Potential of Renewable Energy in Japan

A Solar Plant in Shuzenji, Izu, Japan

09 June 2024 – by Viktor Tachev

Japan is among the most technically-advanced and innovative countries in the world. Furthermore, there is a lot of potential of renewable energy in Japan. Yet, it is behind the curve with its energy policy and currently has one of the highest volumes of carbon emissions per capita, ranking 6th on a global scale. Despite this, Japan’s renewable energy potential is vast, and the country is starting to change course. The government’s ambitious policies and goal of achieving a net-zero society and carbon neutrality by 2050 are in motion.

Japan’s Great Renewable Energy Potential

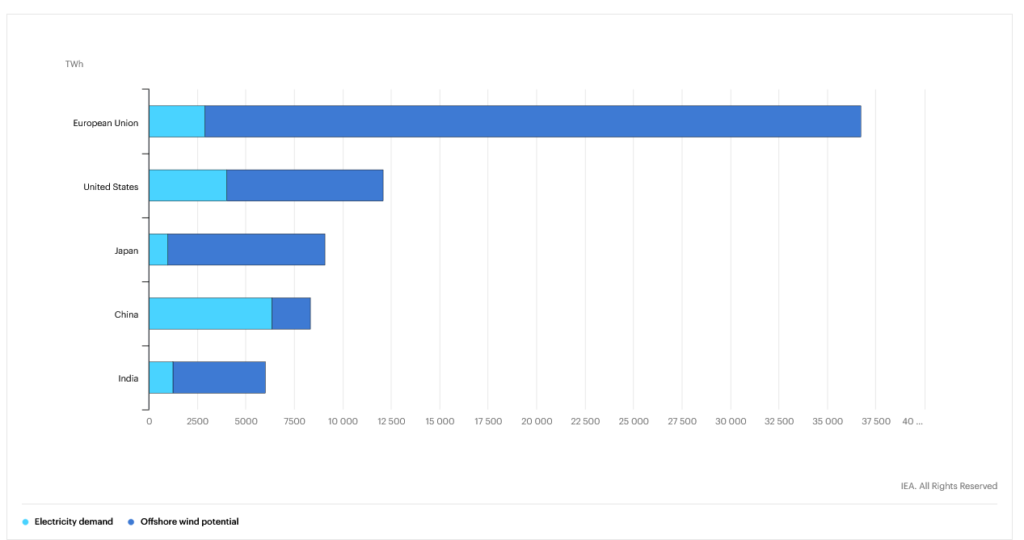

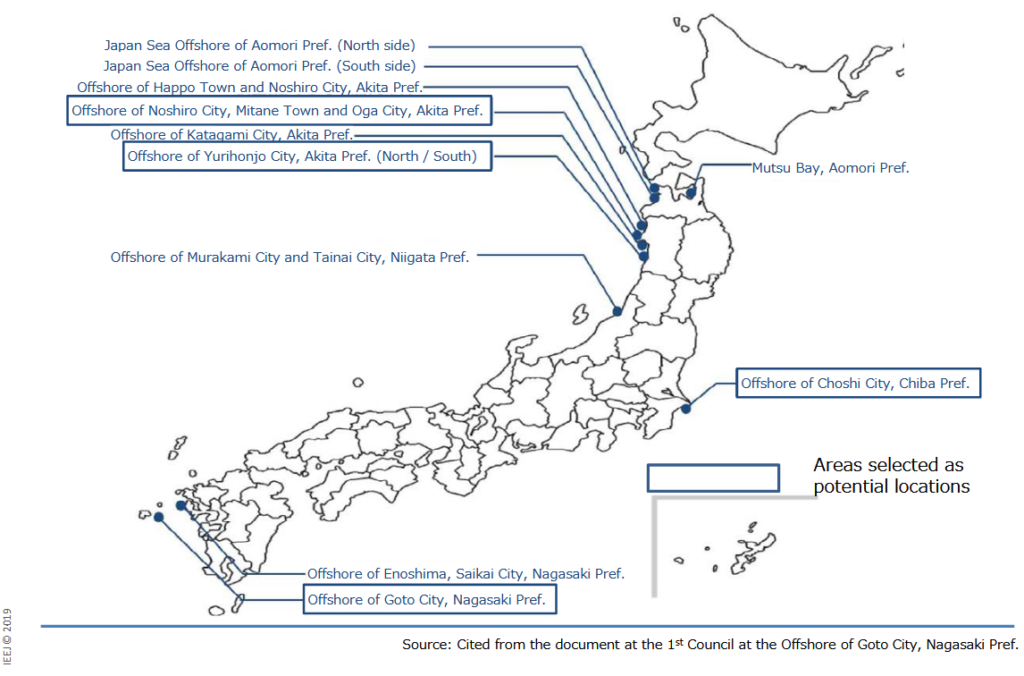

It takes just a single look at Japan’s map to understand the great potential of the archipelago for offshore wind power generation. The Japan Wind Power Association estimates it at around 128 gigawatts (GW) of fixed offshore wind power in shallow ocean up to 50 meters deep and around 424 GW of floating wind power in areas up to 300 meters deep. Other estimations point out to technical potential for wind power of between 296 GW and 938 GW. Yet, wind only accounts for 1.0% of the energy mix.

