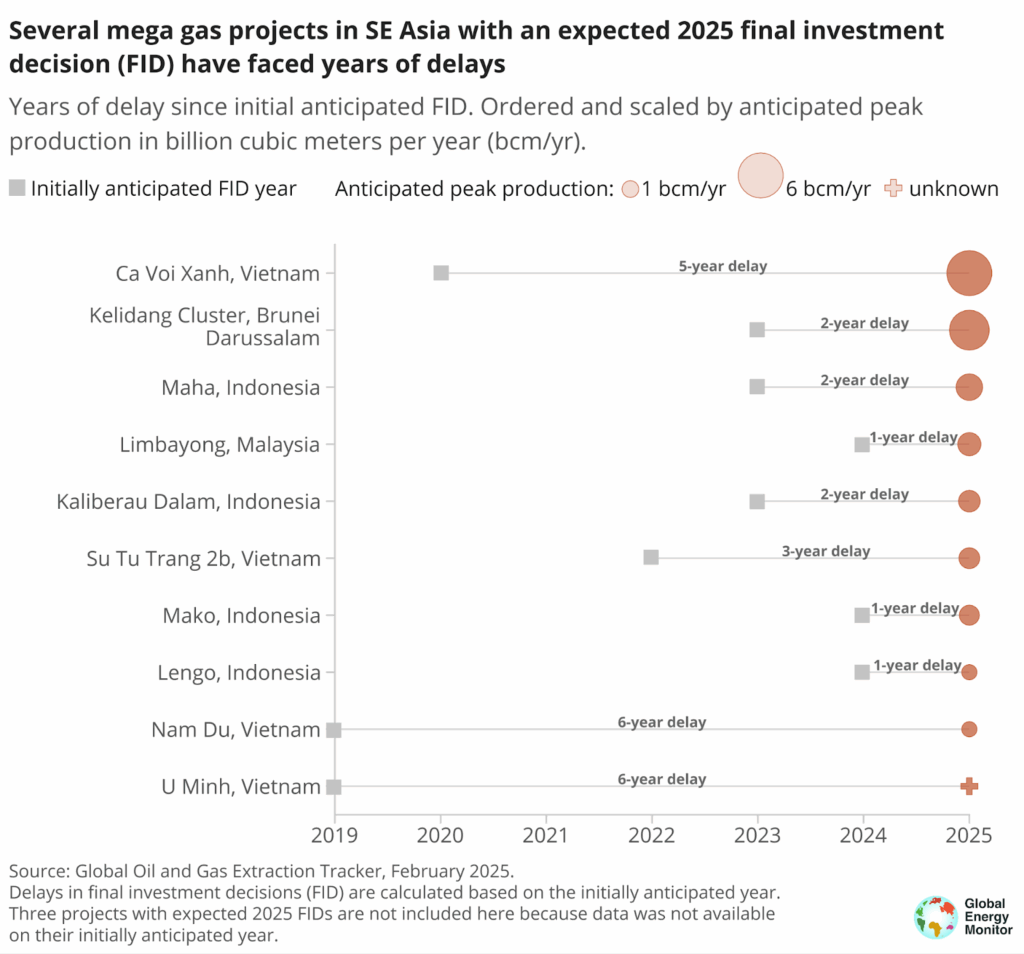

Aside from the ambitious gas buildup and LNG import plans, Southeast Asia is also considering ramping up extraction. According to GEM, the region has the highest number of final investment decisions (FIDs) on oil and gas extraction projects this decade, with over 20 billion cubic metres (bcm) annually of new production capacity potentially in the works. This amounts to an 18% increase over current output.

According to Wood Mackenzie, gas will become a cornerstone for Southeast Asia’s energy future, with a share of around 30% in the region’s primary energy mix by 2050.

Analysts See the Japanese Government and Power Majors as the Key Promoters of Gas Across Southeast Asia

Japan remains the world’s largest international public financier of LNG export capacity, with a share of over 50% for completed projects since 2012 and projects under construction or to be built by 2026. Under the Green Transformation Strategy (GX) and the Asia Zero Emissions Community (AZEC), the Japanese government and companies have been heavily developing the LNG market across Asia, investing in import terminals, power plants and pipelines.

The country is also actively involved in consultations regarding the design of energy plans in several Asian countries, including Bangladesh’s national power development plan, which aims to have natural gas as the leading power source by 2050. Market Forces notes that the Japanese government has heavily influenced domestic energy policies in the Philippines, Thailand and Vietnam, to ensure that gas and LNG, instead of renewables, remain the priority.

The IEEJ, an influential Japanese research organisation, has also been criticised by experts for providing unrealistically favourable forecasts for gas demand in the region, while at the same time undermining the prospects for renewables and their economic competitiveness with natural gas.

