The Climate Leadership of the G7 Now Hangs on Japan

10 June 2024 – by Viktor Tachev

Japan’s Role in G7

It is reasonable to expect that as the host of the first global emissions reduction treaty and the country behind technologies like the first hybrid car, the first lithium-ion battery and some of the first mass-produced solar power panels, Japan would be the climate leader, steering the G7 and the world towards a more sustainable future.

However, the country’s energy policy has taken it in another direction – one where it is more of an obstacle for the energy transition of the G7 and Asia. Fortunately, Japan has the means to get back on track with global efforts to shift towards a cleaner, more resilient and more secure energy system. The ongoing revision of the national energy plan offers the prime opportunity for this. Investors, the private sector and society expect the Japanese government to make the most of this.

Japan’s Domestic Renewable Energy Stage in 2024

Japan’s heavy dependence on fossil fuels and its reluctance to embrace clean energy has attracted strong criticism from market analysts, fellow G7 members and the public. However, the country has been actively working to change the perception of being a climate laggard, significantly accelerating the clean power deployment recently.

Today, non-fossil fuel power accounts for between 28% and 31.6% of Japan’s electricity generation. Alternative sources like nuclear, hydropower and bioenergy account for the majority of it.

Solar also holds a significant share, some 11%, with Japan having twice the average global share. However, wind power remains significantly underdeveloped, at just 1%. As a result, the collective share of solar and wind power remains lower than the global average.

A major reason for this is the market structure, characteristics and existing regulations, which make it difficult for renewables to outperform fossil fuels in terms of pricing. For comparison, other developed nations achieved this a decade ago. Furthermore, analysts note that obtaining clean energy project permission in the country remains a daunting process.

Recently, Amazon, the world’s biggest corporate buyer of clean electricity, said that Japan wasn’t moving quickly enough to deliver green power to the private sector. The company described the situation as “a policy and market problem”. These frustrations follow the organised efforts of a group of more than 400 global companies that have been calling on Japan to increase its clean energy investments since 2021.

This is also evident from a Bloomberg analysis, which found that Japan’s main utilities barely produce wind and solar.

Regulatory Changes Are Critical

Policy measures can address existing clean energy market challenges, resulting in massive gains. Studies have shown that Japan’s vast hydroelectric potential and windy offshore waters alone can ensure a 100% renewable grid at lower prices than current electricity tariffs.

A legislative amendment now promises to accelerate floating offshore wind development around Japan, helping to accelerate its clean energy transition.

The government also recently began discussing revising the Basic Energy Plan. It remains to be seen if Japan will introduce more ambitious measures to wean itself off fossil fuels and bring emissions down in line with a net-zero scenario by 2050. The first signs are that the government plans for more ambitious emission cuts: 66% by 2035, compared to the current target of 46% by 2030. It also looks increasingly likely that nuclear will become a crucial part of Japan’s energy mix. This year, Japan plans to restart the world’s biggest nuclear power plant. Furthermore, Japan’s leading electricity utilities believe that it will need new nuclear power plants to meet the country’s 2050 net-zero goal.

The revised plan will be concluded by the end of 2024. The final strategy will be mapped out by March 2025.

Japan: Odd One Out at G7 Table

Oil Change International finds that, despite the commitment to end domestic fossil fuel expansion, G7 nations still account for 27% of current global oil, gas, and coal production. Furthermore, the US, UK, and Canada could be responsible for 48% of the CO2 pollution from new oil and gas extraction projects planned between 2023 and 2050. In addition, the group also goes against its promise to stop international fossil fuel project financing. According to Oil Change International, between 2020 and 2022, the G7 provided USD 25.7 billion annually in international public finance for fossil fuels, compared to USD 10.3 billion for clean energy (just 1% of the green financing went to low-income countries). Between the end of 2022 and May 2024, the G7 followed with at least USD 8.5 billion in public support for fossil fuel projects abroad, with Japan and the United States providing the majority of this financing.

