Proposed Ammonia Co-firing Solutions More Expensive than Renewables

10 November 2025 – by Viktor Tachev

Southeast Asian countries are increasingly considering ammonia co-firing technologies at coal-fired power plants, with plans to expand further in the 2030s. Experts note that the push for integrating ammonia co-firing as part of Southeast Asian nations’ energy systems is driven mainly by the Japanese government through its energy transition strategies, such as the Green Transformation Strategy (GX), Asia Energy Transition Initiative (AETI) and the Asia Zero Emission Community (AZEC), as well as Japanese energy giants, including JERA, Mitsubishi Heavy Industries (MHI), Mitsubishi Corporation, IHI, ITOCHU, and Idemitsu. JERA and MHI, for example, have already signed agreements with countries like the Philippines, Thailand and Malaysia.

Among the local power utilities that have signed agreements with Japan are Indonesia’s PLN, Malaysia’s Petronas and Tenaga Nasional, Thailand’s BLCP Power Limited, Aboitiz Power from the Philippines and Taiwan Power. According to the Economic Research Institute for ASEAN and East Asia (ERIA), through the move, Southeast Asian governments are trying to find ways to utilise and extend the life of the existing coal-fired power plant fleet, since it was “a stable power source in the energy mix”. ERIA notes that pursuing ammonia co-firing would help ASEAN nations “reduce carbon dioxide emissions, all the while requiring only minor modifications to their existing setups”.

However, there is growing evidence that the opposite is more likely, with experts even arguing that Japan’s strategies are likely to hinder, rather than advance, ASEAN nations’ energy transitions. For example, Zero Carbon Analytics finds that 35% of the 158 memorandums of understanding signed with Asian countries to advance their energy transition efforts under AZEC prioritise fossil fuel technologies, including natural gas, LNG, ammonia co-firing with thermal power plants, ammonia and hydrogen not made by green power, CCS and e-fuels. This is substantially more than the agreements that include solar and wind (7%).

Experts have long warned that prioritising one of the so-called decarbonisation solutions, ammonia co-firing at coal plants, might hinder, rather than boost, the energy transition of ASEAN countries, as well as expose them to significant economic, financial and environmental risks — especially when cheaper, cleaner, and proven solutions like solar and wind energy exist.

BNEF: Ammonia Co-firing Proving Economically Unattractive For Southeast Asia Compared to Renewables

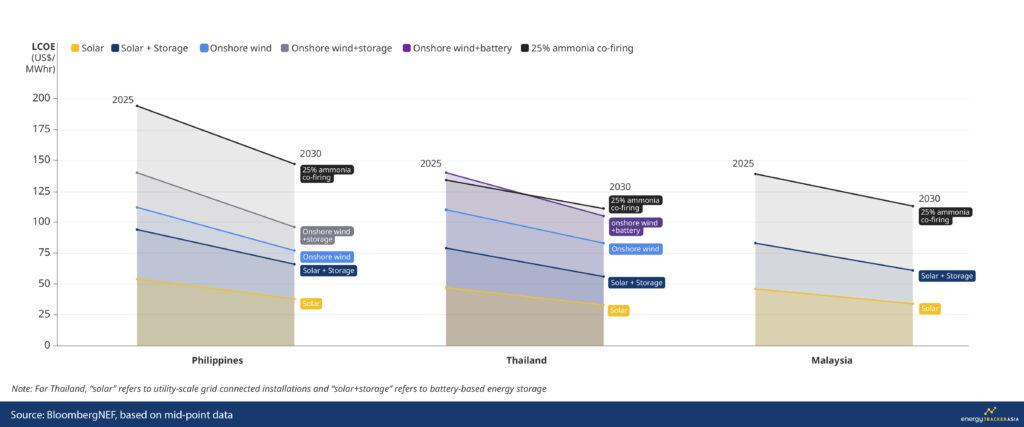

In a series of country-specific reports, BloombergNEF has found that solar and solar paired with battery storage technology are already cheaper than ammonia co-firing in the Philippines, Thailand and Malaysia. Furthermore, as of 2025, onshore wind is also cheaper than ammonia co-firing in the Philippines and Thailand. In the Philippines, onshore wind in combination with battery storage is now more affordable than ammonia co-firing, while in Thailand, it will become so by 2030.