Furthermore, according to Market Forces, Japanese trading houses plan to build 8.6 times more gas power than solar and wind combined in South and Southeast Asia, undermining the region’s energy transition. InfluenceMap notes that the Japanese Business Federation also actively advocates investing in LNG and fossil fuel-based technologies, such as hydrogen and ammonia co-firing.

Besides Japan, in countries like Indonesia and Malaysia, European gas majors are found to be a key driving force behind the projected growth, mainly due to power demand from AI data centres.

Japan, South Korea and China are also heavily investing in expanding their LNG carrier fleets, which, in light of their domestic LNG demand decline and oversupply, can be viewed as an indication of plans to scale up exports of excessive quantities.

However, Southeast Asia’s fixation on gas isn’t entirely a byproduct of external pressure. In fact, some governments across the region are driving the push for gas themselves by planning investments in LNG import infrastructure, increasing deliveries and investing in extraction infrastructure.

Prioritising Gas and Fossil Fuel Based Technologies Raises Economic and Other Risks For Southeast Asia

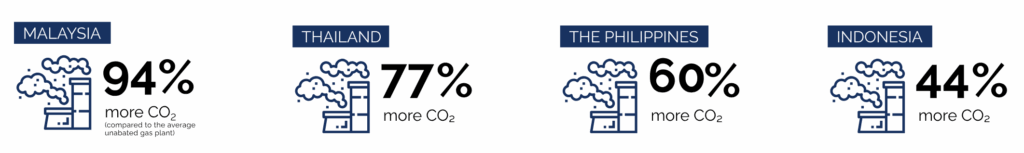

BNEF finds that renewables offer a much more economical decarbonisation solution compared to gas and hydrogen for countries in Southeast Asia.

For example, they warn that the use of hydrogen, as well as its derivative ammonia, as clean fuels to decarbonise baseload thermal power plants will not be economically competitive in the Philippines. Furthermore, the analysts forecast a three times the levelised cost of electricity (LCOE) for a retrofitted combined-cycle gas turbine plant running on 100% blue hydrogen imported from Saudi Arabia, compared with offshore wind in the Philippines in 2050.

The case is no different when it comes to Thailand. BNEF’s dedicated analysis concludes that blending hydrogen and gas will not be the most cost-effective decarbonisation pathway for Thailand, with direct renewable energy use proving a far more effective and affordable method to reduce power sector emissions. The experts even forecast a 3.3 times LCOE for a retrofitted combined-cycle gas turbine plant in Thailand running on 100% domestic green hydrogen, compared with solar-plus-storage solutions in 2050.

For Malaysia, BNEF finds that even using the cheaper, domestically produced clean hydrogen for reducing emissions from thermal power plants will still not be economically feasible. In 2050, the experts forecast a 2.7 times LCOE for a retrofitted combined-cycle gas turbine running on 100% green hydrogen produced in Sarawak compared with solar with storage. As a result, they suggest direct renewable energy use as the far more effective and affordable solution for decarbonising the power sector.

For all three countries, the experts consider clean hydrogen as a solution mainly for hard-to-abate sectors where direct electrification is not possible.

Project Uncertainty, Price Volatility and Unpredictability

Experts reveal that LNG projects are already struggling, with around 81 GW of planned capacity cancelled in Asia alone between 2022 and 2023 due to rising costs. Several projects across the Philippines and Vietnam have faced delays or even cancellations, causing power outages in major cities. The first LNG terminal commissioned in the Philippines has been facing a risk of underutilisation due to high costs. Import-dependent countries like Pakistan and Bangladesh were priced out of the gas markets and left starving for power, with the situation likely to continue in the years ahead.

Furthermore, many developing Asian countries remain fully exposed to spot market volatility due to a lack of long-term contracts. According to the IEA, factors like geopolitical tension, limited gas supply and weather extremes will continue fueling price volatility and cause gas market uncertainty, significantly undermining the energy security of Asian countries. In 2024, price volatility averaged at 40% for Asian countries, 90% above its 10-year average between 2010 and 2019.

Aside from the inherent drawbacks of the gas and LNG import buildup plans, such as exposure to price volatility and unreliable supplies, the uncertainty is further fueled by external factors, including shipping route disruptions and trade tariffs.

Regarding the gas extraction investment plans of Southeast Asia, Global Energy Monitor warns that, historically, such types of FIDs have faced notable delays. As a result, according to the experts, the likelihood of these projects moving forward remains unclear.

Environmental and Climate Risks

The fossil fuel expansion plans come despite the IEA’s warnings that new oil and gas fields are incompatible with limiting global warming to 1.5°C and achieving net zero by 2050. Furthermore, TransitionZero warns that, despite the carbon emission-saving claims, solutions like ammonia co-firing would emit comparable or double the amount of emissions compared to traditional gas power generation by 2030.

