MHI First Transition Bond Program – All You Need to Know

19 September 2022 – by Viktor Tachev

Mitsubishi Heavy Industries’ (MHI) transition bond programme is the latest example of a Japanese company using a financial scheme to accelerate its net-zero transition and achieve company’s net-zero goals. However, some are concerned about whether the programme will work or not.

The Specifics and Terms of the Mitsubishi Heavy Industries Transition Bond Program

Mitsubishi Heavy Industries announced plans to issue its first transition bonds via a public offering on the domestic market for funding projects related to carbon neutrality. On September 2, the company finalised the terms for the programme. MHI’s goal is to diversify its fund procurement methods and raise funds to allocate toward achieving a carbon neutral world.

Climate Transition Finance Model Projects

The issuance amount is JPY 10 billion (around USD 71 million), and the bonds will have a 5-year maturity period. The official issuance date is September 8, 2022. MHI’s transition bond programme has been selected as a model example of the “2021 Climate Transition Finance Model Projects” by Japan’s Ministry of Economy, Trade and Industry (METI).

Achieving Carbon Neutrality

As per the official announcement, the proceeds are said to help MHI decarbonise existing infrastructure. Furthermore, they will go towards building hydrogen and CO2 solutions ecosystems. According to the official documentation on METI’s website, MHI will be able to use the funds for:

- hydrogen gas turbines, LNG-fueled high-efficiency gas turbines and ammonia gas turbines,

- gas engines for power generation (100% hydrogen firing),

- steam power (conversion to 100% ammonia firing),

- production of hydrogen and ammonia (blue, turquoise, etc.),

- metals machinery (hydrogen-reduced iron-making, etc.),

- CO2 capture/storage technology and

- wind and geothermal power plants.

The Issues with Transition Bonds

Green taxonomies around the different countries in Asia leave the door open for greenwashing. And transition bonds are no exception.

In theory, transition bonds are great tools for attracting capital to fund a firm’s transition towards having more sustainable operations, a lower environmental impact and reduced carbon emissions.

However, due to regulatory loopholes, transition bonds, in reality, remain prone to exploitation. They give dirty companies the cover to continue doing business as usual. For example, transition bonds are often used in heavy-polluting sectors, such as oil and gas, steel, aviation and shipping.

As a result, many investors remain unconvinced of the positive effects that transition bonds can have on global decarbonisation efforts.

The Loopholes in the Japanese Transition Bonds Market

For transition bonds to make a real difference, Japan needs to limit the possibility of greenwashing. Experts consider the country’s green finance regulatory framework adopted to be imperfect. As such, it leaves room for the unclear use of proceeds and vague decarbonisation efforts.

Currently, the transition bonds assessments by METI cover neither the technical viability of the proposed use of the bonds’ proceeds nor the associated financial risks. In the case of MHI’s transition bond programme, the company won’t have to report the GHG emissions of its proceeds. This can potentially leave investors in the dark about their financed emissions.

Additionally, Japan’s finance guidelines make it clear that the market should evaluate how aligned an organisation’s actions are with the green transition. Taking this burden off investors’ shoulders by making the disclosure of proceeds mandatory is a crucial first step toward ensuring more transparency and progress.

Until then, firms can hide behind claims that their transition bond programmes help decarbonisation efforts, while, in reality, firms would be able to use them to fund gas projects.

The Growth of the Japanese Transition Bonds Market

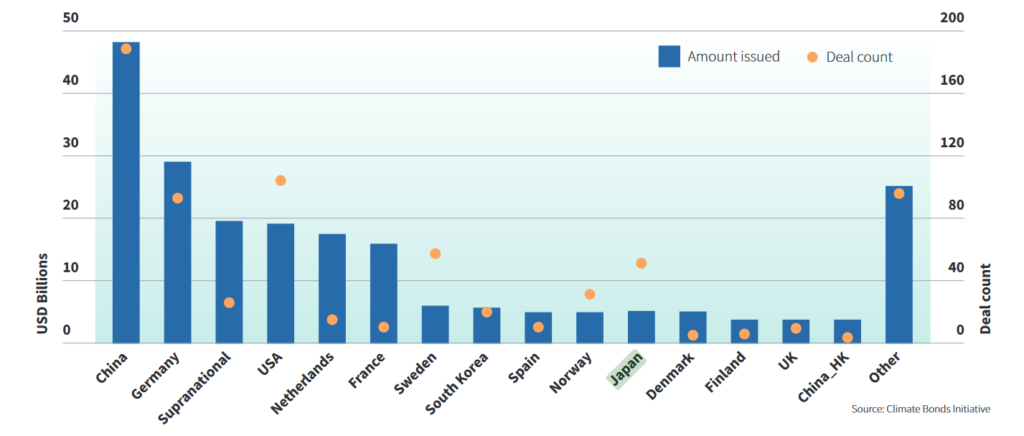

The issuance of transition bonds in Japan is booming. Between January and July 2022, Japanese companies issued over USD 2 billion in green bonds. This is 14 times the total amount issued in 2021. In fact, Japanese businesses were responsible for around 40% of the USD 6 billion in transition bonds issued worldwide from January 2021 to July 2022. The country’s latest plans include issuing USD 157 billion in transition bonds. The country’s annual issuance will likely reach JPY 1 trillion (around USD 7 billion).

