Asia’s Renewable Energy Leaders and Laggards in 2024

04 November 2024 – by Walter James

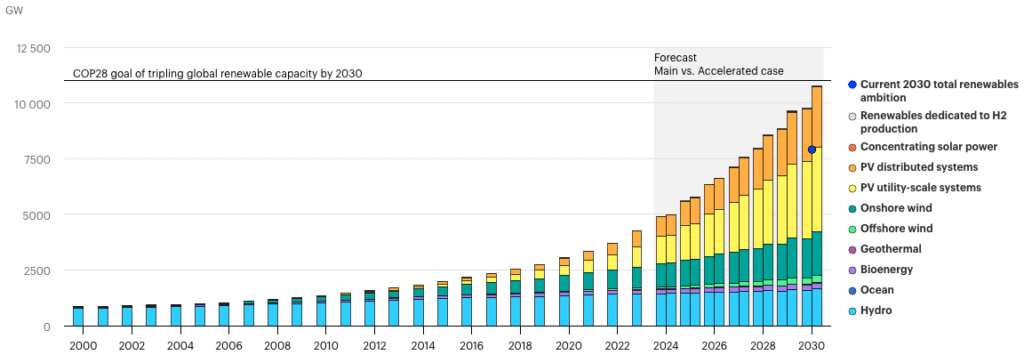

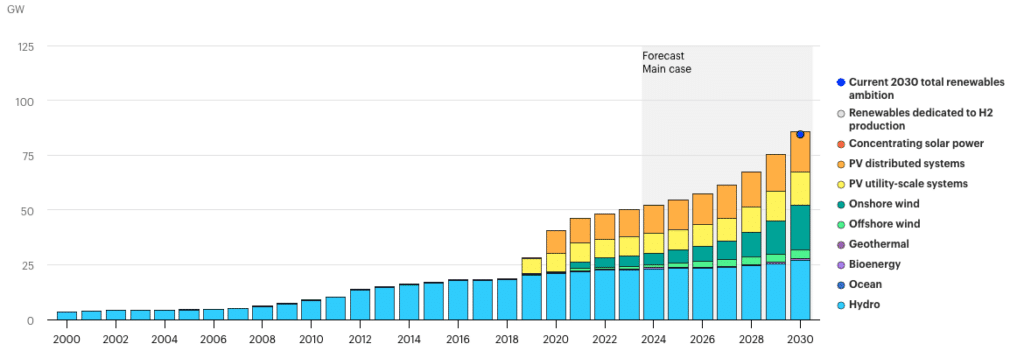

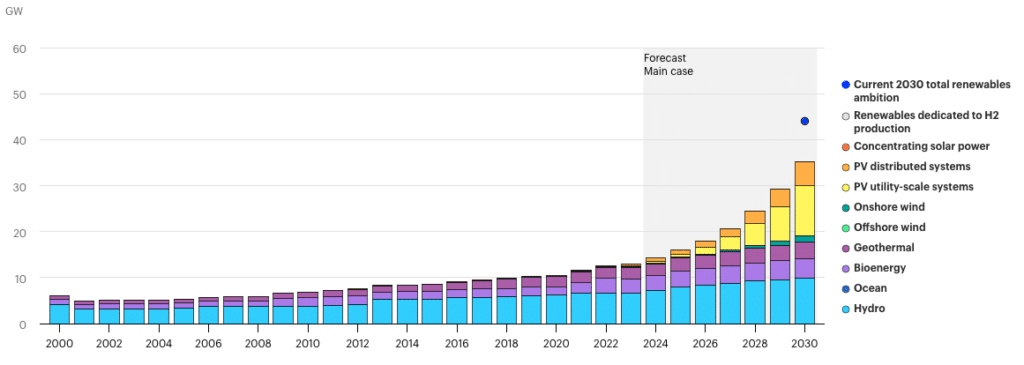

So, who are the Asian renewable energy leaders and laggards in 2024? Globally, the IEA’s Renewables 2024 report projects that renewable energy capacity will grow by 2.7 times by 2030. Overwhelmingly driven by solar and wind energy, this increase will surpass countries’ current ambitions by nearly 25%. Although this growth is still shy of the COP28 goal to triple global renewables capacity, it is an opportunity for governments to ratchet up their ambitions in the next round of Nationally Determined Contributions due in 2025.

