Will Oil-Producing Countries Remain Stable in a Decarbonising World

29 June 2022 – by Viktor Tachev

Oil-producing countries are accused of intentionally delaying their decarbonisation and further fuelling the climate crisis. Although there are grounds for such claims, rapid decarbonisation can cause oil-producing countries significant instability. The key to abandoning fossil fuels while maintaining economic and social stability is in a gradual energy transition backed by adequate policy measures.

The Projected Decline of Fossil Fuels – Including Crude Oil Production

The UN warns that current fossil fuel production, including global oil production, is “dangerously out of sync” with climate change targets.

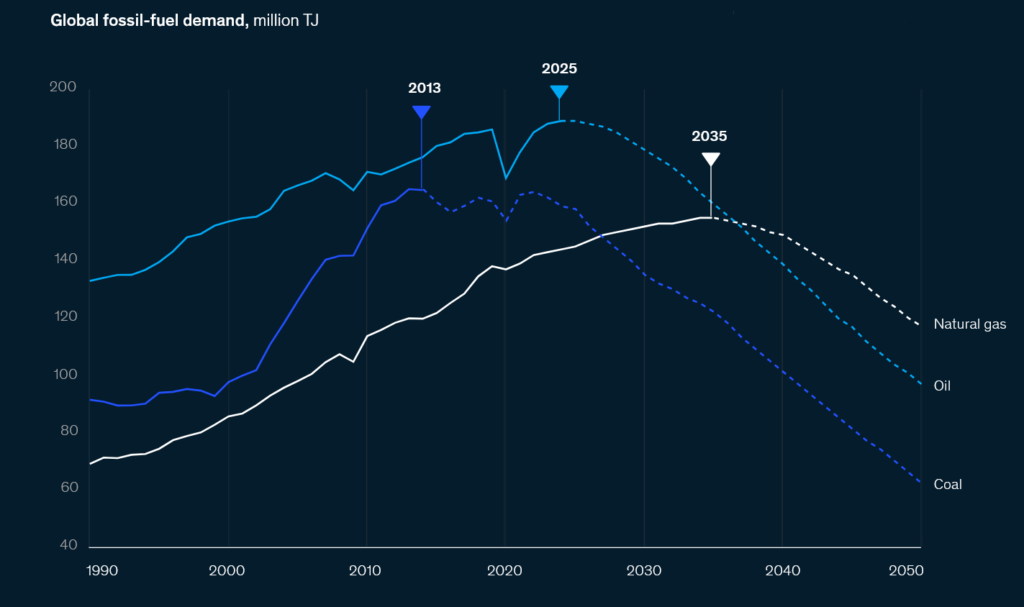

However, this is about to change. McKinsey finds that the peak in fossil-fuel demand continues to move forward and is now between the years 2023 and 2025. The peak for crude oil in the global oil market will come in the next five years, but natural gas will remain the most resilient fossil fuel. By 2050, fossil fuels will make up 43% of the global energy demand.

Demand for Natural Gas

BP, the oil and gas giant, sees gas peaking around 2025. However, in Asia, this peak will likely come later. Among the reasons are the misleading narrative of using natural gas as a bridge fuel, China’s continuing reliance on fossil fuels and the growing gas pipeline in the region.

However, the oil and gas industry differs in its projections, but many in the industry say that the peak will come before 2030. However, according to OPEC, global oil demand growth will extend into the 2030s.

What This Means for Top Oil-Producing Countries

The fate of fossil fuels is sealed. Exporters now face a significant challenge: preparing their economies and societies for the looming energy transition.

According to research, half the world’s fossil fuel assets could become worthless by 2036. In such a scenario, oil-producing countries will face a stranded asset risk of between USD 11 and USD 14 trillion.

These oil producing nations need support to reshape their energy systems. IEA concludes that without additional help for oil-producing countries, net-zero by 2050 will remain a “distant dream”.