According to the IEA, the significant decline in the levelised cost of electricity (LCOE) for utility-scale solar PV in recent years, on a global basis, is due to sharp reductions in module prices following oversupply from China. Efficient permitting and reduced construction costs, as well as competitive auctions replacing fixed feed-in tariffs that different markets are increasingly prioritising, are other key reasons. Jurisdiction-specific factors, such as the increase in solar deployment, coupled with declining equipment cost, the build-up of domestic solar manufacturing capacity and project development know-how, as evident in the case of Thailand, have also influenced the declining LCOE for solar power. Importantly, BNEF notes that, in the future, the economic advantage of solar over thermal power plants will grow over time.

When it comes to solar PV in combination with battery storage, the competitive LCOE has been a result of the rapid decline in battery costs, reaching 90% since 2010 due to technological advances in battery chemistry and manufacturing.

Financial Risks, Poor Economics and Lack of Overall Viability of Ammonia Co-firing Deter Investors

TransitionZero has described the process of converting Asian coal plants to run on ammonia as “an immense waste of capital that could do more harm than good”. According to the analysts, there is no ammonia-based pathway to a net-zero-aligned power sector, even when using “green” ammonia produced from renewable sources.

An analysis by Asia Research & Engagement reaffirms the lack of viability of different ammonia co-firing schemes. For example, at a co-firing rate of 20% ammonia, the study estimates that the production costs of a coal plant are 1.5 times higher than the potential revenue, while at a 50% co-firing rate, the costs are over double the revenue.

Cedric Rimaud from the Anthropocene Fixed Income Institute warns investors that ammonia co-firing technologies won’t reduce emissions, but rather will “prolong and lock-in the use of coal plants,” ultimately advising them to reconsider the use of instruments such as transition bonds.

Furthermore, another analysis by TransitionZero finds that the widespread adoption of ammonia co-firing in existing coal fleets raises transition risks that could “create a new generation of stranded assets”.

In its analysis dedicated to the Philippines, BNEF finds that the commercial feasibility of ammonia co-firing at ratios higher than 20% remains highly uncertain. The experts also note that, to ensure proper greenhouse gas emission reduction benefits, governments should scale investments in technologies for capturing nitrogen oxide (NOx) and nitrous oxide (N2O) emissions, further highlighting the strategy’s poor economics.

In the case of the Philippines, BNEF finds that ammonia procurement for co-firing would be at least seven and nine times as costly as coal procurement in 2030 and 2050, respectively. For Thailand, procuring ammonia could be seven to 17 times more expensive than for coal in 2030, and about seven to 11 times costlier by 2050. For Malaysia, BNEF estimates that ammonia procurement would be at least eight times more expensive than coal procurement in 2030, and nine times more expensive in 2050.

Importantly, coal retrofits for ammonia co-firing across the three countries would require financing equal to that of a new coal plant, the experts note.

Ammonia Co-firing to Result in Marginal Emissions Reduction

Today, 99% of ammonia production is based on fossil fuels, resulting in approximately 1.6 tonnes of CO2 emissions per tonne of ammonia, even when the most advanced available equipment is utilised. These figures don’t take into account the emissions generated from transporting and storing ammonia.

