Green Investments Growth in Asia – the Global Renewable Energy Powerhouse

20 July 2021 – by Viktor Tachev Comments (0)

Asia is the most populous continent and home to some of the fastest-growing economies. As a result, its energy demand is growing exponentially. To address it, the continent is increasingly looking towards renewable energy. The opportunities and the fast-paced progress are driving growth in renewable energy investments in Asia and attracting green investors from all scale.

Growing Energy Demand, Climate Risk, Net-Zero Pathway and Economic Recovery Trigger Asia’s Renewable Energy Transition

According to the International Energy Agency (IEA), among the Association of Southeast Asian Nations (ASEAN), overall energy demand has grown by 80% since 2000. The growth in energy demand is even more glaring in Southeast Asia, where the 6% annual rate is among the fastest in the world.

On a broader scale, according to the Energy Outlook to 2035 report by the Institute of Energy Economics, Japan (IEEJ), the primary energy demand in Asia is projected to grow at 2.5% per year until 2035. By that time, the continent’s share in the global primary energy demand would be close to 42%. Besides, Asia will account for approximately 61% of the world primary energy increase, driven by its sharp economic growth. To meet this demand and achieve the common net-zero goal, the continent has to rely on renewable energy.

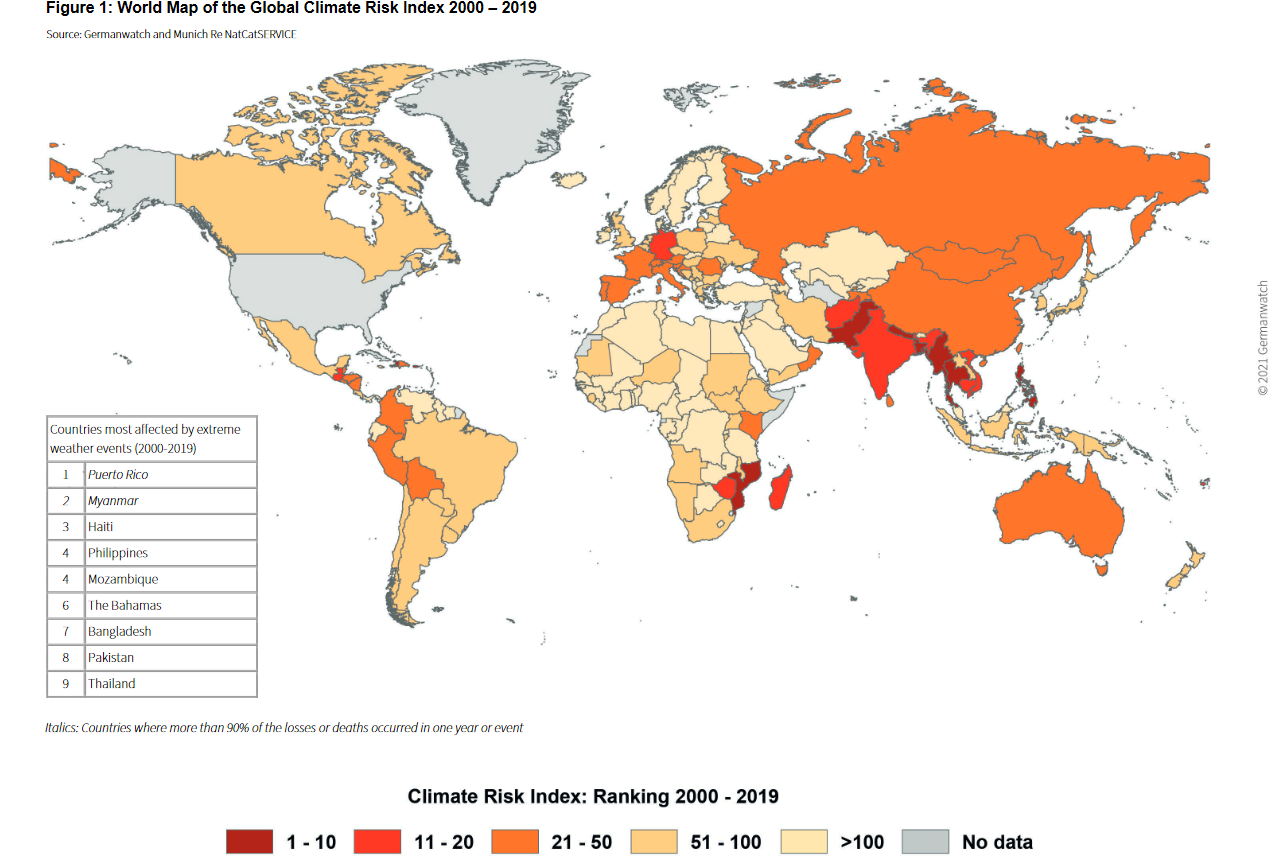

Furthermore, according to the long-term Climate Risk Index (CRI), 5 out of the 10 countries most affected by global warming during the period 2000 to 2019 are in Asia.

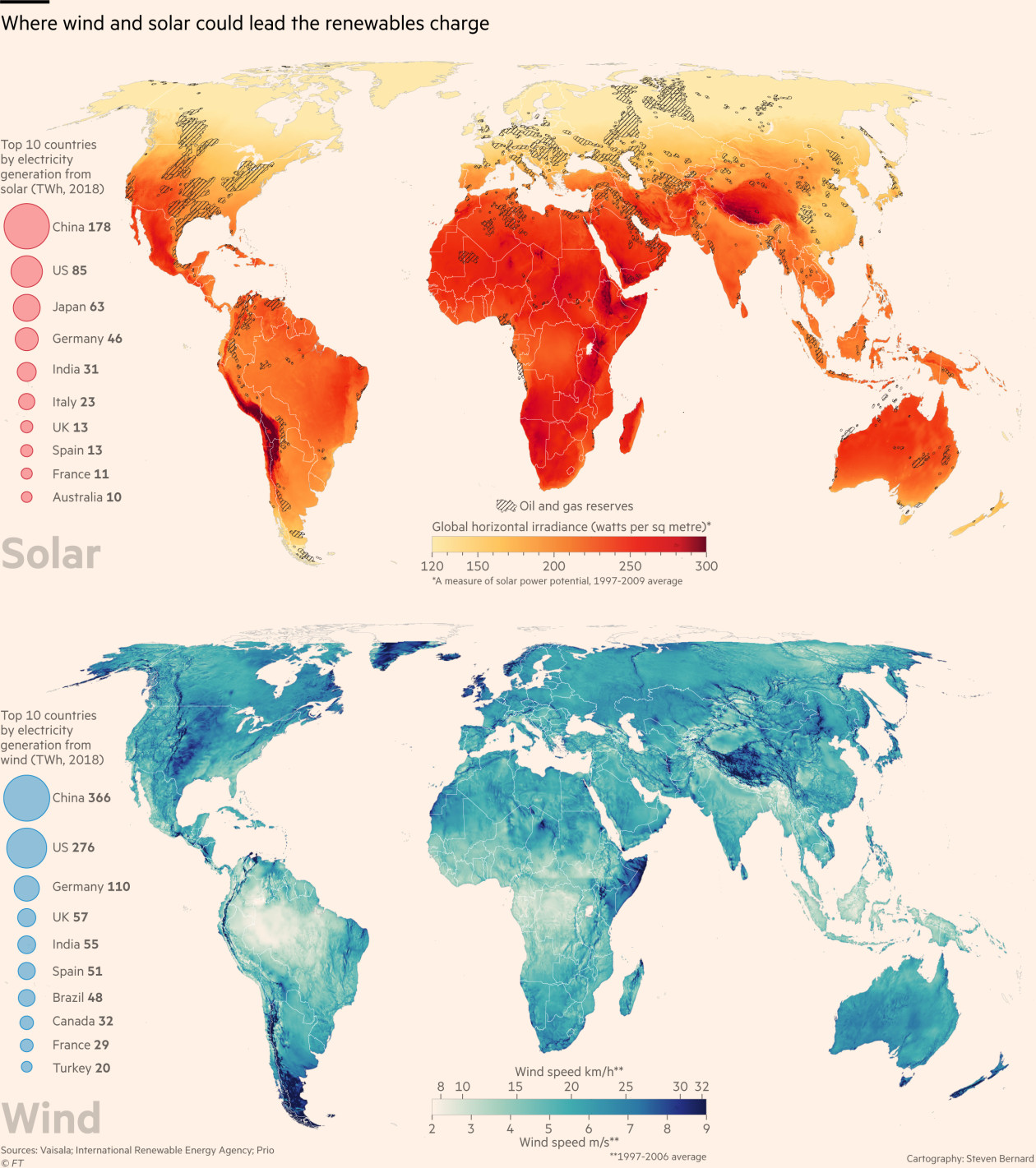

Besides, the bigger part of Asia’s territory has high wind and solar power potential. This makes it a perfect soil for new clean energy project development.