However, support should be granted only to countries making genuine efforts or countries that lack the resources to reshape their economies – not those that continue exporting fossil fuels until the last possible moment.

Focus on Asia: How Can Oil-Producing Countries Overcome Challenges?

Asian countries are among the most exposed to stranded asset risk. The fossil fuel asset infrastructure is the biggest in China – valued at close to USD 2 trillion. The stranded asset risk for Japan and South Korea is USD 1.6 billion and USD 0.5 billion, respectively.

The problem has massive implications also across Southeast Asia. The stranded asset risk for Indonesia is estimated at USD 293 billion, while for Malaysia, it is USD 133.5 billion. The figure stands at USD 167.5 billion for the rest of the region.

Countries can either let this risk materialise or start transforming their energy systems today. They can do this in a number of ways.

Diversifying Economies to Prevent Instabilities

Some studies argue that oil won’t decline quickly enough to cause massive shocks. Instead, problems are more likely to originate from pre-existing instability, corruption and weak governance.

However, oil-producing countries should be looking to diversify their economies as quickly as possible while they can still rely on steady capital flows from oil and gas exports. That way, they will be in a better position for the looming energy system transformation instead of having importers force it upon them once they switch to renewables. Furthermore, this would ensure countries will have more time to comfortably reshape their energy systems and design the optimal road maps for long-term economic growth.

Countries waiting for the last possible moment risk facing increased poverty, unemployment, lost livelihoods and potential unrest and instability. Libya, Venezuela and Nigeria have already experienced similar turmoil.

To avoid such consequences, countries should strategise, diversify and develop business interests in other areas. The focus on growing trends in combination with widening the tax base can wean governments off their dependence oil reserves and on fossil fuel revenues.

Research shows that, through proper measures, countries can abandon fossil fuels and still grow their economies. The case is even stronger for developing nations in Southeast Asia. These nations’ GDP growth is expected to reach up to 10% by 2036.

The Asia-Pacific region is home to 2.6%, 8.8% and 42.8% of global oil, natural gas, and coal reserves, respectively. Coal’s dominance means the continent has a very small window to act. There are indications that coal use will peak as early as 2026. If Asian countries don’t start shifting away from it, they might face possible instability.

The Post-oil Economy in the UAE and How It Is Preparing

Read morePriority on Renewables

Experts see patterns where fossil fuel importers have higher levels of renewable energy while fossil fuel exporters have lower levels. While this is understandable, going forward, the weight of fossil fuels in global power generation will only get lower. At the same time, renewables will become more and more dominant.

Nations that don’t start transitioning can take Iraq’s case as an example of the challenges that a fossil fuel-dependent economy can face.

Iraq – An Example of A Middle Eastern Country

In 2020, poverty rates in Iraq doubled. Additionally, the temperatures in the country are rising up to seven times faster than the global average. Iraq has one way out, and it is renewables. The worst potential solar sites in Iraq get up to 60% more direct energy than the best sites in Germany. At the same time, Germany’s existing solar plants offer 2.5 times the electricity capacity of all Iraq’s operational oil, gas and hydropower plants combined.

Governments should avoid subsidising the fossil fuel sector to stimulate the industry’s transition to a cleaner and cheaper energy system. Furthermore, they should be aiming to transform national fossil fuel companies into national energy or investment companies, similar to the case of Norway.

Making the Hard Choice

The economies of oil-producing countries in Asia and around the world are particularly vulnerable in the clean energy transition. However, the global net-zero journey doesn’t mean that oil-exporting countries and nations rich in fossil fuels are in a losing situation. It means they will have to find a way to overcome a unique set of challenges. They have to redesign their energy systems and mitigate fossil fuel dependency while maintaining economic stability and adapting to the implications of climate change.

Finally, countries that hesitate to start their transformative journey today should remember that the impacts of abandoning fossil fuels are less severe than the worst effects of climate change in their region.

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more