The Biggest Renewable Energy Market Jump in 2023 and 2024

Photo Rahul Ramachandram / Shutterstock.com

25 June 2023 – by Viktor Tachev Comments (0)

The IEA’s Renewable Energy Market Update from June 2023 concludes that clean power is breaking records worldwide. More and more countries are speeding up the deployment of renewables in an effort to reduce greenhouse gas emissions and move away from fossil fuels. As a result, solar and wind power will see the most significant annual jump in new capacity ever. China and India are among the key driving forces for this global renewable energy market trend.

The IEA’s 2023 Global Renewable Energy Market Update

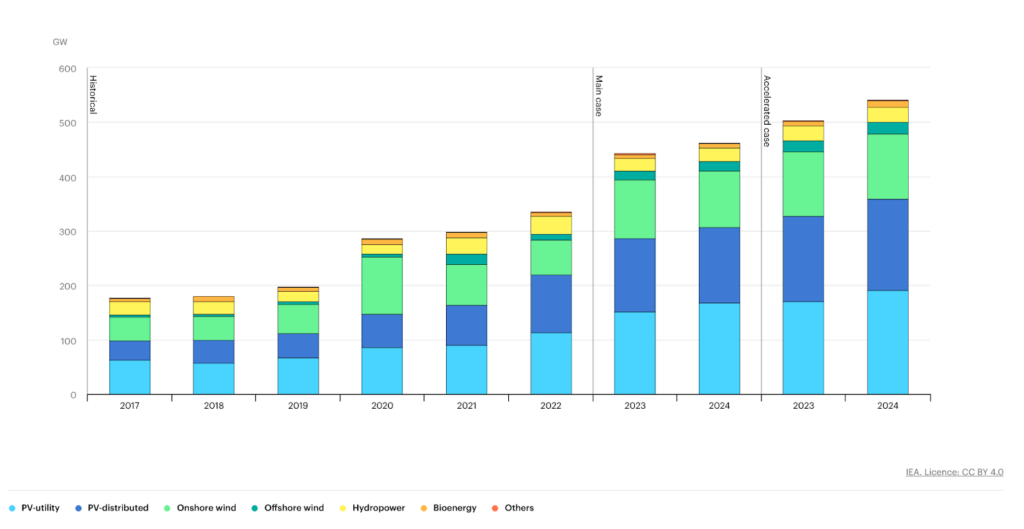

The IEA’s June Renewable Energy Market Update projects that renewable energy capacity additions in 2023 will increase by 107 GW – the largest recorded jump in history – to more than 440 GW. The record-breaking increase will exceed the total power capacity of Germany and Spain combined.

Solar Power

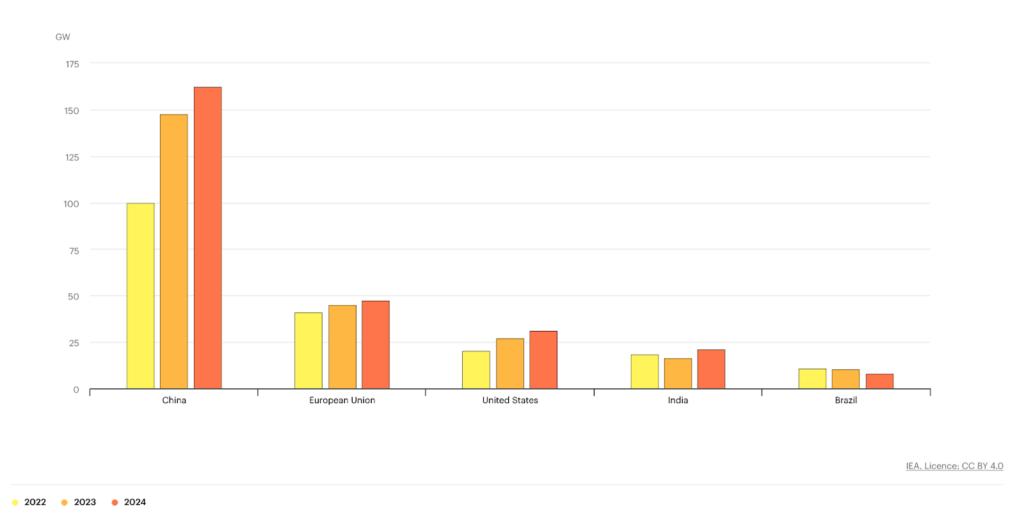

Meanwhile, solar power will remain the leading growth niche, accounting for two-thirds of the clean power capacity increase. Alongside large-scale projects, rooftop solar PV, as a way to reduce household energy bills, will mark notable growth.