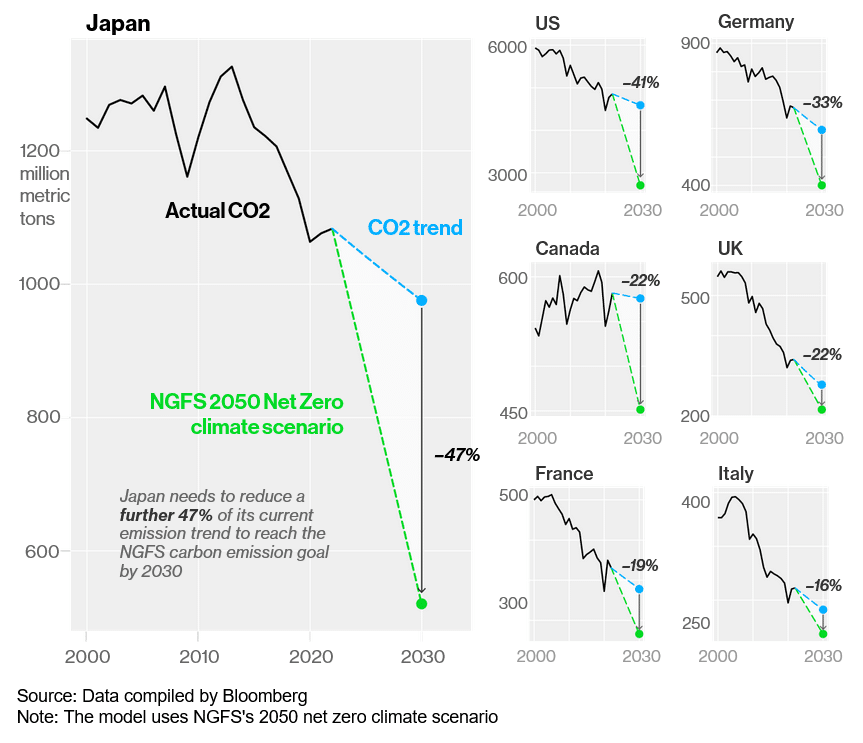

According to Climate Analytics, the G7 is currently on track for between 19% and 33% in emissions reductions by 2030. This is way below its 42% reduction target. To be able to limit warming to 1.5°C, the analysts call for G7 members to aim for a 58% emissions reduction by 2030.

