The Illusion of Progress: Dissecting ASEAN’s 35% Renewable Energy Target by 2025

23 July 2024 – by Viktor Tachev

“We managed to build the largest floating solar farm in Southeast Asia and the third biggest in the world,” Indonesia’s President Joko Widodo proudly announced upon the launch of the Cirata plant in November 2023. The 340,000 panels floating on the waters of a West Java lake, just 130 km southeast of Jakarta, will power 50,000 households – a project embodying Indonesia’s bold strides toward a renewable energy-led future.

Yet, just four hours away to the west, coal ash spouts from the Suralaya Power Station, Southeast Asia’s biggest coal power complex – a sobering reminder of the country’s contrasting energy reality.

As one of the most climate-vulnerable regions, Southeast Asia urgently needs to break its fossil fuel dependence and accelerate the deployment of renewables. In response to the latter, ASEAN set a target of having renewable energy account for 35% of its power capacity by 2025.

As ASEAN approaches the 2025 deadline, it is on the brink of meeting its target, giving the perception of progress. The bad news is that while the goal has great optics, it has little meaningful impact.

The 35% Renewable Energy Target of ASEAN Under the Microscope

As of 2023, analysis of the International Renewable Energy Agency (IRENA) data shows that renewables held a 31.4% share in the region’s total installed power capacity, at 105.28 GW. ASEAN is on course to not only reach but surpass its target.

However, it is worth noting that in its current definition of renewables, ASEAN includes not only solar and wind but also hydropower and biomass.

As of 2023, solar and wind – which climate experts say are the most viable sources of renewable energy – only make up around 10% of the region’s installed capacity, at just 33.9 GW. According to Global Energy Monitor, hydropower makes up the largest share of installed renewable energy capacity across ASEAN at about 40%.

“On all metrics, ASEAN as a region is behind the curve ball at the moment,” says Aditya Lolla, Asia program director at Ember.

Installed Renewable Energy Capacity in ASEAN Countries (2018 – 2023) and the 2025 Target

Biomass and Hydropower’s Inclusion Skews ASEAN’s Progress

While often labelled “clean,” biomass can be more carbon-intensive than fossil fuels, academics warn. Burning wood, for example, can generate 1.5 times the CO2 of coal and three times the CO2 of natural gas per kWh of electricity produced. Biomass used for energy also threatens forests and negatively impacts land use, with the problem especially glaring in high-poverty regions. Furthermore, according to some studies, replanting the trees needed to absorb the CO2 released from biomass burning takes decades.

While hydropower’s carbon emissions are significantly lower than fossil fuels, the Union of Concerned Scientists reports that it is associated with various environmental impacts, including land use, wildlife disruption, and natural ecosystem degradation. Furthermore, these projects are increasingly complex and have long development timelines.

“ASEAN’s goal is ultimately unambitious because it relies heavily on existing hydropower capacity in countries such as Laos, Cambodia, Malaysia, and Vietnam, which boast an average of 58% of total energy capacity from renewable sources,” says Janna Smith, a researcher at Global Energy Monitor.

