Malaysia Nears Its 40% Renewable Energy Target by 2035

05 August 2024 – by Viktor Tachev

While still in its clean energy transition’s early stages, Malaysia is progressing towards its 40% renewable energy target by 2035. To make the most out of its decarbonisation journey, the country should capitalise on its untapped potential, expanding its clean energy mix beyond solar, biopower and hydropower. Whether and how fast Malaysia manages to do that depends on its scaling-up of clean energy investments and reduction in dependence on fossil fuels. Effective policy support will be crucial for both.

GlobalData: Malaysia is Getting Closer to Achieving Its Renewable Energy Target

In 2021, Malaysia’s Ministry of Energy and Natural Resources announced a goal of 31% renewable capacity by 2025. By 2035, it should increase to 40%. Upon releasing the National Energy Policy, the government pledged to build up 18.4 GW of renewable capacity by 2040.

GlobalData’s latest report reveals that Malaysia is advancing toward its goal, and there is a real chance that renewables will account for 40% of the country’s energy capacity by 2035.

Today, renewables make up 13.3% of the total. The current trajectory reveals that Malaysia is on course to achieve 18.2% renewable energy capacity by 2025. By 2035, its share should rise to 36.4%.

National Energy Transition Roadmap and Untapped Potential

While Malaysia steadily advances towards its targets according to Malaysia renewable energy roadmap (MyRER), its clean energy mix comprises only three renewable sources. These include solar, biopower and hydropower.

According to data by IRENA, Malaysia has 9 GW in installed clean energy capacity, up from 7.5 GW in 2018. Solar accounts for 1.9 GW – the third-biggest in ASEAN after Vietnam and Thailand. The share of bioenergy sits at 0.9 GW. With 6.2 GW, hydropower accounts for the biggest share in Malaysia’s clean energy mix at 69.9%.