Underneath global aggregates, the report sheds light on the countries leading and lagging in renewable energy deployment. Countries in the Asia-Pacific region, in particular, span a wide spectrum in renewables growth between 2017-2023 and in their expected increase between now and 2030.

Who are Asia’s renewable energy leaders and laggards, and what factors drive their divergence?

Asia’s Renewable Energy Leaders

China

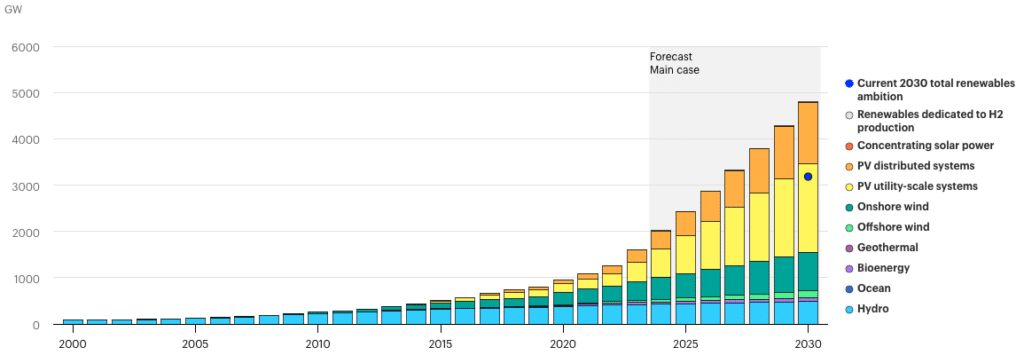

China is far ahead of any other country in its renewable capacity growth, accounting for over half of the world’s renewables additions in 2023. It surpassed its own 2030 target of reaching 1,200 gigawatts (GW) of solar and wind installations six years early – an extraordinary feat. The IEA expects that China will account for 60% of the global renewables increase by 2030.

New investments in solar manufacturing in China since 2022 have drastically lowered module prices, making solar competitive with fossil fuels globally. Domestically, a robust solar market has reduced electricity generation costs for new utility-scale solar below coal power in most Chinese provinces.

There are also two broad policy drivers for the astonishing growth in China’s renewable capacity. First are the green certificate systems, which have allowed some utility-scale solar and wind developers to tap into more attractive prices compared to regulated contracts. On top of this, developers in areas with high solar potential can enjoy more revenue by selling solar-generated electricity to other provinces.

Another policy is the central government’s Whole Country PV pilot program requiring solar panels to be installed on a percentage of rooftops, combined with provincial financial support for small-scale residential solar. This and the rising retail electricity prices for industrial consumers have sped up residential, commercial and industrial solar deployment.

But the stellar surge of renewable capacity in China isn’t without drawbacks. In absolute terms, it is by far the largest greenhouse gas emitter in the world, well ahead of the United States. This is primarily because of China’s increasing use of fossil fuels, particularly liquefied natural gas and coal, in parallel with its renewable capacity additions.

India

Particularly vulnerable to the severe effects of climate change, India has shown strong growth in distributed and utility-scale solar capacities. The IEA estimates that between now and 2030, India’s renewable capacity will triple its 2022 level in line with the COP28 global tripling pledge and become the world’s third-largest market for renewables.

Driving the growth of solar in India are auctions organized by central and state public entities and utilities. In the first half of 2024, 33 GW of capacity were awarded through the auctions – almost 50% more than in 2023. What’s also keeping volumes high is the government memorandum mandating public entities to raise auctioned capacity to 50 GW per year from 2023.

Residential rooftop solar is also likely to grow rapidly thanks to the government’s improved subsidy scheme introduced in 2024, which targets 30 GW of additions by March 2027.

But like China, India’s prolific use of fossil fuels and emissions from industrial factories, vehicles, agricultural practices, and waste burning are causing air pollution-related diseases, local environmental disruptions and significant economic loss.

Who Are Asia’s Renewable Energy Laggards?

Just as the IEA’s Renewables 2024 report makes the renewable energy leaders clear, it sheds light on the laggards in the Asia-Pacific region. While these countries have made strides in renewable energy capacity additions, this growth has either been slower than in recent years or future growth is unlikely to meet these countries’ declared renewable energy targets.

