How Investing in Renewable Energy Fuels Profit and Sustainability

Source: Arevon

06 February 2025 – by Eric Koons

Investing in renewable energy is not just an environmental choice. It’s rapidly becoming a lucrative way to grow your portfolio in today’s shifting global marketplace. With worldwide energy consumption projected to rise at least 55% by 2050, there’s a pressing need to transition from fossil fuels to cleaner, sustainable power sources.

Compelling financial incentives support this urgency as numerous countries introduce policies and subsidies that make renewable energy more accessible and profitable. In short, going green is no longer just an ethical stance or good for global warming only; it’s a smart energy investment strategy that could yield significant returns in the years to come.

Is Renewable Energy a Good Investment?

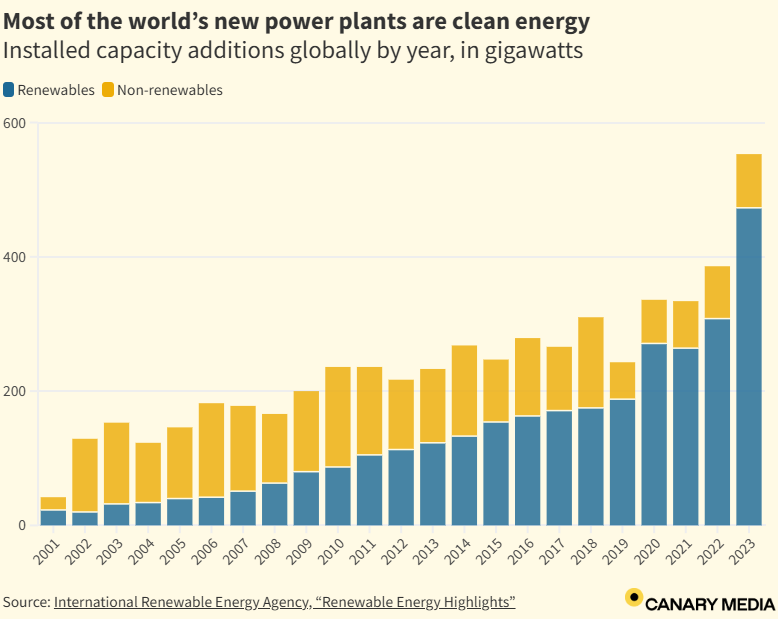

Investing in renewable energy offers a blend of strong growth potential, technological innovation and steady demand. In 2023, renewables accounted for 85% of new electricity capacity worldwide, indicating a surge in adoption and a concerted global push toward renewable energy sources. Below are several key reasons why this sector is attracting investors at record pace.

Government Policies and Incentives on Production and Adoption of Renewable Energy Sources

Strong government backing is a major factor in renewable energy’s profitability. Many countries offer tax credits, subsidies or feed-in tariffs to accelerate the adoption of solar power, wind and other clean power technologies.

For example, in the United States, the solar investment tax credit (ITC) allows investors to deduct a percentage of the cost of installing a solar energy system from their federal taxes. Meanwhile, the European Union’s Fit for 55 plan aims to cut net greenhouse gas emissions by at least 55% by 2030, introducing various incentives to boost clean energy projects and clean energy investment.

Such policies help lower investors’ risks and ensure a more predictable financial environment, often guaranteeing a buyer the power produced through long-term agreements.

Rising Global Demand – According to International Energy Agency

Global demand for green energy solutions is on the rise. According to the International Energy Agency (IEA), renewable electricity capacity is set to expand by over 60% between 2020 and 2026, propelled by growing consumer and corporate interest in environmental responsibility. Major companies like Amazon, Google and Apple are committing to 100% renewable power for their operations, signalling a shift that’s reaching across industries.

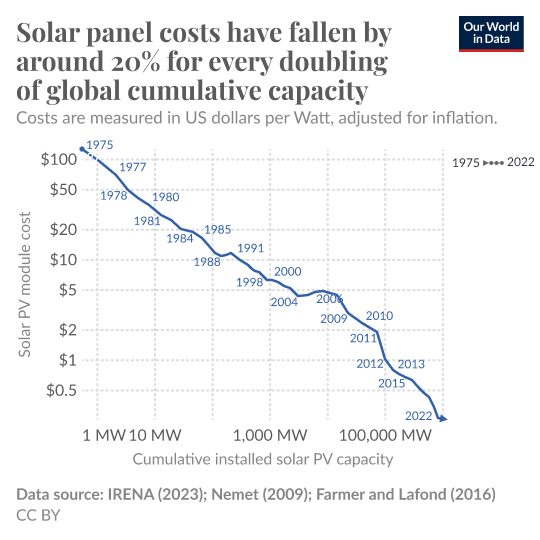

Additionally, rooftop solar installations by individual consumers are at an all-time high, particularly as solar module costs have dropped more than 90% over the last decade.

On the utility scale side, onshore wind costs have fallen by 70%, and battery storage costs have fallen by 90% over the same period. This trend points to a market where clean energy is not just preferred — it’s becoming the norm.

Long-term ROI and Stability: Renewable Energy vs. Fossil Fuels

Despite potentially higher upfront costs, renewable energy projects can offer stable, long-term returns. Power Purchase Agreements (PPAs), common in large wind and solar developments, can lock in energy prices for 10 to 20 years. For investors, this means predictable income streams and insulation against market volatility often seen in the fossil fuel sector.

In fact, a review of global renewable energy projects found wind and solar farms produce cheaper power over their lifetimes than coal and gas plants. Over time, lower operating expenses, minimal fuel costs and reliable revenue from PPAs can translate into attractive returns on investment.

Areas of Renewable Energy to Invest In

Whether you’re a seasoned investor or just starting out, renewable energy has multiple segments. Each offers unique opportunities—and risks—that suit different investment styles and goals.