Global Climatescope’s index shows that Asia is home to some of the countries with the most stable fundamentals and best opportunities for renewable energy expansion, including India, China, the Philippines, Taiwan, Malaysia, Myanmar, and more.

Experts see the post-COVID recovery period as the perfect moment for the continent to grow its efforts on the renewable energy stage. The clean energy transition can address the economic slowdown, create massive employment opportunities, reduce electricity costs, connect more people to the grid, and improve its resilience.

Success Stories from the Renewable Energy Investment Scene in Asia

Asia’s green scene is full of success stories on a national level. China, for example, installed half of all new global solar power capacity in 2018. Vietnam managed to become a top 10 solar power market in the world in just a couple of months. The list of countries with remarkable progress and aspiring plans goes on, but what is more important is that even Wall Street is recognizing the continent’s potential and increasingly backing the transition through different types of investments.

The clean energy infrastructure investment’s growth reflects government efforts to reduce carbon emissions and the lower technology and energy costs involved. Reports point out renewable power costs being 25% less in China and India compared with developed countries. Backed by ambitious targets to go net-zero by 2050 and 2060 and soon-to-peak CO2 emissions, the two countries are the cradle of the renewable energy revolution in Asia.

But change is also seen on the corporate level, especially in Japan, as we have already reported. Currently, 26% of companies in Asia aim to become carbon-neutral by 2030. In their net-zero targets, Asian corporations are second only to their European peers.