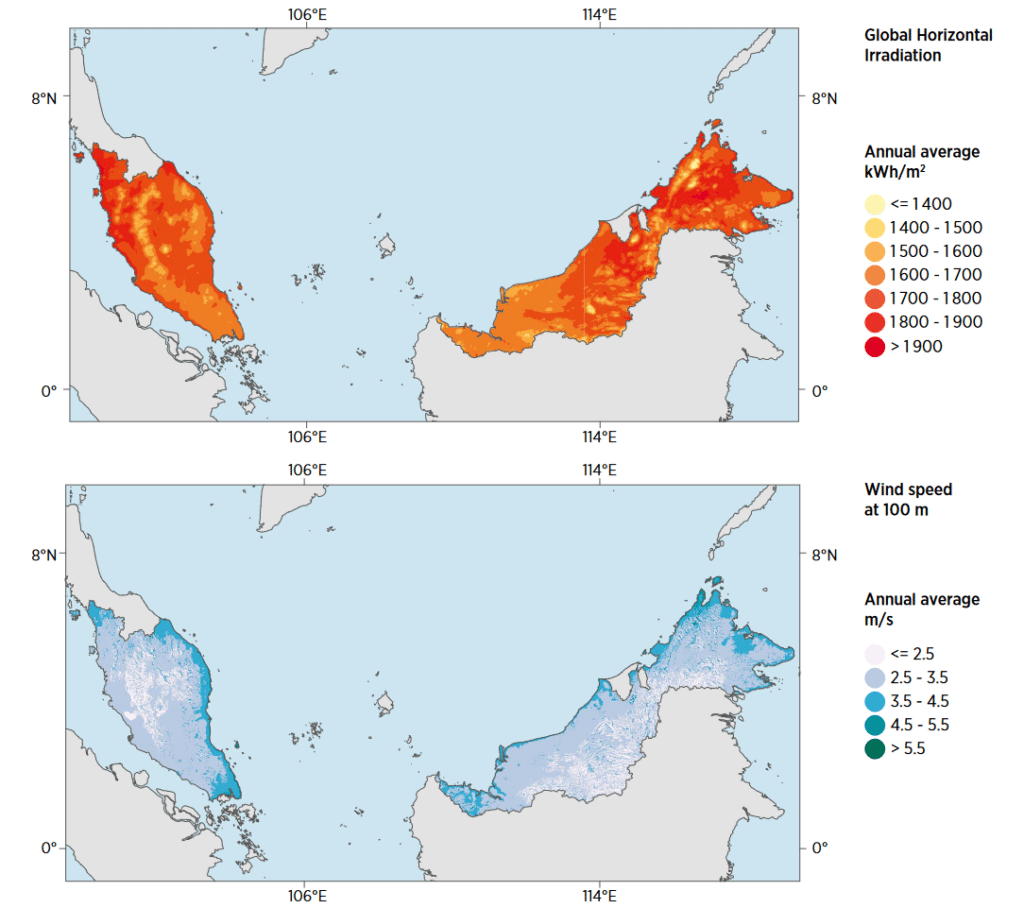

The country has significant untapped renewable energy potential. Due to its location near the equator, the country sees at least 12 hours of sunlight and high solar irradiation at a direct 90° angle during most of the year. This enables the production of more solar energy per square metre. According to IRENA, Malaysia has the potential to install 153 GW of solar power by 2050. In addition, it can add 782 GWh of storage.

However, there are arguments that Malaysia’s conditions are unfavourable to wind power development. The reason is the low wind speeds of around 2 m/s. Although they can get up to 11 m/s in high-altitude regions, the countrywide average annual wind speed is less than the recommended for small wind (4 m/s) and utility-scale turbines (5.8 m/s) to become viable. In total, studies estimate the maximum wind power potential in the country at between 500 MW and 2 GW.

So far, Malaysia’s efforts to expand its clean power mix beyond solar, biomass and hydropower have fallen short. GlobalData’s analysis notes that while the country made efforts to explore geothermal power in 2015 with a 30 MW project, the plans were scrapped. The government also hasn’t prioritised onshore wind due to unfavourable wind speeds during the off seasons. For example, on the country’s east coast, which has the strongest winds, wind speed declines by 50% between seasons. This variability makes it difficult to depend on wind energy. It also explains why Malaysia has just one small 0.2 MW onshore wind plant in operation.

Favourable Renewable Energy Policies Crucial For Aligning with 1.5°C

Malaysia’s clean energy market is still in its infancy and remains underdeveloped. As a result, it would need massive investments to get up and running.

