Russian Oil Exports and Fossil Fuel Revenues Outstrip the Invasion Costs

Photo by Michal Bednarek

19 September 2022 – by Viktor Tachev

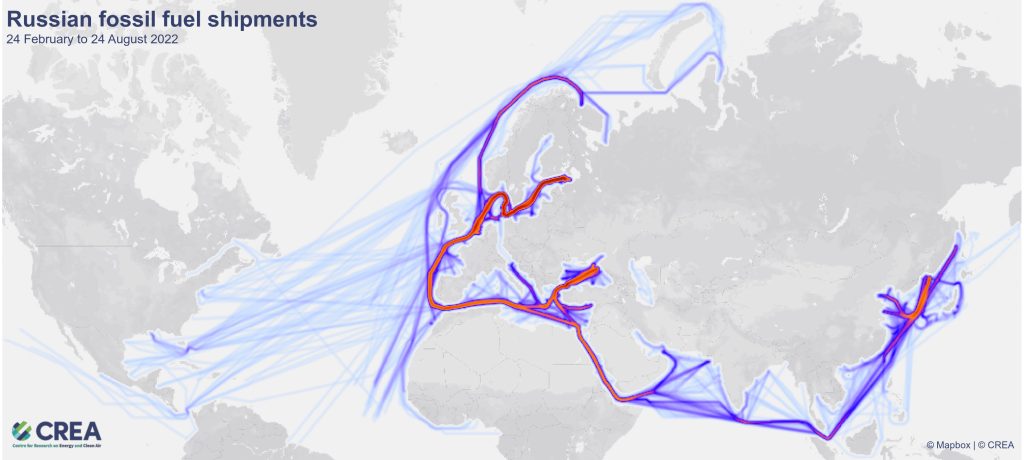

Russian oil exports are the fuel that enables the war in Ukraine to continue, leading to more casualties and destruction. While countries have long been ignoring fossil fuels’ climate impact, turning a blind eye now to their significance to Russia’s war chest is no longer a viable option from a moral standpoint. However, as the latest data shows, many European and Asian countries continue doing business as usual.

The Third Edition of the CREA Report Reveals Massive Revenue From Russian Oil Exports

The findings of the Centre for Research on Energy and Clean Air (CREA) reveal that Russia’s revenue from fossil fuel exports outstrips the cost of the invasion of Ukraine. Russia has made EUR 158 billion in fossil fuel export revenue for six months after Russia invaded Ukraine. In comparison, the war has cost the Kremlin EUR 100 billion. High energy prices helped Russian exports to bring more revenue.