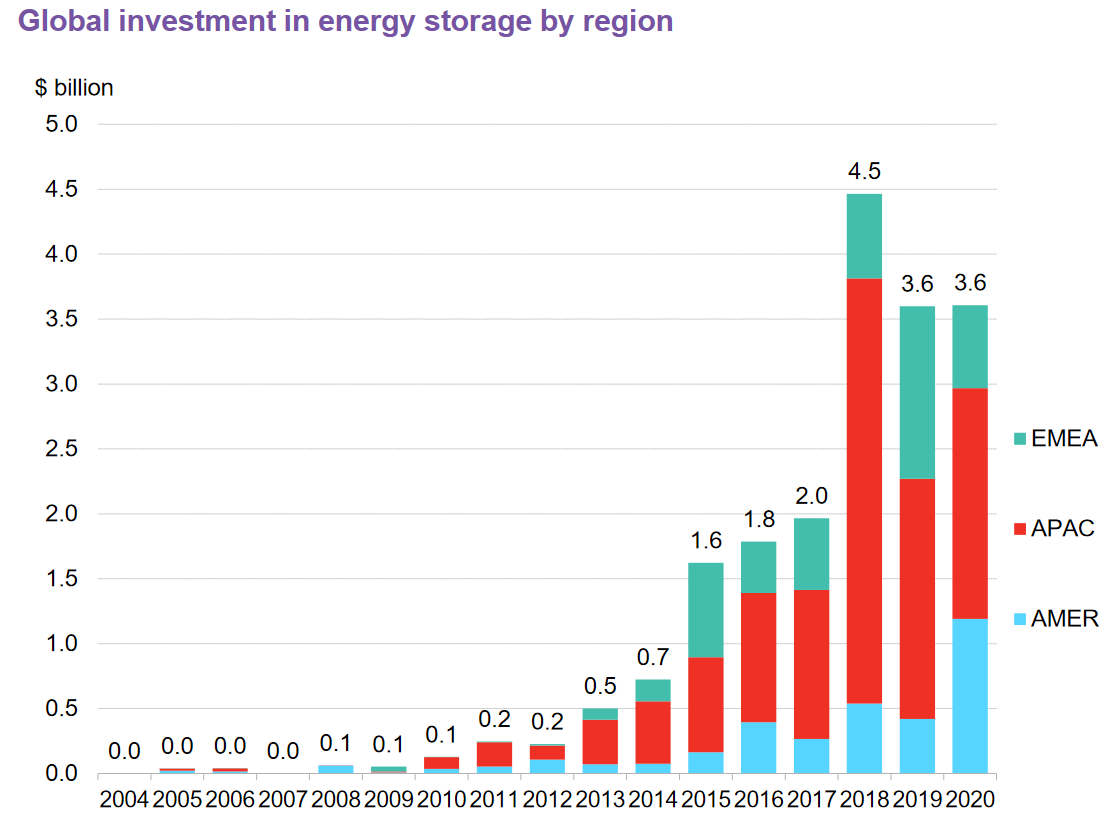

The APAC region is currently the global leader of energy storage investments, totalling USD 1.8 billion in 2020.

Aside from the soaring renewable energy investments, Asia also leads sales of low-carbon goods and services as a share of GDP with China dominating in solar manufacturing.

Furthermore, the close trade relations with low-carbon global leaders help ASEAN member states enhance access to low-carbon technologies and speed up the decline in their costs.

The Challenges Ahead

The biggest challenge in Asia’s swift renewable energy transition is the continued reliance on fossil fuels and investments in new coal plants. Many Southeast Asian nations are looking to oil and gas resources to meet increased energy demand.

For example, in the case of China, coal still accounts for 35% of its BRI energy investments. The country remains the main supporter of new coal-fired power plants abroad.

Fortunately, it is changing course. China has already achieved great success on the renewable energy stage, ranking as the biggest clean energy market globally. Furthermore, it declared that it would stop considering projects like coal, which results in high pollution.![]() Another critical challenge is the lack of a stable and reliable grid. The problem is most glaring in archipelago territories and countries in Central Asia. A 2020 report by the European Commission concluded that an aging power grid has a severe effect on the quality of power supply. As a result, investments in strengthening and modernizing the power grid would likely be prioritized.

Another critical challenge is the lack of a stable and reliable grid. The problem is most glaring in archipelago territories and countries in Central Asia. A 2020 report by the European Commission concluded that an aging power grid has a severe effect on the quality of power supply. As a result, investments in strengthening and modernizing the power grid would likely be prioritized.

A significant project targeting the optimized use of the physical infrastructure is the ASEAN Power Grid. The initiative aims to connect the region through an integrated Southeast Asia power grid system.

Another hurdle is the urgency surrounding the need for new investments. In 2017, the ASEAN countries were estimated to need a 400% increase in green investments per year to protect their population and economies from climate change.

According to the International Renewable Energy Agency (IRENA) director, today, the world needs to spend USD 131 trillion on the energy transition by 2050 to leap through the fast-closing window of achieving the 1.5°C Paris Agreement goal. Such an investment would grow the clean energy capacity we have today by ten times, hitting 27,700 GW by 2050.

Asia as the Global Renewable Energy Powerhouse

In its “Asia’s Net Zero Energy Investment Potential” report, the Asia Investor Group on Climate Change (AIGCC) references several different studies and assessment models on the continent’s investment opportunities. The conclusions are that to achieve net-zero, Asia would need between USD 26 trillion (2°C scenario) and USD 37 trillion (1.5°C scenario) from 2020 to 2050. This equates to 1.7% to 2.0% of the continent’s GDP. The report’s authors describe the scale of this opportunity as “the defining investment trend of this century.”

According to David Giordano, BlackRock’s global head of renewable power, the Southeast region will lead Asia’s renewable energy expansion. It is expected to lead investment activity over the decade, thanks to its rising population, economic growth, and currently small installed capacity.

In addition, aside from the economic and demographic factors, the renewable energy transition will also be backed on a political level. ASEAN governments united around the idea that an increase in renewable energy capacity can help revive their pandemic-hit economies. They have laid a joint five-year sustainability plan, targeting a 23% share of renewables in the total primary energy supply in the region. By 2050, ASEAN countries aim to have 35 – 40 GW installed clean energy capacity.

There is no doubt that Asia will become the fastest-growing renewable energy region in the near future. The question that remains is at what point will investors start flooding in. As the investment theory has taught us, the sooner, the better.

![]()

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more