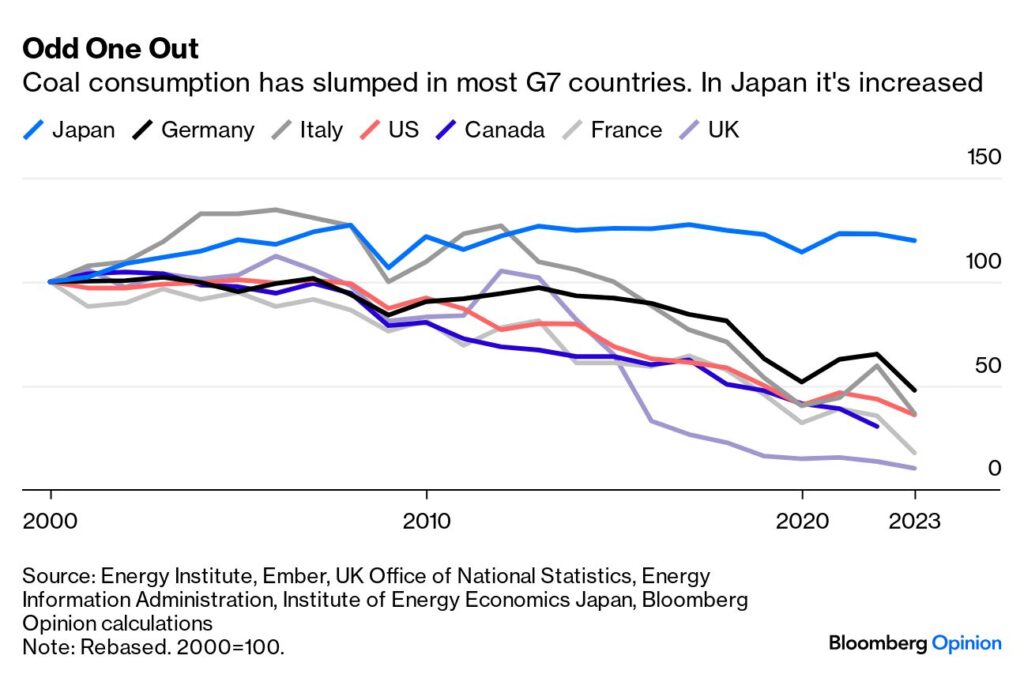

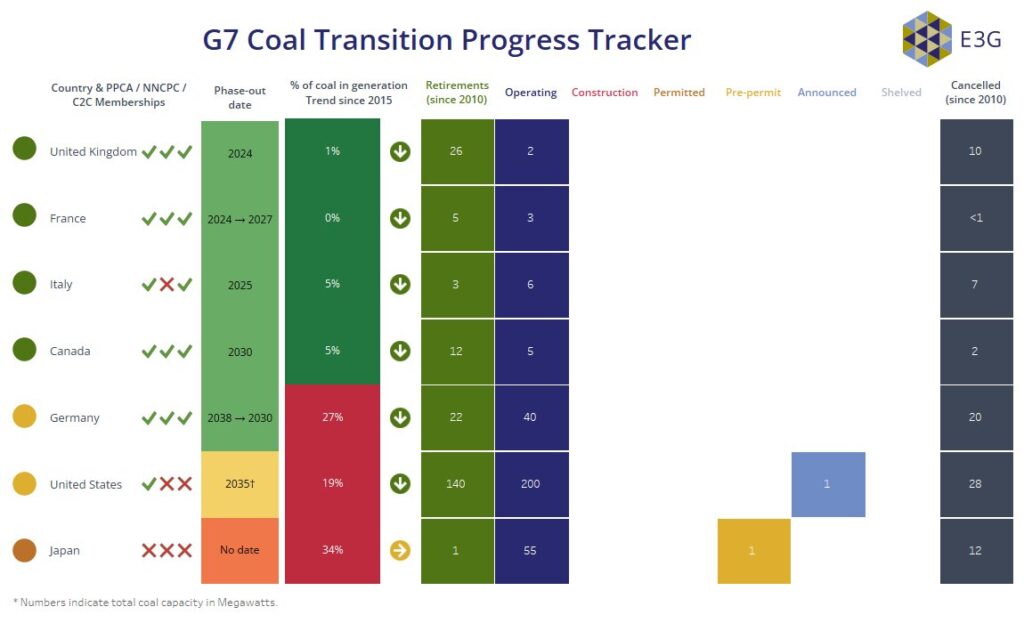

While this shows that the G7 is by no means perfect, there are clear outliers in the group. According to Ember, while most G7 members are steadily progressing to phase out coal power, Japan is dragging its feet. Coal still accounts for 32% of the country’s electricity production. Since 2015, the decline has been just 7%, compared to an average of 66% for the rest of the G7. Recently, it has even demonstrated signs of increased coal use. Japan also remains the only G7 country without a domestic coal phase-out commitment.

On the contrary, the rest of the G7 has been reducing its consumption. The UK leads the way, with a 93% coal reduction between 2015 and 2022. France is next with 63%. Furthermore, both countries plan to close their last coal-fired power plants this year.

Coal comprises just 6% of Italy and Canada’s energy mixes. Italy plans to end its use in 2025, while Canada will follow suit by 2030. Germany’s target for ending coal use is 2038. However, the country hopes to do so by the early 2030s.

In the US, the Environmental Protection Agency now requires coal plants to capture nearly all of their climate pollution or shut down before 2040. Furthermore, coal consumption in the country is now progressively decreasing.

During the G7 ministerial meetings on climate, energy, and environment, the world’s leading economies agreed to end unabated coal power use by the early 2030s. However, the agreement left the door open for countries to lean on their circumstances, like those “heavily reliant on coal”, to stretch the deadline. Instead, the timeline remains consistent with maintaining the course of a 1.5°C rise. Analysts believe this caveat is a move to favour Germany and Japan, the most coal-dependent G7 economies, which also have the weakest coal phase-out policies.

These observations are also backed by the fact that Japan’s Ministry of Economy, Trade and Industry (METI) considers the term “unabated” as subject to interpretation by each country. METI, for example, considers highly efficient coal and ammonia co-firing as an abated technology, while market experts describe it as a highly polluting and “false” solution to “legitimise coal in the eyes of financiers and lenders”.

In fact, the rest of the G7 has previously criticised Japan’s fixation on fossil fuels and its “clean coal” plans. Furthermore, they have challenged the country’s GX strategy, reportedly blaming it for prolonging the use of fossil fuels. Some officials are said to have even referred to Japan as an “obstacle” in the group’s energy transition agenda.