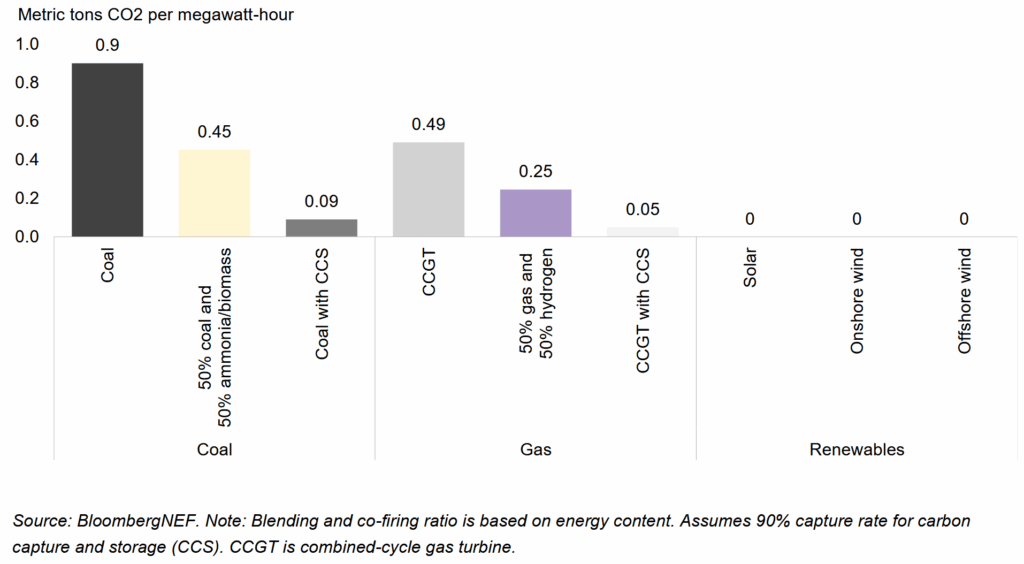

BNEF notes that tests of ammonia co-firing at commercial coal power plants have so far been limited to 20% ammonia, with the most recent test conducted by JERA and IHI at the 1 GW Hekinan-4 plant in Japan. In fact, coal retrofits with more than 20% ammonia co-firing haven’t been tested or commercialised, and, at such low levels, results have shown that blending coal with ammonia will only result in marginal emissions reductions from traditional coal power plants.

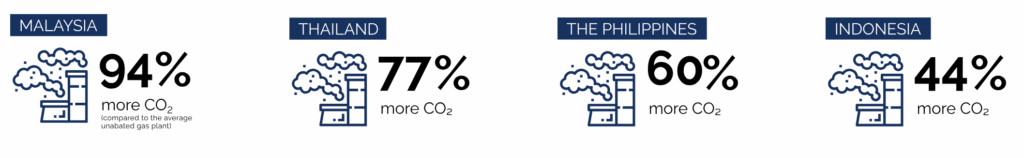

According to researchers, emission cuts from ammonia co-firing contradict the net-zero targets in Indonesia, Malaysia, Thailand and the Philippines. A 20% ammonia co-firing rate, the most feasible scenario, will generate more CO2 emissions than an average unabated gas plant in the ASEAN countries.

Importantly, the technology also raises the risk that ageing coal plants will continue running for a longer time to recoup as much of the retrofitting costs as possible. This contradicts the IEA’s call to phase out all unabated coal power plants before 2040 to limit global temperature increase to 1.5°C, which, according to the UN’s head, is a milestone that humanity has already missed.

Furthermore, scaling up ammonia co-firing at coal plants instead of renewables will strengthen, not bend, the trajectory of increasing fossil fuel consumption. In 2024, fossil fuel energy consumption hit a record high, with coal, oil and gas all at peak levels. For reference, combined solar and wind consumption was 31 times lower than fossil fuel energy consumption.

Increased Air Pollution and Health Risks Due to Ammonia Co-firing in Coal Power Generation

According to TransitionZero, co-firing ammonia could even be worse for the environment than burning unabated coal.

BNEF warns that ammonia co-firing could lead to increased risks of air pollution, including increasing emissions of NOx and N2O. The latter poses major risks as it boasts a 273 times bigger global warming potential than CO2 itself over a 100-year timescale.

Experts warn that the levels of fine particulate matter (PM 2.5), a major health risk, will surge as a result of scaling up ammonia co-firing technologies. An analysis by the Centre for Research on Energy and Clean Air (CREA) of a 20% ammonia co-firing installation at Unit 4 of Hekinan Thermal Power Station in Japan, for example, projects a 67% increase in PM 2.5 and other gases.

Scientists find that long-term exposure to PM 2.5 can trigger various adverse health conditions, including ischemic heart attacks, lung cancer, lower-respiratory infections, chronic obstructive pulmonary disease, stroke, Type 2 diabetes and adverse birth outcomes such as autism. Statistics show that fine particulate matter currently contributes to 8 million premature deaths globally and 43,000 deaths in Japan per year.