Wind Energy

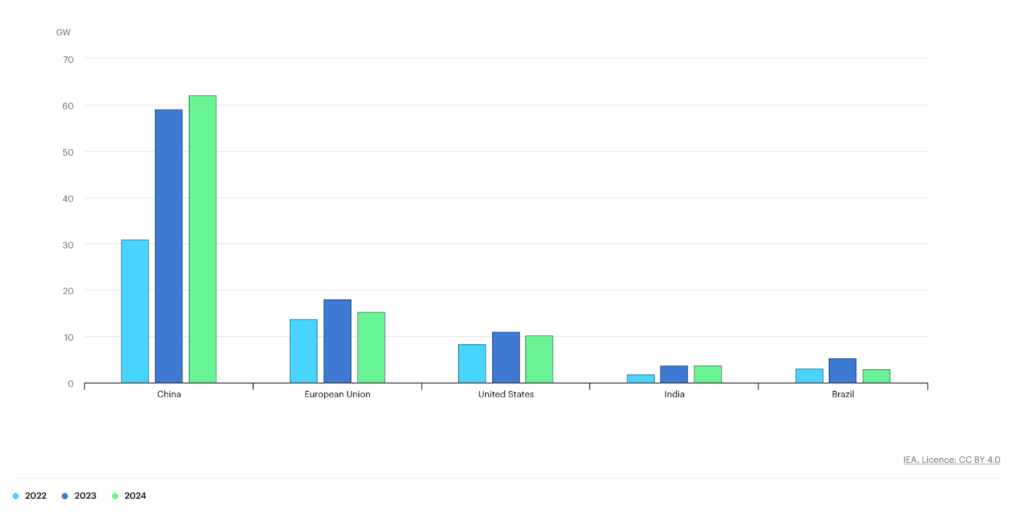

Wind power is expected to rebound by nearly 70% from a slow 2022. Onshore wind will even break its 2020 record.

Renewable Energy 2024 Forecast

The report also provides forecasts on renewable energy development for 2024. The projections show that the world’s total renewable energy capacity will hit 4,500 GW. This is equal to the total power capacity of China and the United States combined.

Solar PV production capacity will likely double by 2024, reaching 1,000 GW. As a result, the IEA projects that, by 2030, the world will have enough renewable energy resources to meet the annual demand level for adhering to the Net Zero Emissions (NZE) by 2050 Scenario.

However, wind power’s technology manufacturing growth in 2024 is uncertain and will depend on whether governments address permitting procedures and auction challenges through policy support. The IEA also notes that wind turbines supply chains won’t be able to meet the growing renewable generation demand in the medium term.

Policy Developments as the Main Reason

The IEA identifies the growing momentum on the policy front as the main reason for progress in the renewable energy industry. Other notable drivers for the mass deployment of renewable electricity include the high prices and energy security concerns associated with fossil fuel reliance.

The key growth markets will be Europe, the US, India and China. Europe, Spain, Germany and Ireland will see wind and solar surpass a 40% share in their annual electricity generation by 2024.

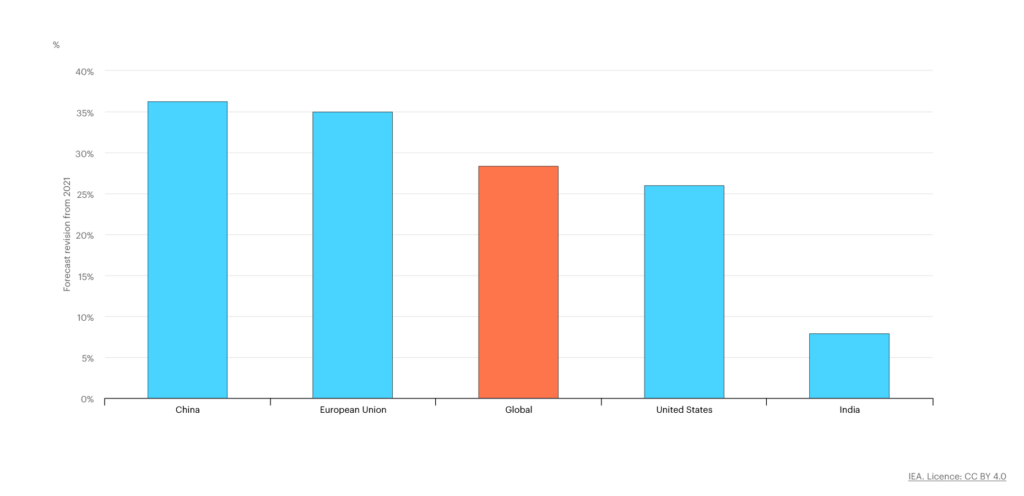

What Has Changed Compared to the December 2022 Edition?

The IEA’s December 2022 edition of the report, which we analysed in detail, made predictions concerning the period between 2022 and 2027. According to the December report, global renewable energy capacity growth will almost double by 2027. It forecasts that global clean power capacity will grow by 2,400 GW by 2027 – equalling China’s total power capacity at the end of 2022.

The IEA also predicted renewables would surpass coal capacity in the next five years, becoming the largest energy source globally. They would account for over 90% of global electricity expansion. Furthermore, the agency expects them to become the world’s largest source to generate electricity by early 2025.

The June 2023 version of the report focuses more on short-term trends – notably in 2023 and 2024. Both reports identify China and India as the main driving forces behind clean energy growth.