Japan Remains Entrenched in Fossil Fuels

If all countries followed Japan’s climate and energy approach, global warming would reach between 2°C and 3°C. According to conservative estimates, the country’s current energy plan will ensure that coal still accounts for at least 19% of energy generation in 2030. This would make its emissions equal to those of the whole of West Africa. However, according to some analysts, fossil fuels could account for as much as 60% of Japan’s power generation by 2030.

The scenario seems likely, considering the country remains the only G7 nation without a concrete coal phase-out timeline. In fact, not only is Japan not moving forward with a coal plant phase-out, but it continues to open new plants. It also remains a leading proponent of LNG and a range of questionable fossil fuel-based technologies with substantial domestic and regional expansion plans.

Furthermore, Japanese banks are found to be pouring billions into financing fossil fuel projects. Since the Paris Agreement, MUFG, Mizuho and SMBC have collectively provided nearly USD 800 billion.

According to the 2024 Banking on Climate Change report, the trend continues. In 2023, Mizuho was the second largest fossil fuel financier globally, while MUFG and SMBC ranked fourth and eighth, respectively. Mizuho and MUFG also ranked first and second in terms of providing funding to companies in the LNG sector.

Furthermore, according to the Breakthrough Institute, Japan’s ammonia and hydrogen co-firing plans may produce more emissions than simply burning coal or gas. Other research groups also reach similar conclusions. TransitionZero finds that Japan’s goal of 20% ammonia co-firing at domestic coal power plants by 2030 will still generate nearly double the emissions of standard gas-fired power plants. In Southeast Asian countries, the figures are even higher. BloombergNEF warns that even green ammonia-based scenarios can’t align with a net-zero power sector.

Yet, despite all the warnings, Japan continues to refer to ammonia and hydrogen as “clean sources,” including in a recent call between Prime Minister Kishida and Saudi Arabian Crown Prince Mohammed bin Salman.