Global Energy Monitor notes that the majority of the fields in Southeast Asia’s gas expansion plans are within ecologically sensitive areas, where gas development could have significant adverse impacts on biodiversity and derail ecosystem conservation efforts. One example is the Coral Triangle and the Mekong Delta, an area of ocean around Malaysia, Indonesia and other countries. Over 120 million people rely on the biodiversity hotspot and its resources for their livelihoods. According to estimates, around 16% of the protected area in the Coral Triangle overlaps with gas blocks, most of which are in the exploration phase. If all current proposals are implemented, more than 1.6 million square km of the Coral Triangle would be directly affected by fossil fuel development.

Another case in point from Southeast Asia is the Verde Island Passage in the Philippines, where, although no gas extraction is planned, gas import infrastructure development is already taking a toll on the environment.

BNEF’s Blueprints For Ensuring Cleaner and More Affordable Electricity in the Philippines, Malaysia and Thailand

Experts note that changing the situation requires political ambition for weaning the energy systems off fossil fuels, as well as pledging to more ambitious clean energy targets and introducing measures to support clean energy developers. One measure to unlock rapid clean energy growth across Southeast Asia is feed-in tariffs (FITs), which are already successfully implemented in Indonesia. Through the flexible pricing, which accounts for regional electricity costs and technology characteristics and allows for further adjustments, the government eases developers and private investors by providing clear, guaranteed and consistent revenue. Vietnam’s FITs have also been pivotal in fueling the country’s rapid clean energy growth and spurring massive investment from both domestic and international developers.

In its dedicated analysis pieces on Malaysia, Thailand and the Philippines, BloombergNEF suggests a series of additional steps that can help each country advance toward a net-zero power grid and cleaner and more affordable electricity.

The Philippines

BNEF suggests ensuring the effective implementation of the renewable energy portfolio standards, improving Green Energy Auction designs, increasing energy storage deployment and expediting the project permitting process. Improving the power grid, enhancing the implementation of the Green Energy Option Program and leveraging financing from development institutions to nurture private investments are other proposed measures.

Similar to the case of Thailand and Malaysia, other applicable measures for the Philippines, according to the analysts, include building capacity among policymakers and the technical workforce, leveraging affordable financing from development institutions to catalyse private investment and raising funding for energy transition via a carbon pricing mechanism and sustainable debt instruments.

Thailand

In the case of Thailand, BNEF notes that the heavy reliance on gas-fired power plants and LNG imports has already resulted in higher power prices. Instead of adding more thermal power plants, the experts advise Thailand to consider an orderly phaseout of its thermal power plants in coordination with the expansion of clean power, including enabling the participation of flexible power supply and demand sources.

Other crucial steps that authorities can take include undertaking power market reforms, such as enabling a competitive ancillary services market, conducting regular energy storage auctions and accelerating the deployment of battery-based solutions to overcome the variability of renewables. Utilising the growing interest from corporations in clean power procurement to attract more private investment in the deployment of renewables, energy storage and the power grid is also advisable for advancing the clean energy transition. Last but not least, the analysts also advise improving power capacity expansion planning to avoid future cost burdens.

Malaysia

BNEF’s analysis suggests developing dispatchable clean power sources, strengthening the power grid to facilitate private sector investment, linking the Peninsular and Sarawak grids and lowering the barriers to corporate clean power procurement. According to the analysts, it is also crucial to assist project developers in securing land and grid connection and conducting regular energy storage auctions to incentivise the deployment of small-scale battery systems.

Seizing the Opportunities of Renewables Is at an Arm’s Reach, But Giving Up Gas and LNG Remains Crucial

Southeast Asian nations face a significant challenge: their economies are booming and becoming more power-hungry, while securing energy supplies has proven challenging. At the same time, most countries in the region are at the front lines of climate change. All this means that they need to switch to cleaner, more stable and more affordable power. The shaky financial and energy security fundamentals of gas and LNG, as well as their adverse impacts on climate and nature, mean they aren’t the answer. Clean energy, on the other hand, offers the solution to Southeast Asia’s needs.

Studies project that switching to green energy could save trillions of dollars and unlock additional economic benefits, including job creation, more stable power prices and indirect gains from averted losses due to climate change. In total, IRENA estimates that the energy transition will help Southeast Asia reduce energy costs by USD 160 billion by 2050 and save up to USD 1.5 trillion in cumulative costs from the health and environmental damage caused by fossil fuels by 2050. Importantly, IRENA finds that the region can transition from just a 19% renewable energy share in 2018 to 65% by 2050. According to BNEF, Malaysia, Thailand and the Philippines, for example, would benefit from limiting thermal power expansion and, by scaling up renewables build-out, would also be able to boost domestic energy security and affordability.

Considering the abundant, untapped technical potential for green energy in ASEAN countries, the economic gains of prioritising renewables instead of gas are not only within arm’s reach, but clearly the only viable way forward. In light of that, any reluctance to leave fossil fuels in the past and accelerate the shift toward cheaper, cleaner and more energy-secure renewables would raise a lot of question marks over the agenda behind governments’ actions.

To access the country reports, please visit the following links:

Malaysia | Thailand | Philippines

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more