The December edition estimated that China would account for nearly 50% of new global clean power capacity by 2027 (1,070 GW). The projections of the updated version are for a share of 55% of the worldwide total across 2023 and 2024. However, China also deployed around 30% less wind power than anticipated, according to the 2022 report.

Overall, the projections for clean energy growth across Asian countries are consistent in the two editions. Furthermore, both reports identify the lack of regulatory certainty and favourable policies as the key stumbling blocks for clean power development in the rest of Asia.

There aren’t any discrepancies in the findings about renewable energy technologies manufacturing, with China remaining the undisputed leader.

China and India to Lead the Renewable Energy Market in Asia

The IEA notes that in 2022, China was responsible for around half of all new clean energy capacity globally. In 2023 and 2024, China will account for close to 55% of global clean energy additions.

The wind energy capacity in the country will continue to increase in 2024. In fact, China will deliver nearly 70% of all new offshore wind projects worldwide. It will also be responsible for over 60% of offshore wind and 50% of solar photovoltaic projects.

China will continue to lead solar PV manufacturing capacity, followed by the US, India and Europe.

In 2022, India’s utility-scale solar PV capacity additions reached a record-breaking 14 GW. The country’s new capacity additions will increase both in 2023 and 2024. The drivers behind the growth will be faster solar PV, onshore wind and hydropower deployment.

However, according to the IEA, India will also face some challenges. For example, utility-scale solar PV projects will slow briefly in 2023 due to supply chain and trade policy issues. Due to the imposed import tariffs, large-scale solar PV manufacturing will likely face supply and demand gaps. This could result in a 20% slowdown. However, the agency expects a possible recovery in 2024.

Lessons For Developing Asia

According to the IEA’s Executive Director Fatih Birol, the global energy crisis has highlighted the critical importance of renewables for making energy supplies cleaner, more secure and affordable.

Prioritising renewable energy sources instead of gas, hydrogen or coal and ammonia co-firing schemes will speed developing Asia’s transition to cleaner, cheaper and more resilient energy systems.

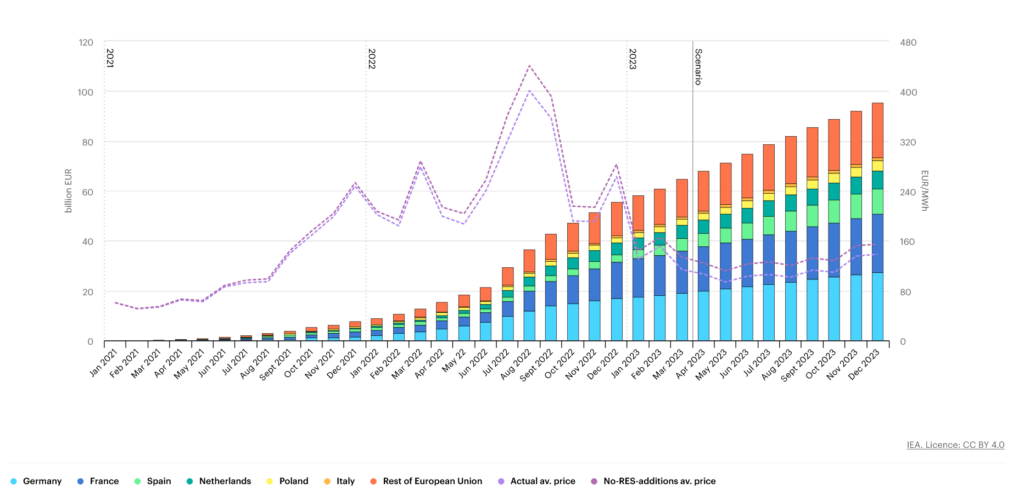

Thanks to the replacement of around 230 TWh of fossil fuel power with renewables, EU electricity consumers, for example, will save around EUR 100 billion between 2021 and 2023. Additionally, newly installed solar PV and wind power will reduce energy costs by 8%.

In the December edition of the report, the IEA noted that addressing clean energy project permitting procedures could result in 30% more renewable energy deployment in Europe. Currently, at least 59 GW of onshore wind capacity (four times the capacity commissioned in 2022) is on hold in the EU. Fortunately, this is a problem that EU officials have realised and are working specifically to solve by introducing new regulations.

Renewable Energy Market Policies as a Difference Maker For Asian Countries

Asian countries should focus on refining their energy policies and addressing market obstacles to make the most of the energy transition.

Thanks to Europe and China, the Asian region has a battle-tested policy action blueprint to follow. The IEA finds that almost 60% of utility-scale solar PV and wind deployment will originate in countries with remuneration policies like fixed tariffs, premiums, and utility-owned projects over the next two years. Stimulation policies should also be able to adapt to changing market conditions and support grid infrastructure investments.

The IEA notes that today, wind and solar PV plants can produce electricity at 30-50% lower prices than future power contracts in most key markets.

Asian countries have already learned this first-hand. In the first half of 2022, solar generation helped China, India, Japan, South Korea, Vietnam, the Philippines and Thailand collectively avoid potential fossil fuel costs of approximately USD 34 billion. Developing Asia simply can’t miss the opportunity to continue on that trajectory.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more