The Potential Risks For MHI and Its Investors From Using Proceedings For Gas Infrastructure

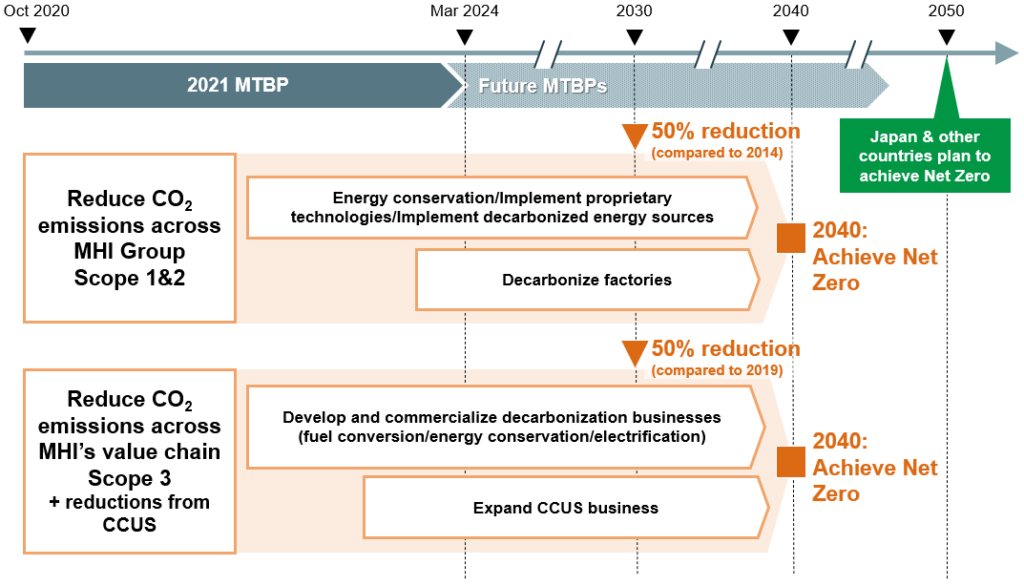

The company has set a target of net-zero by 2040, covering Scope 1, 2 and 3 emissions. However, its website uses “net-zero” and “carbon neutral” as interchangeable terms, making it unclear what the company is actually aiming for. MHI says it is “accelerating the promotion of projects contributing to Carbon Neutrality of Japan and the world”.

However, the transition bond programme will put such statements to the test, considering that the proceeds aim to support mainly gas-powered technology. Such a scenario will again surface the issue of the financial and energy dependency risks of gas-related infrastructure, especially due to the continuously increasing prices and the lack of secure supplies.

Furthermore, Japan’s hydrogen and ammonia plans have already attracted greenwashing accusations, raising concerns about their financial viability and lack of climate reasoning. For reference, Shell’s Quest carbon capture and storage (CCS) facility in Canada, one of the world’s only two blue hydrogen plants, hasn’t turned a profit after almost six years of operation. What’s more, it has received CAD 720 million in government subsidies.

Meanwhile, using the proceedings for questionable technologies will expose MHI to significant reputational risks. It will also lead to a potential loss of trust when it comes to growing a green investor base. Investors want to see their money going towards technologies with real, positive impacts. They don’t aim to finance the status quo, of which gas is a major part.

Furthermore, green investors want to support technologies that will make a difference today rather than conceptual technologies like green hydrogen.

The Two Scenarios For MHI’s Transition Bonds

MHI is making significant efforts to develop green technologies that help the world mitigate its climate impact. The MHI transition bond programme is another way to prove that the company can be a green leader. However, it also opens the door for developing projects that are more of a distraction rather than a solution. Without a sustainable strategy, these projects risk slowing down or even distancing the company from its net-zero target.

It is up to MHI to decide how it will invest the proceeds of its transition bond programme. On the other hand, investors will be watching closely. What’s clear is that they will voice their opposition if they see their money used to support technologies that contradict their investment principles.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more