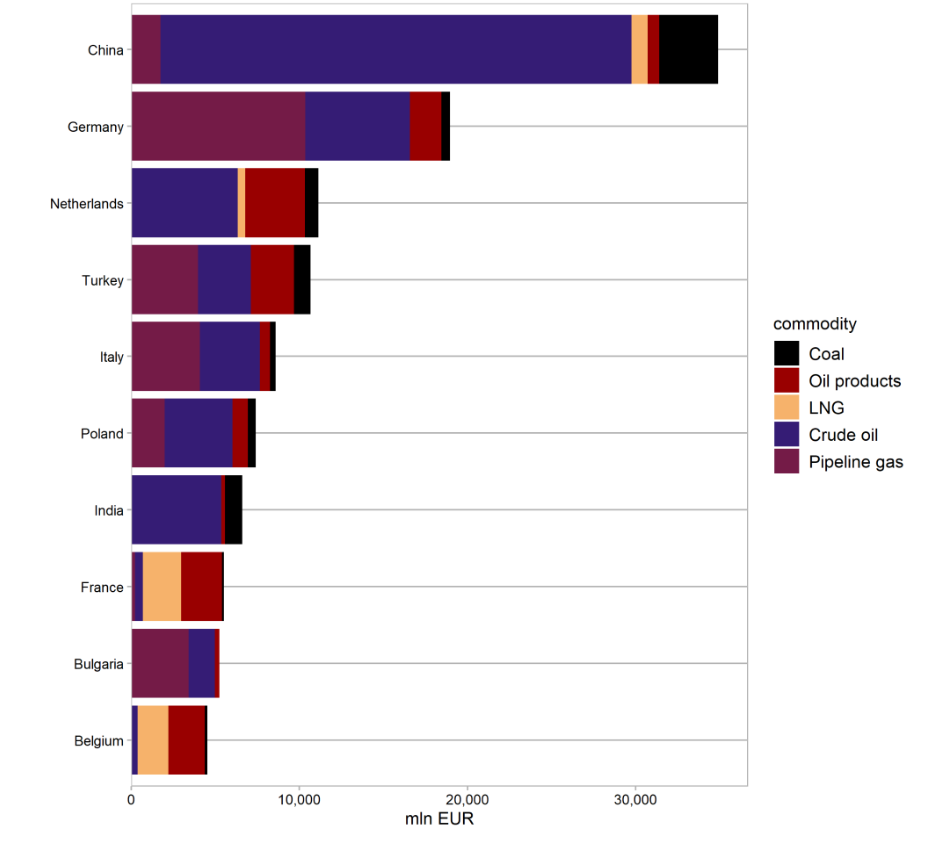

The regions pouring the most money into Russian fossil fuels include:

- the EU – EUR 85.1 billion

- China – EUR 34.9 billion

- Turkey – EUR 10.7 billion

- India – EUR 6.6 billion

- South Korea – EUR 2 billion

Indirect Deliveries

Many leaders have publicly opposed Russia’s war in Ukraine and imposed bans on Russian fossil fuels. Yet, despite that, countries continue to receive shipments.

The US and Australia are actively importing from Indian refineries, which are buying Russian oil at scale. Furthermore, ships owned and insured in European Union countries continue supplying Russian oil to buyers.

The rerouting of Russian oil exports and the “backdoor” deliveries allow countries and companies to circumvent the “officially announced” bans and continue doing business as usual.

According to the think-tank, the EU should ban the use of European-owned ships and ports for Russian oil supplies to third countries. In addition, the UK should pressure its insurance industry to stop insuring vessels supplying Russian gas and oil.

An Export Decline in Sight For the EU

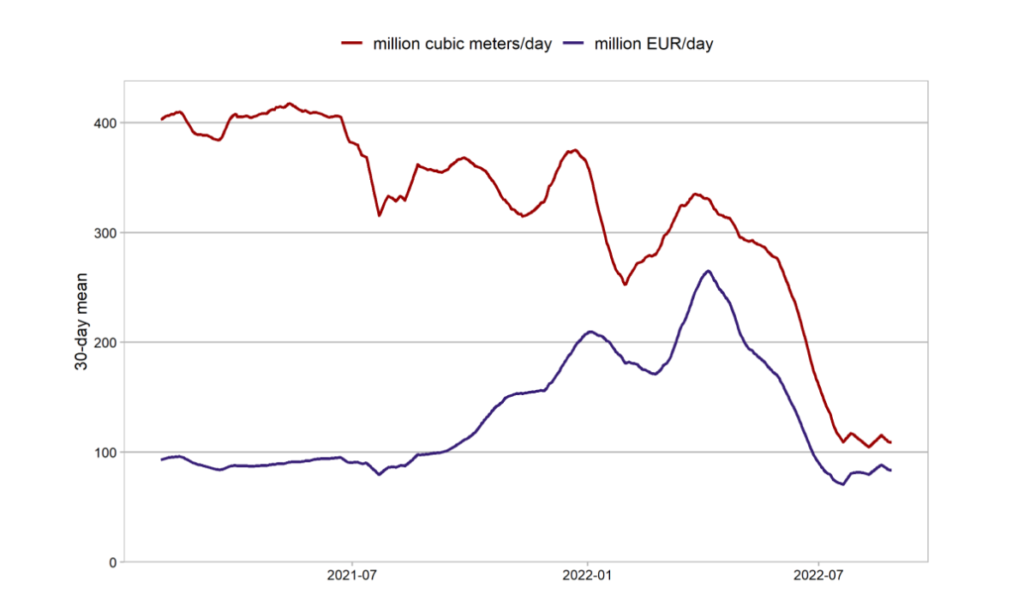

The report finds an 18% overall drop in fossil fuel export volumes in the world economy compared to the start of the invasion.