Adoption of Solar and Wind, the Backbone of the Energy Transition, is Stalling

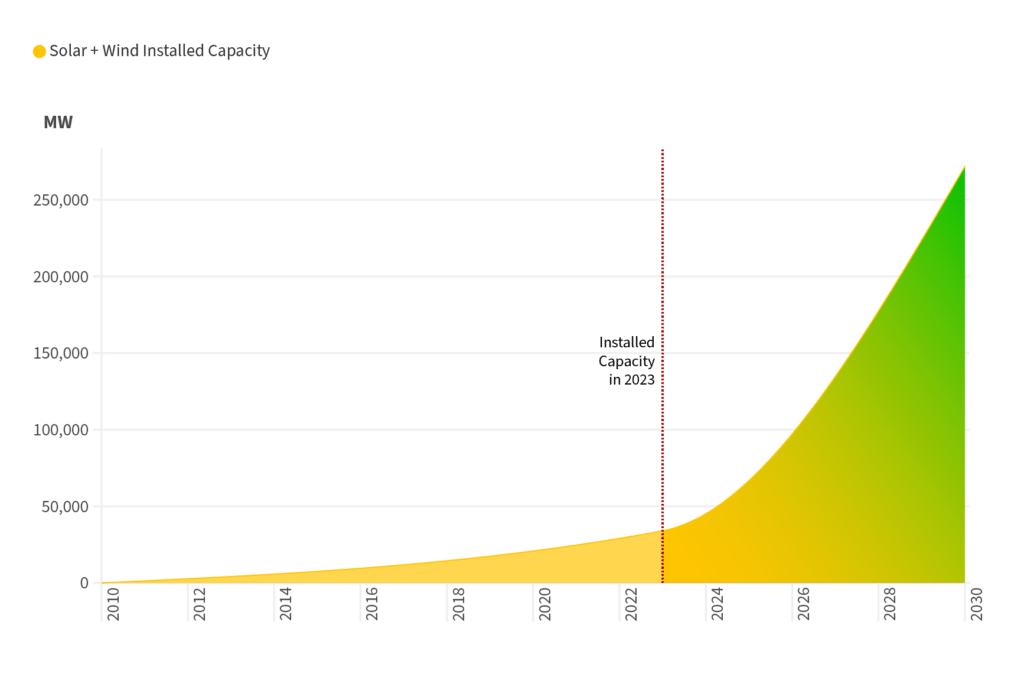

ASEAN’s goal is unambitious for another reason: it is out of step with the Paris Agreement. According to IRENA, aligning with a 1.5°C scenario requires increasing the existing solar and wind power capacity almost eight times, reaching 271.88 GW by 2030. Of these, 241.36 GW should come from solar and 30.52 GW from offshore and onshore wind. IRENA considers solar power the flagship decarbonisation solution for ASEAN.

This means the region has only deployed 12.5% of the solar and wind capacity needed to stay on track for 1.5°C.

According to Global Energy Monitor, ASEAN’s untapped potential for utility-scale solar and wind power capacity is around 220 GW. Of that, its potential offshore wind capacity is 124 GW, nearly twice the current global offshore operating capacity.

Yet, only 23 GW of utility-scale solar and wind projects are expected to come online in ASEAN by 2025.

“Infrastructure and policy challenges create an unsupportive environment of bringing this capacity into operation,” says Smith. “An energy policy that favours fossil fuels and doesn’t instil confidence in investors in national renewable energy markets continues to make the buildout of this capacity challenging.”

Uneven Renewable Energy Progress Across ASEAN Highlights Stark Differences

Experts say the reason for ASEAN’s lagging renewable energy progress is partially due to its diversity.

“The different ASEAN countries have different political priorities, renewable resources and existing constraints in the power system. Some are endowed with fossil fuel resources such as coal and gas and thus may feel less urgency to move. Others see the energy transition as an opportunity to attract clean energy investments,” says Putra Adhiguna, managing director at the Energy Shift Institute.