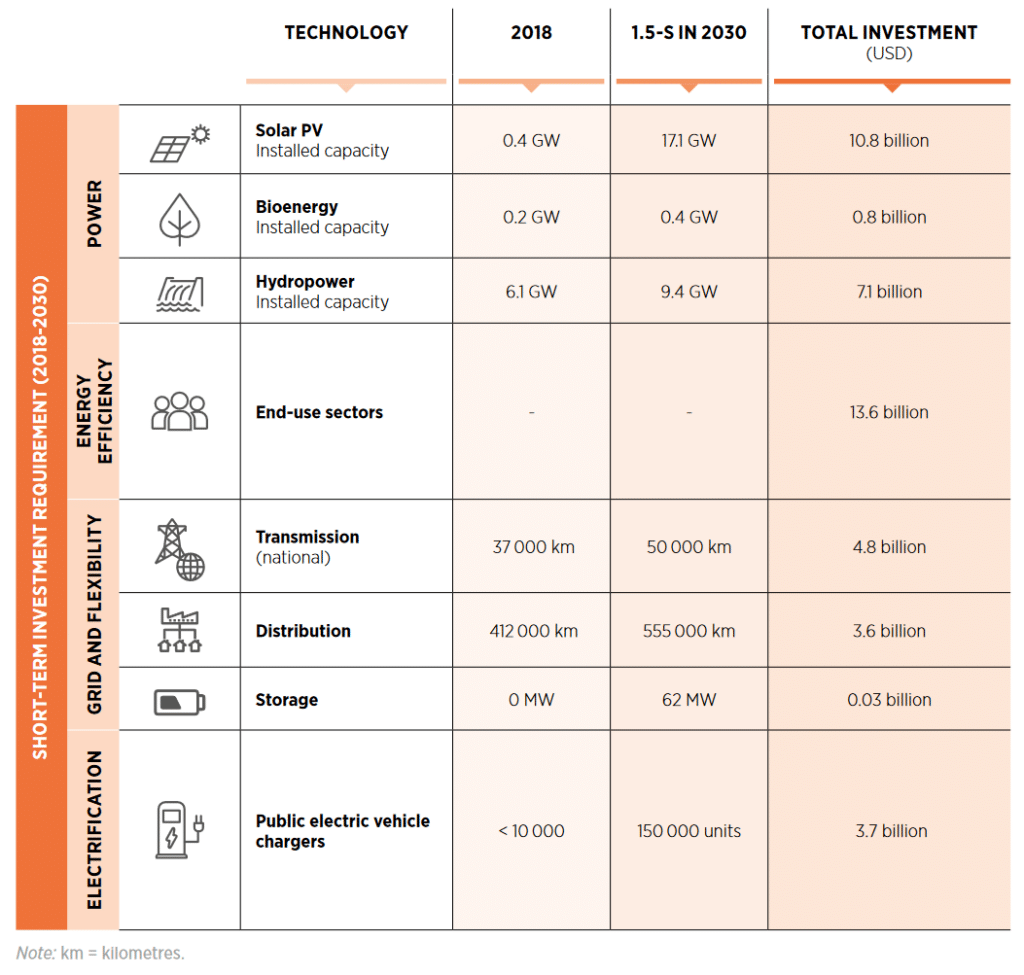

IRENA warns that Malaysia would need more ambitious targets to align with a 1.5°C-compatible scenario. By 2030, solar PV alone would have to scale up to 17.1 GW in capacity. This would require around USD 10.8 billion in investments. In total, aligning with a 1.5°C scenario would require energy transition investments to top USD 415 billion by 2050.

Raising the needed investments would require enhancing the policy support for clean energy and overcoming existing barriers, including project bankability.

Malaysia has launched three key policies to accelerate renewable power deployment: the Renewable Energy Act, the National Renewable Energy Policy and Action Plan and the Sustainable Energy Development Authority Act. Other efforts that the Malaysian government has undertaken include extending the Green Investment Tax Allowance and Green Income Tax Exemption until 2023. For solar leasing companies, the latter measure was extended to December 2026.

“In addition, the government has feed-in tariffs for up to 1 MW capacity and net metering policies in place to encourage the adoption of renewables,” notes Sudeshna Sarmah, power analyst at GlobalData.

According to Sarmah, encouraging foreign investments towards setting up large-scale renewable projects is among the measures that can further push the country towards achieving its renewable energy goals.

IRENA notes that the Malaysian government can also work to shorten project approval times and improve the financing landscape through new and existing mechanisms like power purchasing agreements and tariff rates to ease and stimulate clean energy project developers. Accelerating grid infrastructure capacity buildup and ensuring its stability and flexibility are also crucial measures for adopting renewables at scale and connecting with neighbouring countries.

Phasing Out Fossil Fuels Integral to Malaysia’s Energy Transition

While scaling up financing might be a major barrier to Malaysia’s energy transition, it isn’t the only one, as the country’s economy remains heavily dependent on fossil fuels. It is Southeast Asia’s second-largest oil and natural gas producer and the fifth-leading LNG exporter globally.

However, according to estimates, the country’s petroleum reserves will last only for another 15 years. While production has become challenging, the country continues to maintain robust natural gas activity with recent investment and planned exploration efforts, according to an analysis by Rystad Energy.

Furthermore, the Central Bank of Malaysia estimates that the country spends around 12% of its GDP on fossil fuel subsidies. This is significantly higher than the global average of 8.1%, and way above most regional peers.

For Malaysia to achieve its long-term energy transition targets and align with a 1.5°C pathway, the accelerated clean energy deployment should be accompanied by ambitious efforts to reduce its fossil fuel dependence.

The government has made some progress, including planning to reduce coal reliance by 50% by 2035 and completely retire its plants by 2045. Building upon those efforts would unlock massive economic benefits.

IRENA estimates up to USD 13 billion in annual savings from avoided cumulative energy, climate and health costs, and a fossil fuel subsidy phase-out. The agency notes that while pursuing a 1.5°C-compatible scenario might initially require substantial investments, when taking into account externalities, such as fuel, operations, maintenance and financing costs, the bottom line would be lower overall, including energy system and external costs.

Looking Ahead

Considering its potential, Malaysia is lagging in its renewable energy transition. However, the government’s targets promise that this process will accelerate in the near future. By 2050, Malaysia aims for renewables to have a 70% share in its electricity mix. Furthermore, the country plans to take advantage of its rich raw resources, establishing itself as a leader in solar power module manufacturing and advancing in other green industries, such as EV battery development. It will also set up an exchange hub for cross-border renewable energy trading.

Considering that Malaysia has solid renewable energy market fundamentals and, according to the IEA, hosts low investment risks for project investors, the country is well-positioned to raise the needed capital for aligning with a 1.5°C scenario. However, policy intervention would be crucial.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more