The deliveries to the EU dropped by 35%. The main reason is the imposed coal import ban, which affected Russia’s exports and production.

Russian oil exports to the EU fell by 17% between July and August compared to the start of the invasion. Furthermore, they are expected to fall by 90% by the end of 2022 once the EU’s ban on Russian oil gets into full force.

Focus on China

According to the CREA report, China and India are the top destinations for Russian imports of fossil fuels. Moreover, China is already buying everything that Russia can supply to the Pacific market.

These results come as an extension to the findings of the previous edition of CREA’s report, which noted that China imported 80% more coal and 210% more oil and natural gas from Russia in the first three weeks of April compared to before the war. For India, the import growth was even more impressive, with 130% for coal and 340% for crude oil.

China’s friendly relationship with Russia is no secret. However, the growth in fossil fuel imports might come as a surprise, considering that China has stunned the world with its clean energy рrogress.

For example, it was responsible for about 40% of the global renewable energy capacity growth between 2015 and 2020. In 2021 alone, the country added 16.9 GW of offshore wind capacity – more than all other countries combined in the past five years. On top of that, China added 30.67 GW of onshore wind and a record of 54.9 GW of solar power. With that, at the end of 2021, solar power capacity in the country reached 306 GW. By 2030, China plans to have 1,200 GW of clean energy capacity.

Furthermore, it champions green technologies, including electric vehicles, batteries, wind turbines and solar panel manufacturing. The country even plans to step up its support for other developing countries in building more green energy capacity.

Renewables growth aside, the Russian coal imports boom also contradicts China’s plans to slash coal imports, which were announced earlier this year.

“Companies Funding Russian War” – CREA’s 2022 Report Exposes

Read moreClean Energy as a Way to Escape the Dependence on Russian Crude Oil Exports

Aside from being at the core of global warming, fossil fuels have emerged as weapons of war. In the past, analysis has proven that Russian oil exports positively correlate to the country’s military spending. According to the International Energy Agency, 45% of Russia’s federal budget in 2021 came from oil and gas revenues. The CREA finds that oil and gas-related taxes and export tariffs account for more than 40% of Russia’s federal budget annually. Furthermore, at the end of May 2022, Russia’s finance minister announced that a part of its RUB 1 trillion budget from additional oil and gas export revenue this year would be used to “conduct a special operation” – a term the country hides its war behind on state media.

The case against fossil fuels is growing bigger by the day. Countries that delay their response will voluntarily expose themselves to increased financial and energy dependency and reputational risk – all on top of having an indirect role in the war in Ukraine. This is already happening in Europe.

Currently, EU countries pay Russia substantial amounts for fossil fuels due to the sky-high gas prices, which reached levels 13 times as high as those last year in August. This led to instant power price increases. Higher crude oil prices have also increased revenue for Russia.

“The real solution to this energy crunch is not switching to coal or diversifying gas supplies, it’s about demand response, demand reduction and energy savings combined with accelerated renewables deployment.”

Sarah Brown, Senior Energy & Climate Analyst, Ember

A Change is Happening

European countries are now shifting away from fossil fuels, leading the transition to clean energy. For example, there are accelerated clean energy targets in 19 European countries. Their adoption is expected to cut fossil fuel use in the power sector by 30% by 2030.

Furthermore, the US plans to introduce the Inflation Reduction Act – the single most influential legislation on clean energy to date. It will incentivise clean power generation, electric vehicles and energy-efficient appliances to help achieve a projected 40% GHG emission cut from 2005 to 2030. Asia needs to follow the flow of the change quickly.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more