Researchers find that South and East Asia currently have the highest numbers of deaths due to long-term exposure to air pollution, including ambient PM 2.5 and ozone (O3). Scientists note that these deaths could potentially be avoided by phasing out fossil fuels.

The Arguments For Ammonia Co-firing as a Solution For Southeast Asia’s Energy Transition Are Vanishing, With Renewables Present the Viable Way Forward

In its “Renewable Power Generation Costs in 2024” report, IRENA concluded that renewables continued to maintain their cost leadership globally. The case is the same when it comes to Southeast Asian economies.

According to BNEF, scaling up renewables remains the most economically viable pathway for the Philippines, Malaysia, and Thailand to meet their decarbonisation and energy transition goals, while retrofitting thermal power plants for hydrogen blending or ammonia co-firing or equipping them with carbon capture and storage technology are all more costly and less effective in abating emissions.

This means that any investments in ammonia co-firing technologies not only lack economic and financial arguments but will also lock ASEAN countries into a future of high emissions, worsened air pollution and increased health risks. Renewables, on the other hand, can provide a cleaner, cheaper and more energy-secure alternative to effectively meet the growing energy demand of the booming economies in Southeast Asia.

While ASEAN economies have vast clean energy potential, it mostly remains untapped, with the combined share of solar and wind in the energy mix of different countries rarely exceeding 5%. The IEA projects that, between 2025 and 2030, ASEAN countries will add over 95 GW of renewable energy capacity, nearly double the deployment of the previous six-year period. However, growth will mainly be driven by two markets: Vietnam and Indonesia. On the other hand, the deployment rates in other ASEAN economies are likely to remain insufficient for reaching net-zero emissions.

ASEAN Economies Hold the Keys to Unlocking the Gains of the Energy Transition and Avoiding the Risks of Ammonia Co-firing with Coal

According to BNEF, accelerating the energy transition across ASEAN countries and seizing their immense clean energy potential requires stronger political ambition to wean energy systems off fossil fuels, undertake power market reforms, pledge more ambitious climate targets and support clean energy developers. One measure to unlock rapid clean energy growth across Southeast Asia is feed-in tariffs (FITs), which are already successfully implemented in Indonesia. Vietnam’s FITs have also been pivotal in fueling the country’s rapid growth in clean energy deployment and spurring massive investment from both domestic and international developers.

The IEA advises ASEAN markets that, in order to capitalise on their significant potential for clean energy capacity growth, they should take advantage of enabling measures, such as competitive auctions and market-based procurement, which are increasingly driving global utility-scale renewable electricity expansion. Overall, the agency estimates that the combination of more ambitious policy targets, strengthened implementation frameworks and increased adoption of grid flexibility solutions could enable renewable deployment in ASEAN to reach 70% above the main case, the highest upside potential of all major regions.

Research projects that accelerating the green energy transition could save trillions of dollars and unlock additional economic benefits, including job creation, more stable power prices and indirect gains from averted losses due to climate change. In total, IRENA estimates that the energy transition will help Southeast Asia reduce energy costs by USD 160 billion and save up to USD 1.5 trillion in cumulative costs from the health and environmental damage caused by fossil fuels by 2050. Importantly, IRENA finds that the region can transition from just a 19% renewable energy share in 2018 to 65% by 2050. According to BNEF, Malaysia, Thailand and the Philippines, in particular, would benefit from limiting thermal power expansion and, by scaling up renewable energy build-out, would also be able to boost domestic energy security and affordability.

“We are seeing the first signs of a crucial turning point,” said Malgorzata Wiatros-Motyka, senior electricity analyst at Ember. “As costs of technologies continue to fall, now is the perfect moment to embrace the economic, social and health benefits that come with increased solar, wind and batteries.”

________________________

To access the country reports, please visit the following links:

Malaysia | Thailand | Philippines

by Viktor Tachev

Viktor has years of experience in financial markets and energy finance, working as a marketing consultant and content creator for leading institutions, NGOs, and tech startups. He is a regular contributor to knowledge hubs and magazines, tackling the latest trends in sustainability and green energy.

Read more