Oil Majors Spend More on Spin, Less on “Green Hydrogen”

Source: Chemistry World

25 November 2021 – by Eric Koons

New day, same tune. The world agrees that we are in a climate crisis and fossil fuels are the main contributors. Oil and gas must be phased out and replaced by sustainable alternatives, like green hydrogen, to keep climate change at bay and reduce carbon emissions. There should be more hydrogen fuel cell electric vehicles because these hydrogen fuel cell vehicles will help to curb carbon emissions.

The oil majors know this, but there is still reluctance amongst them to embrace the green hydrogen and green transition. While large oil and natural gas firms are now touting the importance of environmental sustainability, they often lack the policies to back up their claims. Particularly so when the change is not financially lucrative.

Declining LCOE for Renewable Energy and Production of Green Hydrogen

While oil and natural gas majors stall, the levelised cost of energy (LCOE) for renewables continues to tumble. Last year, the cost to produce energy from onshore wind fell by 13% and its offshore counterpart by 9%. Solar, too, fell, with concentrated solar power dropping by 16% and utility-scale photovoltaics falling to 7%. The cost of Green hydrogen production, while not being as low as solar energy or wind, is now lower than natural gas. Now, more cheap green hydrogen is possible, and less investment is required to produce green hydrogen and renewable electricity.

Now, more than ever, the use, production and selling of renewable energy is more practical than ever before. Innovations throughout the industry continue to streamline renewable energy production, and government policies now strongly incentivise it.

How are Companies Responding to Calls to End Fossil Fuel Use and Increase Green Hydrogen Production?

In Asia, energy companies are increasingly assuring investors and the public that they will reach net-zero emissions targets by 2050. However, promises and setting concrete steps to achieve them are two separate issues. And amongst insiders, though, greenwashing is at play.

Roughly half of the companies in Asia that have committed to reducing their emissions are yet to set science-based targets. While many companies are setting science-based targets, the others can be seen as simply jumping on the green bandwagon.

PetroChina Claims to Be Moving Towards Net Zero

PetroChina is one of those oil and natural gas companies that has committed to net-zero by 2050, yet is short on detail about how exactly it will get there. However, this is the first time a major Asian oil company has publicly stated such a goal. The Chinese firm is targeting USD 400 to 700 million per year in renewable energy investments.

Yet, puzzlingly PetroChina’s figure represents a minute percentage of their total capital expenditure, at 1 – 2%. Compared to some oil and gas majors in Europe, this goal is underwhelming. In comparison, Eni, the Italian oil and gas major, aims to spend over 20% of its budget on sources and sustainable energy. Similarly, BP, the British multinational, is setting aside 33%.

Like many other companies, PetroChina’s plans to achieve net-zero are murky. Its primary strategy is increasing natural gas production, which is less carbon-intensive than oil but is hardly seen as a clean energy source. The integration of science-based targets would help bolster their claims to grasp net-zero.

What are Companies Saying About Green Hydrogen and Blue Hydrogen?

Along with their commitments, many oil and gas companies are pushing hydrogen as an alternative energy source. Yet, hydrogen still remains cumbersome to produce, and not all hydrogen production is environmentally friendly. Two of the most well-known types of hydrogen are green hydrogen and blue hydrogen.

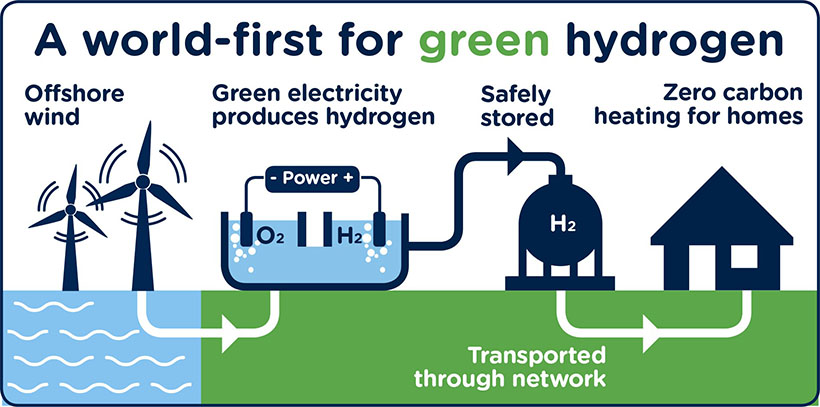

Green hydrogen uses renewable energy electrolysis technology to separate water into hydrogen and oxygen. Blue hydrogen is made by splitting natural gas into hydrogen and carbon dioxide.

Green Hydrogen is Not That Common

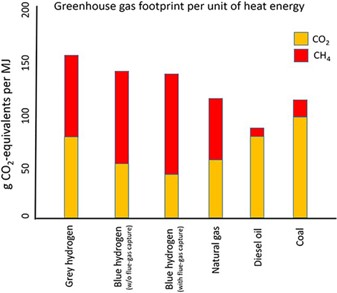

In reality, though, less than 1% of global hydrogen production comes from renewable resources. And under the guise of clean energy, oil and gas companies are touting their investments in hydrogen production, when in reality, most of it is blue and is just another form of fossil fuel energy production. With hydrogen’s popularity growing into a worldwide movement to further pursue the fuel to meet net-zero goals, some studies show that blue hydrogen, made from fossil fuels, could be worse for the climate than coal.

Why Should Oil and Natural Gas Companies Embrace the Renewable Energy Shift?

Aside from the obvious environmental benefits of a renewable and clean energy transition, public opinion is shifting, and government legislation is increasing, creating more incentives for oil and gas companies to embrace the energy shift.

Green hydrogen economy presents an incredible opportunity for companies to capitalise. Forecasts suggest that green hydrogen production will grow by a compound annual growth rate of 57% between 2019-2030. While the production of green hydrogen remains an expensive venture, costs continue to shrink to produce hydrogen, and government policies will likely continue to make its production more affordable through incentives and subsidies.

Hydrogen Oil: Green vs Blue, What’s the Difference?

Read moreChallenges For the Oil and Gas Industry

The transition to renewable energy does not come without its obstacles for oil and gas companies. Chief among them is the question of profitability. Is it still profitable to turn off the tap on fossil fuels and open the door to renewable energy and clean hydrogen? But a future of lower commodity prices and higher carbon taxes awaits. Returns on oil and gas investments continue to nosedive, whereas it is the opposite for renewable energy projects. This does not bode well for oil and gas companies in Asia or elsewhere. The sooner they jump on board, the more they stand to gain.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more