Energy Generation

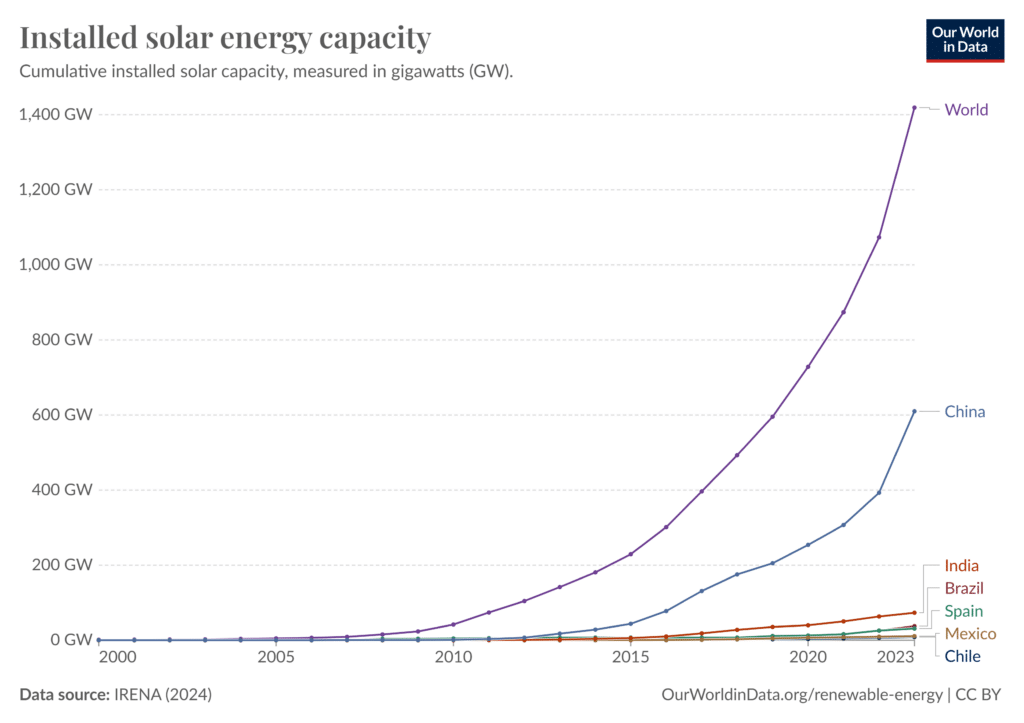

Energy generation is the most visible segment of renewables, comprising sources like solar, wind, hydro, geothermal and biomass. Solar and wind dominate this space, with solar capacity topping 1,400 GW and wind capacity reaching over 1,000 GW globally in 2023.

Investors can buy shares in publicly traded companies that operate solar or wind farms or consider backing manufacturers of solar panels and wind turbines. For instance, global solar panel manufacturers like Tongwei Solar often see significant growth as demand rises.

Infrastructure

Behind the scenes, robust infrastructure is essential for transporting and storing renewable energy. This includes transmission lines, battery systems and emerging technologies like pumped hydro storage. According to Wood Mackenzie, global energy storage is expected to grow at a 31% annual rate through 2030. Investing in companies that develop and maintain these systems allows you to tap into a critical facet of renewables’ expansion.

Controls and Management Systems

Advanced controls and management systems, including AI-driven grid balancing, Internet of Things (IoT) sensors and energy management software, are essential for maximising efficiency in renewable energy networks. These technologies help predict energy consumption, optimise supply and mitigate downtime.

Startups like AutoGrid and established players like Siemens are developing smart-grid solutions that promise to streamline renewables distribution. Investing in these companies can position you at the cutting edge of an industry where efficiency gains are crucial for profitability.

Risks and Considerations

While investing in renewable energy can be highly rewarding, it’s vital to understand the potential pitfalls and strategise accordingly.

Market and Technological Volatility

Renewable technology evolves at breakneck speed. What’s cutting edge today could be outdated tomorrow. Innovations like floating solar arrays or deep sea offshore wind platforms can shift the market landscape rapidly. Staying informed through industry news will help you navigate these changes and diversify your holdings to hedge against sudden shifts.

Regulatory and Political Factors

Government policies — which are so helpful in spurring the industry — can also change. Shifts in political leadership or economic constraints can reduce incentives or introduce new regulations, impacting profitability. Monitoring legislative agendas and international climate agreements can help investors anticipate policy-driven market changes and adjust strategies accordingly.

Diversification and Portfolio Balance

As with any sector, putting all your capital into one area is risky. A balanced portfolio might include a mix of solar stocks and emerging tech solutions, complemented by investments outside the renewable sphere. This approach spreads risk while still positioning you to benefit from renewables’ projected growth.

Seizing the Green Opportunity: A Final Word on Investing in Clean Energy

Investing in renewable energy is an opportunity to participate in one of the fastest-growing sectors worldwide. From robust government incentives to surging global demand, the renewables landscape is rich with potential. While there are risks associated with the sector, the long-term prospects point to stable returns. This is particularly true as clean energy becomes the new standard for corporations and households alike.

By researching market trends and staying abreast of policy developments, you can align your portfolio with a future powered by sustainable energy and reap substantial financial and environmental rewards.

by Eric Koons

Eric is a passionate environmental advocate that believes renewable energy is a key piece in meeting the world’s growing energy demands. He received an environmental science degree from the University of California and has worked to promote environmentally and socially sustainable practices since. Eric’s expertise extends across the environmental field, yet he maintains a strong focus on renewable energy. His work has been featured by leading environmental organizations, such as World Resources Institute and Hitachi ABB Power Grids.

Read more