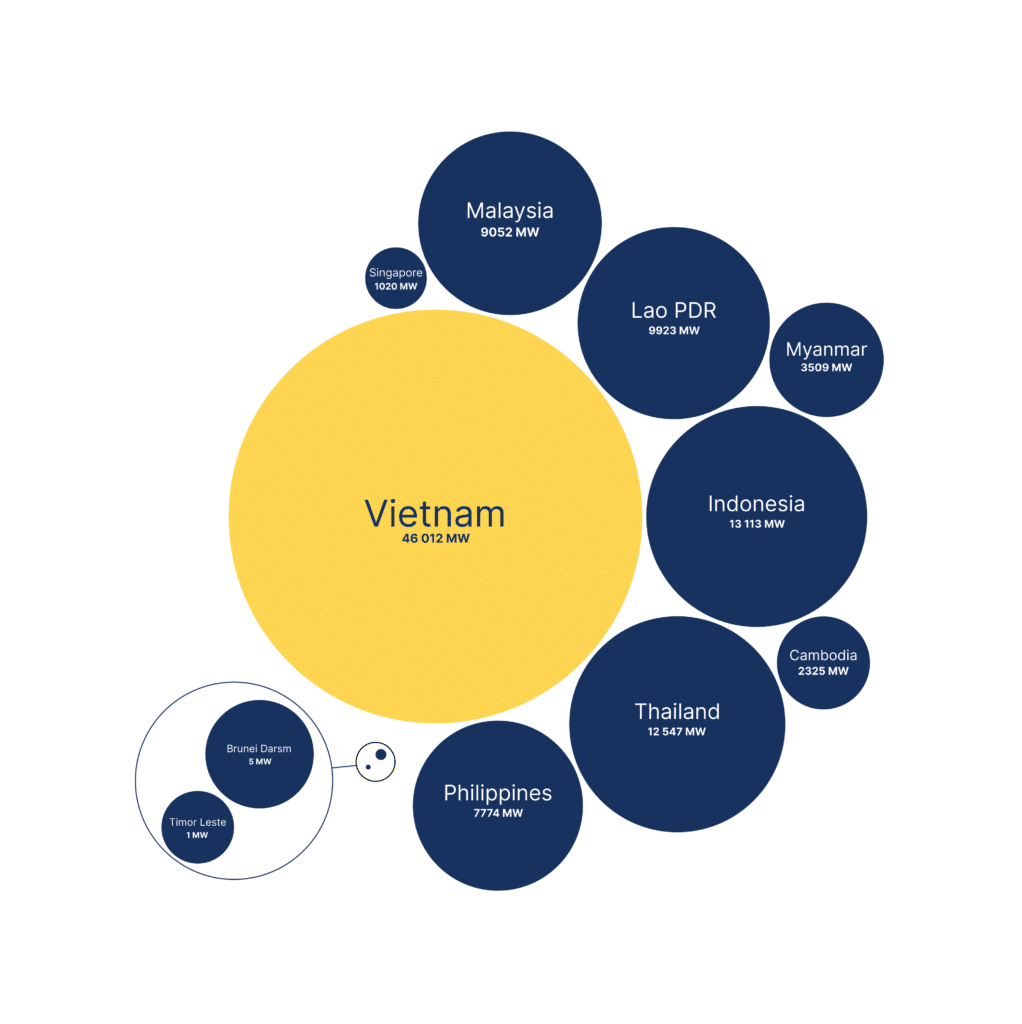

According to IRENA, Vietnam has emerged as the undisputed leader in the region, accounting for 43.7% of ASEAN’s total renewable energy capacity in 2023 at 46 GW. This is more than the collective total for the other four of the top five countries. On the other end are countries like Brunei and Timor Leste, which have marked minimal progress over the past five years.

As of 2023, Vietnam has 17 GW of solar and 5.9 GW of wind power capacity, dwarfing the rest of ASEAN’s deployed renewable power generation capacity.

Experts say Vietnam’s performance is largely due to its successful feed-in tariff policies, which have attracted investors, and its land lease exemptions, which have accelerated renewable project development.

ASEAN Countries Breakdown of Renewable Energy Capacity (2018-2023)

Measures like these helped Vietnam leap in its energy transition over the past 10 years. In 2014, its share of renewable energy in electricity generation was just 0.3%. Between 2018 and 2019, the total renewable energy capacity grew 39.4%. Between 2019 and 2020, it rose 47.2%, according to official data by IRENA.

Other ASEAN Countries Should Learn From Vietnam’s Experience

Despite Vietnam’s high performance, technical issues and policy changes have impeded the country’s growth in renewables in recent years.

“The phase-out of Vietnam’s feed-in-tariff scheme and the stability concerns have played a part in the slow down in numbers for the entire ASEAN, although they have started to pick up again in 2023,” Lolla says.

Vietnam’s challenges have halted the progression of around 40 GW of new utility-scale solar and wind capacity announcements between 2021 and 2023. However, they also provide valuable lessons for other ASEAN markets on how to address potential barriers to scaling up renewables.

“ASEAN nations can also learn from the curtailment challenges faced by Vietnam by ensuring holistic whole-system policies, including grid upgrades while focusing on solar and wind deployment to accommodate the intermittency of both energy sources,” says Lolla.

Some are already doing so. The Philippines piloted its own competitive auctioning process through the Green Energy Auction Program, which shares similarities to Vietnam’s auctioning process. Programs like the Just Energy Transition Partnerships in Vietnam and Indonesia also offer key opportunities to advance renewables, including grid infrastructure upgrades.

Strong Policy Action Crucial to Advance ASEAN’s Clean Energy Transition Beyond Vietnam

Lolla says ASEAN is at a phase where market, policy and regulatory barriers, and not technological ones, are blocking renewables growth. He notes that expanding and modernizing a national and regional grid, especially to integrate intermittent power from wind and solar, is also critical to this growth.

“Lessons from other parts of the world show that clear policy vision and direction, smooth regulatory processes, and sufficient support mechanisms to attract private investment are absolutely critical,” he concludes.

The next step for ASEAN is clear, and it isn’t celebrating the achievement of a loosely defined target. Instead, it should involve strengthening policy to achieve something truly commendable: alignment with 1.5°C.

This story was written in consultation with Yan Naung Oak and Aika Rey from Thibi. Thibi is a consultancy working in the space between data + design. Thibi builds data-driven cultures and technologies that enable people to tackle complexity with empathy.

Data analysis and story development: Yu Sun Chin, Jinda Wedel, Sunadda Samana, Manita Chantaharn, Andri Prasetiyo, Wira Dillon

Data visualisation: Safir Soeparna, Rudraya Gupta, Illia Yarovyi, Kate Korwanidkun

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more