Weak Clean Electricity Targets

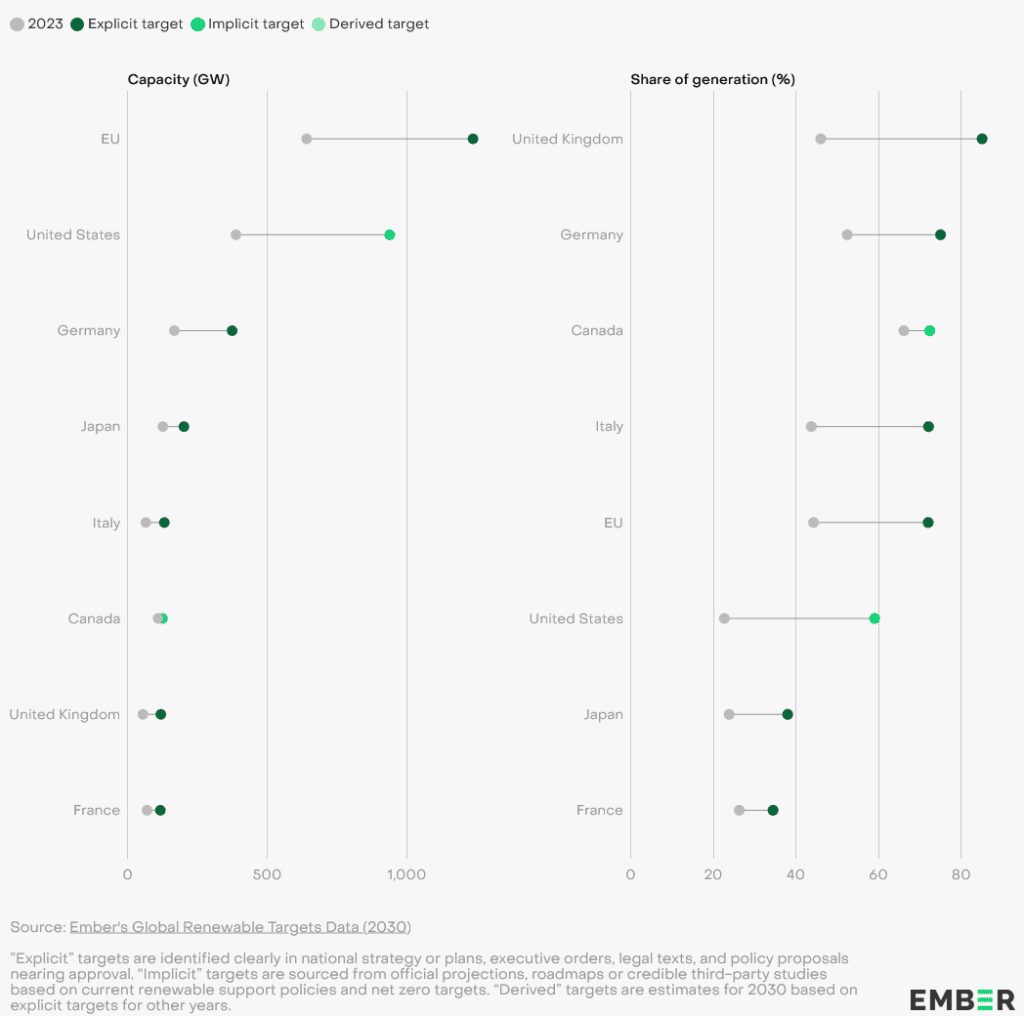

According to the IEA’s Net Zero Emissions scenario, countries should target a 60% share of renewables in their electricity mix by 2030. Although research groups like the Renewable Energy Institute reveal that an 80% clean energy share in Japan’s total energy mix by 2035 is viable, the country targets just 38% by 2030.

For comparison, the UK aims for 85% renewable electricity by 2030, while Germany’s target is 75%. The targets of Italy and Canada are also more ambitious, with both targeting 72%. The US plans to have renewables account for around 59% of its electricity mix by the decade’s end. The only G7 country with a weaker target than Japan is France: 34% by 2030.

The wind sector, for example, is a crucial niche that illustrates Japan’s subpar progress. Currently, its electricity generation share is just 1%. By 2030, only 4% of the G7’s proposed offshore wind deployment would be in Japan, capturing just 1% of the country’s 392 GW theoretical offshore wind power potential. For comparison, wind is the UK’s largest source of clean electricity, with 28% in 2023, up from 8% in 2013. The situation is similar in Germany, where wind, at 27.2%, recently overtook the share of coal in the total energy mix.

Setting more ambitious clean energy targets is crucial for Japan. According to a Berkeley Lab report, if Japan targets an 18% share of offshore wind by 2035, it will be on track for a 90% decarbonised power sector. However, its current wind target is 5%.

The US’ top climate envoy recently urged Japan to accelerate its renewable energy roll-out and prioritise offshore wind.

Furthermore, according to the Renewable Energy Institute, an 80% clean energy share by 2035 will generate 4 trillion yen (USD 25.5 billion) in annual fossil fuel power generation cost savings.

Fortunately, there have been signs recently that the government and the industry have recognised the gap and are working to close it. The country targets projects totalling 10 GW by 2030 and up to 45 GW by 2040, although BloombergNEF estimates that Japan is on track for just 4.4 GW by 2030.

A group of 14 Japanese energy firms, including Mitsubishi’s wind power unit, JERA and Tokyo Gas, to name a few, have teamed up to boost the development of floating offshore wind farms and jointly create new technology.

The G7’s Climate Leadership Hangs on Japan

The G7 should lead global climate policy. Its decisions can influence the outcome of the G20 and COP meetings and the fragile global climate progress and energy agenda in a year when the leading polluters are having elections. However, all members should look in the same direction for this to happen.

Japan’s continuous efforts to block the energy transition, as demonstrated during past G7 meetings, are damaging its image in the eyes of other nations in the group. Furthermore, they highlight the G7’s indecisiveness in times when activists and affected communities from climate-vulnerable nations are calling for help in dealing with a problem they didn’t create in the first place.

Japan remains increasingly isolated among the wealthy democracies also in the sense that it continues to go against the G7 promise to end new direct international government support for fossil fuels, as first introduced in 2022 and reaffirmed at the G7 Meeting in Japan in 2023. This has prompted protests across Japan and also abroad, including in the Philippines, Indonesia, Thailand, Bangladesh, the United States, Mozambique, Canada and Australia.

Japan can change course by demonstrating stronger political will. The first step is ensuring that the revision of the Basic Energy Plan acknowledges the existing problems in the domestic energy market and introduces measures to ease the accelerated clean energy adoption through actionable and timely coal phaseout strategies and reduced reliance on LNG and polluting and inefficient fossil fuel-based technologies.

The upcoming NDC submission at the start of next year offers Japan the perfect opportunity to present a fossil-free roadmap and ambitious emissions reduction targets to the world. The G7, the private sector and climate-vulnerable communities across Asia will be waiting.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more