The government plans to increase this capacity to 10 GW by 2030. By 2040, the figure is set to increase up to 45 GW through offshore wind power.

IRENA sees Japan as having the third-highest potential for geothermal energy in the world at 23 GW. Yet, it currently utilises only around 2%. The case is quite similar when it comes to Japan’s solar energy capacity.

Various studies estimate Japan’s solar power potential at between 350 GW and 2,746 GW. The country currently has 87 GW of solar power capacity installed and ranks third in the world for access to solar power after China and the USA. Furthermore, the government plans to increase it to 108 GW by 2030.

In fact, studies suggest that Japan can transition to 100% renewable energy and ensure complete self-sufficiency at competitive costs.

What Holds Back Renewable Power Generation in Japan?

Japan’s renewable energy potential contains an interesting paradox. Many Japanese investors, including the Japan International Cooperation Agency, Japan Bank for International Cooperation, and Sumitomo Mitsui Banking Corporation of Japan, back renewable energy projects overseas. Meanwhile, investments in the Japan’s green energy projects don’t happen at the pace required for an economy of the size of Japan.

Financial Challenges

Among the main reasons are the higher costs and challenging project development procedures. For years, the price of Japanese solar energy has been high, in some instances almost double that of Germany. Today, the cost of solar PV in Japan still remains significantly higher compared to average international levels. To overcome this issue, the country will have to prioritise improving its FIT system (Feed-In-Tariff).

Fortunately, the government has recognised the problem, and an auction system for non-residential solar power is underway. To address this, officials plan to ensure financial support for R&D relating to battery storage technologies and solar panel development. Additionally, the government intends to make generating electricity from offshore wind power cheaper than thermal energy between 2030 and 2035.

Geographical Obstacles

Currently, onshore wind development projects are considered challenging due to the lengthy approval processes and land-use restrictions. Japan consists of 6,850 islands, while 70% of its territory is a mountainous region. Due to it being an island, Japan’s grid is also isolated from other countries. It is segmented and consists of many smaller grids with weak interconnections. The supply-demand balance should be maintained at each of the small grids, which further complicates the renewable energy transition.

Moreover, the country finds it challenging to capitalise on having the third-biggest potential for geothermal power generation globally because many of the sites are in rural and mountainous regions. The power transmission network in those areas is still not stable enough. Another part of high-potential regions is within national parks, which are subject to nature conservation programmes. These combined factors make the development of geothermal plants costlier and more time-consuming.

In regards to hydropower, its slow growth is attributed to the fact that the most fruitful locations have already been identified. This means little potential remains within areas for the development of new power plants.

Strong Fossil Fuel Lobby

Japan is driving an industry push for mass adoption of ammonia co-firing, hydrogen, and CCS technologies for power generation domestically and across Asia. Experts have branded these solutions as “false,” threatening to derail the transition to renewable energy in Japan and the region, while scientists have warned of their environmental and health consequences.

First, they will extend the life of fossil fuels. Furthermore, they contradict the repeated callings of the IEA, IPCC, and the Academies of the G7 to phase out polluting energy sources as soon as possible.

Next, they will undermine Japan’s energy security and divert policymakers’ attention from the much-needed reforms to ease developers of clean energy projects and renewable energy companies looking to set foot or expand across Japan.

Net Zero Society and Carbon Neutrality Are Feasible Goals

Achieving net zero is an urgent task for Japan. The country is targeting to reduce its emissions by 46% by 2030 and achieve carbon neutrality by 2050. Putting environmental causes aside, renewables would also reduce the country’s massive reliance on foreign sources to fulfil its energy consumption needs, which is over 96%.

To achieve these goals, in October 2020, Hiroshi Kajiyama, Japan’s economy minister, revealed ambitious plans to make renewable energy a major power source within the local energy mix.

As of 2024, renewable energy holds a 12% share in the energy mix of Japan, compared to 69% for fossil fuels. The goal of the government is to increase it to 36% – 38% by the end of this decade. The targeted growth rate isn’t significant since other much less technologically advanced countries in the region, like the Philippines, for example, aim at similar levels, while others are aiming at figures of approximately 25% by 2025. Although a bit conservative, Japan’s goals are a step in the right direction.

To ease the process, the government plans to attract private financing and devote a bigger slice of the public budget to foster renewable energy development in the country. This will focus on improving transparency and make it easier for the electric power industry regarding planning and investment decisions on future projects.

The Bright Renewable Energy Future Ahead for Japan

If the country remains true to its plans, it could create more than 67,000 new jobs related to clean energy by 2050. Corporate environmental activism also matches the government’s efforts. The Japan Climate Leaders’ Partnership promotes low carbon business activities and some of Japan’s largest banks and airlines are heavily advocating for the green energy transition, which is why the initiatives are already making their marks.

Japan aims to ease renewable energy adoption through several ways. These include shifting concerns around energy security, new policies to stimulate investment in renewable energy and mounting private sector activism in climate initiatives. All this makes the country a potentially attractive destination for long-term profit in renewables and across the energy transition spectrum, including clean tech, grid flexibility and storage. While the road towards renewable energy dominance in the country’s mix won’t be smooth, it is indeed feasible and will unlock several clean energy investment opportunities.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more