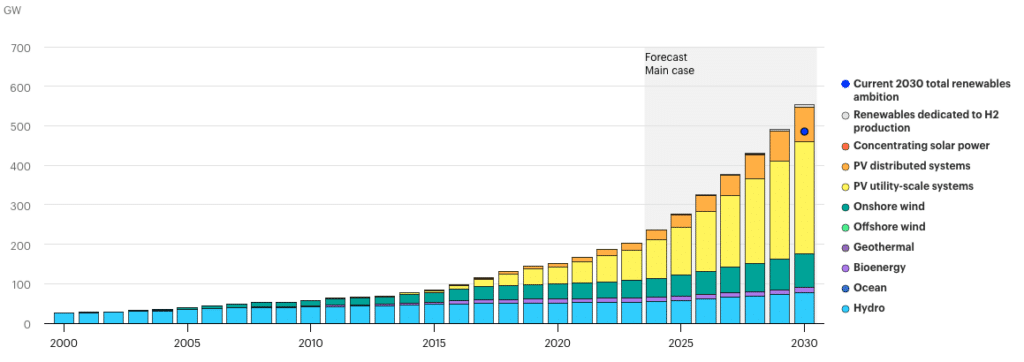

Vietnam

New renewable capacity additions in Vietnam are expected to reach 36 GW between now and 2030, with onshore wind accounting for 42% of these additions. This is a modest rise compared to the 2019-2020 investment boom in renewables. The projected growth by 2030 will help reach Vietnam’s renewable energy target but falls short of the record level achieved in 2020 when 12 GW, mostly solar, were added in a single year.

Grid congestion challenges and the expiration of feed-in tariffs are at the root of this limited growth. The difficulty of integrating new utility-scale solar projects into the power grid led the government to project a modest growth in solar in its updated National Power Development Plan (PDP8).

The PDP8 places high hopes for wind and hydropower. But limited policy support since the feed-in-tariffs expired is delaying wind project development.

Efforts are now underway to accelerate renewable energy deployment. The government plans to allow direct power purchase agreements between large consumers and generators, which will aid utility-scale deployment. Commercial and industrial electricity consumers are expected to continue steadily investing in rooftop solar systems, thanks to the economic attractiveness of self-consumption. The Just Energy Transition Partnership (JETP) agreement that Vietnam signed in 2023 may boost renewable energy growth later this decade.

Indonesia

Indonesia’s renewable energy capacity is expected to grow by 22 GW between 2024-2030, mostly driven by utility-scale solar. While this increase is nearly a five-fold acceleration from the 2017-2023 period, it will still be shy of Indonesia’s 2030 target.

What’s behind this modest growth? First, the September 2022 presidential decree established a promising renewable energy policy framework, but the government has not yet introduced detailed regulations and procurement processes. Second, pre-existing, long-term contracts with fossil fuel generation plants make it hard for Indonesia’s national utility to procure energy from new renewable projects.

Despite these barriers, there is hope that Indonesia will accelerate its renewables deployment. Similar to Vietnam, the JETP is likely to provide a stimulus for renewables by offering roughly USD 20 billion in concessional financing to hasten strategic investments in Indonesia’s energy sector, including in renewables. This programme will likely nudge Indonesia to undertake more ambitious renewable energy targets and implement new support policies.

Policies to Accelerate Renewable Energy Growth

Although still falling short of the COP28 agreement to triple global renewable energy capacity, the world is moving fast to deploy renewables. In Asia, China and India are leading this charge by aggressively adding new renewables. They also offer policy lessons for laggards in the region.

For example, competitive auctions by the government or utility companies can stimulate utility-scale renewable energy development. Attractive feed-in tariffs help make renewable energy generation profitable. Requiring a percentage of buildings and houses to be equipped with solar can help increase the total distributed generation capacity. As the share of renewable energy increases, countries need to invest in their power grid infrastructure and reform rules to facilitate grid integration.

All countries need to also set fossil fuel phase-out strategies as soon as possible. The policy actions to unleash the growth of renewables will make it easier to retire fossil fuel power plants and achieve countries’ climate targets.

by Walter James

Walter James is the principal consultant at Power Japan Consulting, which offers research, writing, and consulting services related to Japan's climate and energy policies. He also writes about these topics on his Power Japan Substack. He holds a Ph.D. in Political Science from Temple University and is a former research fellow at Waseda University in Tokyo, Japan.

Read more